What Is ExtraCredit?

When it comes to your finances, you have to wear a lot of hats. In between budgeting, paying the bills, and maintaining a healthy credit score, there’s a lot to juggle. And let’s be honest—you’re probably not a financial or credit expert. Very few people are! So how can you keep on top of everything?

ExtraCredit is here to lighten your load. It’s a brand-new product from Credit.com that gives you unmatched credit coverage for one low monthly fee. Think of it as your one-stop shop for everything credit. No other credit product is as fully loaded as ExtraCredit.

ExtraCredit’s five features offer you complete credit coverage:

- Track It: Track your FICO credit scores and credit reports

- Build It: Add rent and utility reporting to your credit reports

- Reward It: Get paid when you are approved for select offers from our partners

- Guard It: Protect your identity

- Restore It: Get an exclusive discount to one of the leaders in credit repair (not available in Oregon)

Here’s what you need to know about Track It.

Stay on Top of Your Scores with Track It

So you think you only have one credit score? Maybe three: one for each credit bureau? Actually, you might be surprised to learn that you have a ton of credit scores (more on that later)! But how can you know which scores are actually important? And how can you keep tabs on them?

That’s where Track It comes in. Track It shows you 28 of your FICO® scores. But it isn’t just showing you random scores. It shows you the scores that different lenders see, like auto and home lenders. Not only that, but it’ll show you your credit reports from the three major credit bureaus, plus your credit report card. And on top of all of that, you’ll receive advanced credit monitoring and alerts. We’ll keep track of everything, all in one easy to access place.

- 28 FICO Scores: You know, and we know, that there’s no way you can keep track of every single one. That’s why we do it for you! Track It will show you 28 FICO scores, as well as which lenders look at which score.

- Credit reports from all three bureaus: Normally, you’d have to chase all three of your credit reports down. But when you use Track It, you’ll have them all in one place for you to peruse whenever you’re ready.

- Credit monitoring and alerts: Monitoring your credit is a huge part of your financial health. Every time you log in to ExtraCredit, you can see how—and why—each of your scores has changed.

- Data snapshot: Your data snapshot is an easy way to keep an eye on everything. Check the name, address, and basic account info recorded on your credit reports to check their accuracy.

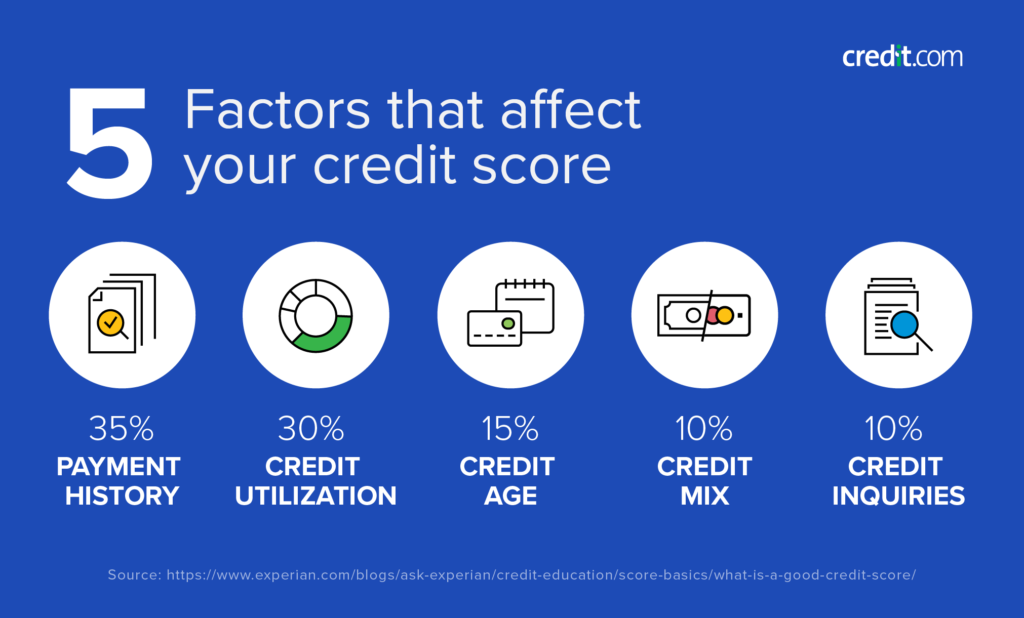

- Credit factor report card: Easily check how you’re doing on each of the five factors that affect your credit score.

