![What Is a Good Credit Score? [With Ranges]](https://www.credit.com/wp-content/uploads/2023/05/image-2.png)

Generally, the credit bureaus consider anything over 670 a good credit score.

Considering applying for a new line of credit like a mortgage or credit card, but not sure how your credit score stacks up? If your score is 670 or higher, you’re doing fairly well. The best credit score and the highest credit score possible is 850 for both FICO® and VantageScore® models. FICO considers a score between 800 and 850 to be “exceptional,” while VantageScore considers a score above 780 to be “excellent.” It’s possible to get an 850 credit score, but it’s tough to achieve.

In This Piece

- What Is a Good Credit Score?

- What Is a Good FICO Score?

- What Is a Good VantageScore?

- Understanding Credit Score Ranges

- What Are Credit Scores?

- How to Get a Good Credit Score

- How Lenders Use Credit Scores

- How Can I Get My Credit Scores?

- FAQs about Good Credit Scores

- What if I Don’t Have a Good Credit Score?

What Is a Good Credit Score?

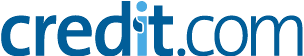

A good credit score will depend on the scoring model, but either 670 or above would be considered good. Credit scores calculated using the FICO or VantageScore 3.0 scoring models range from 300 to 850. Those scores are broken down into five categories, though the breakdowns differ slightly. Since they have somewhat different range calculations, what’s considered good for VantageScore may be considered fair for FICO, and what’s considered very good for FICO may only be good by the VantageScore model.

FICO and VantageScore aren’t the only credit scoring models. However, they are the most commonly used models and the ones used by the three major credit bureaus: Experian®, Equifax® and TransUnion®. Some lenders even have their own scoring models. But most lenders and credit card companies use FICO scores or VantageScores.

What Is a Good FICO Score?

For FICO, a good credit score is 670 or higher. A score over 739 would be considered very good, while a score above 800 is considered exceptional—the highest designation possible aside from a perfect 850.

What Is a Good VantageScore?

In the VantageScore 3.0 model, a good score is 661 or higher. Since this model doesn’t have a designation between good and excellent, the range of good scores is much wider than it is for FICO. Excellent scores start at 781 rather than 800 in this model, with 850 also being considered a perfect score.

Understanding Credit Score Ranges

The credit score ranges vary depending on whether you’re looking at a FICO score or a VantageScore. They line up fairly similarly, but their score designations have different labels — FICO lacks a “very poor” designation, while VantageScore lacks a “very good” range. Here’s how they break down.

FICO Score Range

- Poor: 300-579

- Fair: 580-669

- Good: 670-739

- Very Good: 740-799

- Exceptional: 800-850

VantageScore Range

- Very Poor: 300-499

- Poor: 500-600

- Fair: 601-660

- Good: 661-780

- Exceptional: 781-850

Credit Score Range Chart

To give you a clear idea of how FICO and VantageScore’s credit score ranges compare, here’s a comparison credit score range chart.

What Are Credit Scores?

The three-digit figures called credit scores are what scoring institutions use to rate your credit profile based on your credit report. Since these bureaus have their own records, your score might differ from one scoring institution to the next.

Your score suggests to potential creditors how likely you could be to repay a loan, pay off a credit card, make late payments, and default on payments. Basically, it helps them determine whether you’re an acceptable risk and if they should approve your application for a loan or credit card. A low score doesn’t always mean lenders will decline your application. Instead, it might mean they’ll consider approving you with higher interest rates or less favorable loan terms.