*Get a free seven-day trial when you sign up now!

Your FICO Scores

Like we said, Track It will keep tabs on 28 of your FICO scores. But what is a FICO score, exactly? Your credit score is a three-digit number that measures how likely you are to pay back your debts as owed. The higher your score, the less interest you’ll likely pay and the more financial products you’ll have access to.

But here’s the thing—you actually have dozens of different credit scores, created by different scoring systems for different purposes. FICO Scores and VantageScores are the two most common types of credit scores, and each system has different scoring methods. According to FICO, it is used by 90% of top lenders.

The free scores you get from other services are generally what are considered “educational scores”—meaning they’re for educational purposes, but not actually used by lenders when you apply for loans or credit. When you sign in to ExtraCredit, the score you see right away is your FICO Score 9, a real FICO score used by lenders to determine your credit eligibility.

[Insert image of a sample FICO Score 9 at the top of someone’s Track it page]

Even if you were to glance at your Track It page, you’d have a great sense of where you and your credit score stand. But Track It takes it 27 steps further by showing you your FICO Mortgage Scores, Auto Scores, and Bankcard Scores from all three bureaus.

FICO Mortgage Scores

We call these your “Mortgage Scores” because it is the model mortgage lenders usually look at, but these scores are also considered your “base” FICO scores and are generally what we’re referring to when we talk about FICO Scores.

Some lenders will check only one credit score, but mortgage lenders typically look at your FICO scores from all three credit bureaus, which means it’s especially important to check all of these scores before applying so you know where you stand. These scores are also used by some lenders for other credit application evaluations, such as credit cards, personal loans, and student loans.

FICO Score 8

We hate to confuse you even more, but there are actually multiple kinds of FICO Scores. But it’s actually not that complicated! First introduced in 2009, FICO Score 8 is used most widely by lenders. Here are some quick facts you should know about FICO Score 8:

- This version is more sensitive to high utilization of credit cards than previous versions.

- FICO 8 is more forgiving of isolated late payments—but if you have a habit of late payments, you’ll likely see a bigger drop compared to previous versions.

- FICO 8 reduces the benefits of “tradeline renting,” which is where consumers are added to a stranger’s credit account in order to superficially inflate their credit score.

- FICO 8 also ignores small-balance collections accounts less than $100.

FICO Score 9

Up next is FICO Score 9, which is the newest FICO Score version. It became available to lenders in 2014, but many are still evaluating it before they decide to use it. This is the version you’ll see at the top of your Track It screen. FICO made some significant changes to how it calculates these scores compared to previous versions. Here are some things you should know about FICO Score 9:

- This version ignores third-party collections that have been paid off.

- Medical debt collections are treated differently than other types of debt: unpaid medical collections have less of an impact on your score.

- Rental history, when reported (check out Build It to get yours reported!), affects this score.

FICO Scores 2, 3, 4, and 5

We weren’t lying when we said that there are multiple kinds of FICO Scores. Some earlier versions of FICO scores are still in use. In fact, guidelines set by the Federal Housing Finance Agency and government-backed mortgage companies Fannie Mae and Freddie Mac require lenders to use these classic scoring models for mortgage loan underwriting.

FICO Scores 2 and 3 are used by Experian, FICO Score 4 is used by TransUnion, and FICO Score 5 is used by Equifax. These earlier versions are less forgiving of unpaid collection accounts, especially medical accounts. Because mortgages are very large loans, lenders tend to be cautious with them and may prefer to use a score that considers those factors as well.

FICO Auto Scores

Thinking about applying for an auto loan? You might want to review your FICO Auto Scores. Lucky for you, Track It shows you nine of your FICO Auto Scores (three from each bureau). You can see your FICO Auto Score 8 and Auto Score 9 from each bureau, as well as one score specific to that bureau.

To determine your auto scores, FICO will first calculate your base score. Those are then adjusted based on industry-specific risk factors. These scores range from 250 to 900 and are fine-tuned for auto lending.

- FICO Auto Score 8: Like the FICO Score 8, this is the most common score used by auto lenders.

- FICO Auto Score 9: This is the newest auto score version recently made available to lenders. Many are currently evaluating this version before they migrate to this scoring model.

- FICO Auto Scores 2, 4, and 5: These are older versions of FICO’s auto scores. These are also fine-tuned for auto lending, and many lenders still use them when pulling a credit report. FICO Auto Score 2 is used by Experian, Score 4 is used by TransUnion, and Score 5 is used by Equifax.

FICO Bankcard Scores

Because credit cards are considered revolving credit, they affect your credit in specific ways that installment loans (like mortgages and auto loans) don’t. Your FICO Bankcard Scores take those differences into consideration to better predict your risk of defaulting on credit card payments. It’s a variation of your base FICO score that weighs credit card history more. These scores range from 250 to 900.

If you’re trying to improve your Bankcard scores, here are some things to consider:

- Becoming an authorized user may not help your Bankcard scores. Your Bankcard scores care more about your personal, established history of paying your bills on time.

- A high credit utilization may negatively affect your Bankcard score more than other types of scores.

- One-time late payments don’t hurt quite as much, but a history of late payments will have a big impact.

- Frequent credit inquiries will also negatively affect this score more.

You’ve probably figured this out by now, but the credit card industry is a bit decentralized. So there’s no way to know for sure which credit score a credit card lender might use to determine your eligibility. Seeing nine of your Bankcard scores together may be able to give you the best insight into your odds of approval.

- FICO Bankcard Score 8: This is the most commonly used Bankcard version used by lenders. It’s similar to the base FICO Score 8, but pays more attention to how you handle your credit cards.

- FICO Bankcard Score 9: This is the newest Bankcard Score version.

- FICO Bankcard Score 2, 4, and 5: FICO Score 2 is used by Experian, Score 4 is used by TransUnion, and Score 5 is used by Equifax.

Credit Reports

We’ve established that you have multiple credit scores. But did you know that you also have multiple credit reports?

Your credit reports are based on information sent to the credit bureaus. But your creditors aren’t actually required to send anything to them! That means that some creditors may report to just one bureau, while others may report to all three and some may not report anything at all. Because each credit bureau has different information about your credit history, you have a different credit report with each bureau.

Your credit report shows your entire credit history. Think about it like this: your credit score is like the grade you got in class, while your credit report is like a report card that shows how well you did on all of your assignments.

You can request your credit report from each credit bureau individually—or you could download all three right from ExtraCredit. These reports are just as detailed as what you’d get from the bureaus themselves, and they’re updated monthly. See a complete accounting of your positive accounts, late accounts, payment history, credit inquiries, and more.

Learn more about how to read your credit report >>

Credit Report Card

Like our free Credit Report Card, Track It lets you review each of the five factors that affect your credit score and see how you’re doing. Using a proprietary algorithm, ExtraCredit creates your credit grade for each factor, based on information in your credit reports. You can see your grade for each factor and details, and figure out what you can improve on. Each bureau has slightly different information about you, so you can see how each is reporting on all of these factors.

There are five main factors that affect your credit scores, and ExtraCredit breaks down each one for you and how it’s impacting your scores specifically.

Payment History

Payment history is a big one—it accounts for 35% of your credit score. If you need to build up your score, making on-time payments could really make a difference. Track It will show you

negative accounts listed on your credit reports, your total late payments, as well as 30-day late payments and 90-day late payments.

Tip: Our only real tip for you is to do whatever you can to make your payments on time, every month. Set an alarm, use an app, schedule it on your calendar, just make sure you pay them on time!

Learn more about the importance of your payment history >>

Debt Usage

Your debt usage makes up 30% of your credit score. Keeping your credit utilization ratio low can prove to potential creditors that you can responsibly manage your debts. ExtraCredit shows you your current debt to limit ratio, your current revolving debt, number of accounts with a balance, and your total credit limit. You can also see which accounts are showing a balance and what that balance is for each.