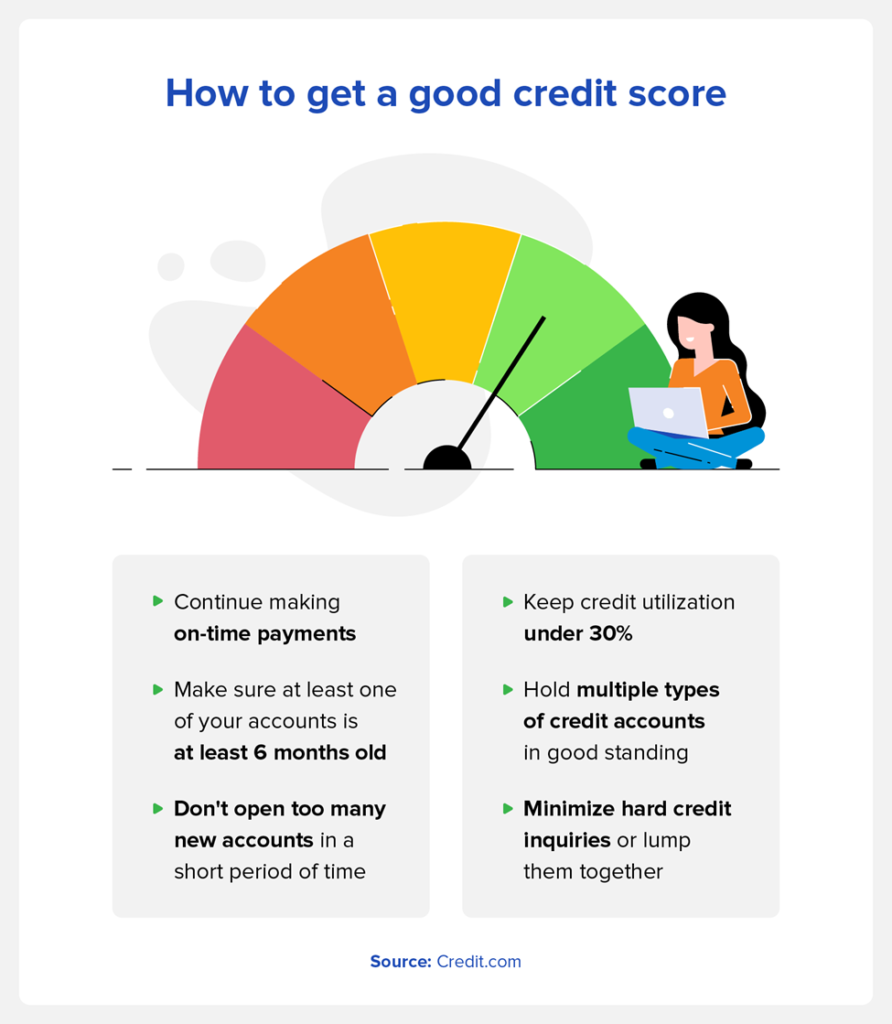

How to Get a Good Credit Score

VantageScore and FICO scores are calculated using similar information. Each model may use slightly different terms for these, but here’s what they’re looking for.

Payment History

FICO weight: 35 percent

VantageScore weight: 40 percent

Late and missed payments can have a major impact on your credit score. Both FICO and VantageScore take your history of payments into account when calculating your score and look at your number of late payments, the number of accounts you’ve missed payments on, and the overall number of missed payments. Maintaining a consistent, on-time payment history goes a long way in establishing good credit.

Amounts Owed/Credit Utilization

FICO weight: 30 percent

VantageScore weight: 20 percent

Credit utilization is calculated as a ratio. It divides the amount of credit you’ve used by your total credit limit. If your credit limit is $5,000, for example, and you use $2,000 in credit, your utilization rate is 40 percent. It’s recommended to keep this rate to 30 percent or less and preferably below 10 percent. To help improve your credit score, try to reduce your utilization ratio if you often find yourself going above 30 percent.

Length of Credit History/Credit Age

FICO weight: 15 percent

VantageScore weight: 21 percent

Your credit history refers to the amount of time your credit accounts have been open, averaged across all of your accounts. That means that if your credit history has factored in your oldest account for the last 15 years but you suddenly close that account, your average credit age will drop accordingly, which could also lead to a drop in your credit score.

For that reason, it’s a good idea to maintain your oldest credit accounts. As a rule of thumb, try to make sure you have one account that’s six months old or older open at all times.

Credit Mix

FICO weight: 10 percent

VantageScore weight: N/A

Your credit mix refers to the number of revolving and installment accounts you have open. Here’s how those accounts differ:

- Installment accounts: These are essentially defined long-term loans like home mortgages or vehicle financing on which you make payments in specified amounts over a predetermined period.

- Revolving accounts: These types of accounts set a specific amount of credit you can use as needed, such as a credit card. You only pay back the amount of credit you borrow against this limit.

Potential lenders will want to know you can manage both of these account types, so it helps to have a history of successfully managing each. While FICO has a category explicitly for this, VantageScore does not—though it still may factor into other elements of your VantageScore. As such, it can be helpful to have multiple types of accounts in good standing regardless of the scoring model.