Tip: How low should your credit utilization be, exactly? Experts say around 30%.

Learn more about credit utilization >>

Credit Age

Credit age, or the length of your credit history, accounts for 15% of your credit score. ExtraCredit makes it easy to see how old your credit history is, including your youngest account, oldest account, and average account age.

Tip: You can’t go back in time to open up a credit account and extend your credit history, but you can refrain from closing old accounts now. Keep your old accounts open to lengthen your total credit history, even if you’re not regularly using them anymore.

Learn more about credit age >>

Account Mix

Your account mix makes up 10% of your credit score. Having a variety of credit cards and other accounts is really appealing to potential lenders, because it shows that you can responsibly manage different types of accounts. See how many revolving credit accounts, mortgage loans, auto loans, and student loans you have on your credit report.

Tip: Account mix has a relatively small effect on your credit score. Don’t open an account just to improve your account mix if you won’t be able to pay it.

Learn more about account mix >>

Credit Inquiries

Credit inquiries make up 10% of your score. Applying for too much credit can be seen as a red flag to potential lenders. Trust us, you don’t want to look desperate. ExtraCredit shows you how many inquiries are showing up on your report. And because inquiries affect your score less the older they are, ExtraCredit breaks it down to show you how many recent inquiries there are, how many old inquiries there are, and when the last inquiry was made.

Tip: FICO lumps together similar credit inquiries made within 45 days of each other. If you’re shopping around for credit, try to keep your inquiries close together to minimize the effect of each.

Four Additional Features for Total Credit Coverage

Track It already offers more than our competition, but it’s just one of five all-encompassing tools offered through ExtraCredit.

Build It

Let’s say you have a thin credit file. You want to apply for credit accounts to build your credit, but you don’t even qualify because your credit file is so thin. It’s a vicious cycle. That’s where Build It comes in. You might not be making a ton of payments on credit accounts, but what about rent? Utility bills? Build It will find the payments you’re making and report those payments to the credit bureaus. They’ll then show up on your report, which gives your score more to work with when calculating your score!

Guard It

How often do you think about your identity? Sometimes? Not at all? Here’s the thing—criminals think about your identity a ton. In fact, they’re constantly thinking of sneaky ways to steal your identity. If you’re worried, don’t be—Guard It from ExtraCredit is here to help. We offer $1 million identity theft insurance, dark web monitoring, and much more.

Reward It

So you decided to sign up for ExtraCredit? Great! We want to celebrate by sending you a little present. You’ll get your very own ExtraCredit debit card, loaded up with five dollars. In the meantime, we’ll analyze your credit and send you offers appropriate for your credit type. Every time you qualify for an offer, we’ll load up your debit card with up to $300.

Restore It

Look—no one’s perfect. It’s difficult to achieve a perfect credit score, and even more difficult if there are errors on your credit report. If you see an error on any of your credit reports, you can jump right over to Restore It, which offers an exclusive discount to one of the leaders in credit repair. You’ll have a company experienced in credit issues dedicated to helping you check your report and challenging unfair negative items on your credit report on your behalf.

You won’t find complete credit coverage like this anywhere else.

*Get seven days free.

FAQs

How much does ExtraCredit cost?

ExtraCredit costs $24.99/month, and you can cancel anytime. For a limited time, you can sign up and get the first seven days free.*

Why isn’t my score available?

Your score might be unavailable because you have a thin file! That means that either you have a very short credit history, or none at all.

How often are scores and reports updated?

Your credit scores and credit reports are updated monthly.

*Your trial will begin after you submit your ExtraCredit® sign-up. After your trial period, your subscription will automatically continue on the same day every month as the day you started your trial membership. The credit card you provided will be charged $24.99 (plus any applicable tax) monthly after your trial period unless you cancel. You may cancel at any time by downgrading your service level in your settings or by contacting us at support@credit.com. Dishonored payments will result in an automatic downgrade to the free credit.com product. Available to new ExtraCredit customers only.