New Credit/Recent Credit

FICO weight: 10 percent

VantageScore weight: 5 percent

Opening multiple new credit accounts in a short period of time can have a negative impact on your credit score. Since lenders may see it as a red flag for a borrower to have several recent accounts open, it may be helpful to let your current accounts continue aging while paying them off consistently if you want to maintain or improve your score.

Balances and Available Credit

FICO weight: NA

VantageScore weight: 14 percent

Though only VantageScore has categories specifically for balances (11 percent) and available credit (3 percent), they still play a role in your FICO credit score. The amount of money you owe to lenders and your available credit factor into credit history and utilization rate, so keeping your balances low in comparison to your available credit can be a good idea when trying to achieve a good credit score.

A Note on Credit Inquiries

A hard credit inquiry gets pulled when a lender requests your credit report to assess your creditworthiness. This type of inquiry can drop your score by as much as 5 to 10 points and may stay on your credit report for up to two years, but it will impact your score for only 12 months. To get and maintain good credit, it’s best to avoid these as much as possible.

If you need to apply for multiple credit accounts in a short time or want to shop around for loan rates, it can help to keep those applications within a 14-45-day window so they get grouped into one inquiry. FICO and VantageScore differ on this, with FICO using 45 days and VantageScore using only a 14-day span.

Keep in mind this is only for hard inquiries, as soft inquiries shouldn’t affect your score.

How Lenders Use Credit Scores

Credit scores can offer a gauge of creditworthiness for lenders to determine things like whether or not to approve you for a credit line, how much credit to approve you for, and what your interest rate should be. But while your credit score has a big role to play in this, it’s considered alongside your credit report. Lenders may also consider your income, debt, and your ratio of debt to income.

How Can I Get My Credit Scores?

You can request a full credit report from all three credit bureaus from AnnualCreditReports.com, however, your score is not included with your report.

Most online options for viewing your credit score—free or paid—are limited to one or two scores. ExtraCredit from Credit.com takes it twenty-six steps further by offering you 28 of your FICO scores from all three major credit bureaus. When you sign up for an ExtraCredit account, you can also earn money when you get approved for select offers, monitor your accounts with $1 million identity theft insurance, and get exclusive discounts froma leader in credit repair services. All for one low monthly price.

If you’re not ready for ExtraCredit, Credit.com also offers a free Credit Report Card. This comes especially in handy as it offers you your Experian VantageScore 3.0 credit score for free.

FAQs about Good Credit Scores

Want to know more? Here are a few common questions about what good credit scores are and how they’re used.

Do Lenders Prefer a Good VantageScore Score over a Good FICO Score?

Lenders don’t necessarily prefer one score over the other. It’s likely, though, that a given lender uses only one credit-scoring institution. FICO reports that 90% of the top U.S. lenders use FICO scores when deciding whether to loan money to an applicant. On the other hand, VantageScore states that between March 2021 and February 2023, approximately 14.5 billion VantageScore credit scores were used.

Both models are consistent enough that knowing where you stand in one gives you a reliable indication of your credit in general.

What Is a Good Credit Score to Buy a House?

A FICO score of 580 is the minimum credit score required to qualify for maximum financing. , according to the U.S. Department of Housing and Urban Development. Below 580, borrowers will have to make a minimum downpayment of 10 percent. That doesn’t necessarily mean that you’re guaranteed to qualify for a loan with maximum financing with a score of 580 or above, but it’s what you’ll need if you want the flexibility of a lower down payment.

What Is the Highest Credit Score?

850 is the highest credit score possible for both the FICO and VantageScore models.

What Is Credit?

Credit is access to capital provided by a lender with an expectation that it will be repaid within an agreed time frame. This could be a set installment account—such as a mortgage or car loan that gets paid off gradually—or a revolving account like a credit card with a maximum balance that can be borrowed at a given time.

What if I Don’t Have a Good Credit Score?

Now that you know what’s a good credit score, it’s crucial to act on yours. If your credit is fair or poor, find out why. Then you can address the factors and work to improve your score.

Do you need more credit history? Check out our ExtraCredit Build It feature! Use ExtraCredit to report rent and utility bills you’re already paying and add them to your credit profile as tradelines. This allows the credit bureaus to see additional payment information from you, which can help you build your credit profile.

Do you know your credit score?