Holiday Gender Gap: Men Prefer Credit Cards, Women Prefer Cash

Credit.com Survey Also Finds Consumers Plan to Use Credit Cards Less, Debit Cards and Cash More

San Francisco, CA | December 11, 2013

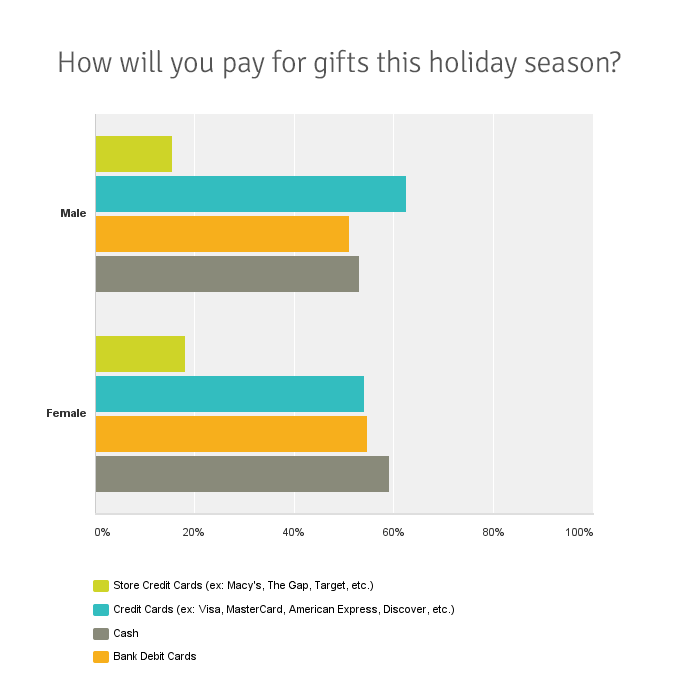

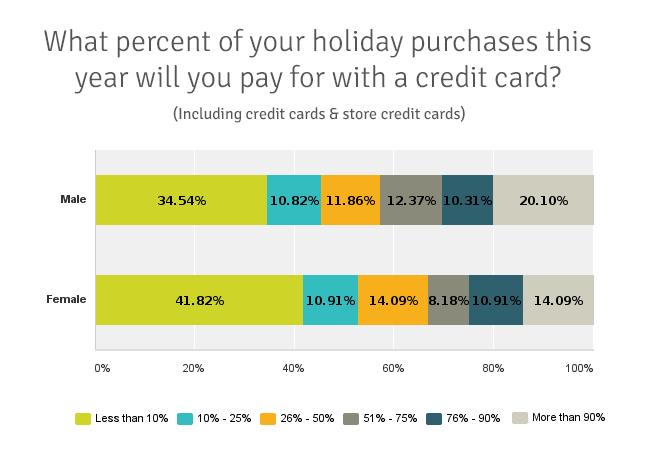

When it comes to paying for holiday purchases, men are more likely to say “charge it” than women, according to Credit.com’s 2013 Holiday Spending Survey. 62.37% of male respondents indicated they will use a credit card to pay for at least some of their purchases, while just slightly more than half of women (54.09%) said they plan to do so. Just under 43% of men (42.78%) say they will use credit cards for more than half of their holiday purchases, while only 33.19% of women say the same.

Women, on the other hand, report they are more likely to use debit cards or pay cash for some or all of their holiday purchase (59.09% of women versus 53.09% of men). Additionally, 30% of women say they will use credit cards less this holiday season than last, compared to 22% of men.

“These days, how we pay is nearly as important how much we spend,” said Adam Levin, chairman and co-founder of Credit.com. “The results of our latest survey have some important findings that provide some valuable insight into how our spending is changing – both qualitatively and quantitatively.”

Spending: This Year vs Last Year

Consumers reported that they expect to basically spend the same amount this year on holiday gifts as they did last year:

| This Season | Last Season | |

|---|---|---|

| $200 or less | 24.4% | 25.2% |

| $500 or less | 59.4% | 58.6% |

| More than $500 | 40.6% | 41.6% |

| More than $1000 | 12.9% | 15.5% |

+/- 4.5 percentage points margin of error

Credit Cards: This Year vs Last Year

- Overall, 26.1% report that they plan to pay for fewer of their purchases this holiday season with credit cards than they did last holiday season.

- 11.1% said they plan to pay for more of their purchases with credit cards, compared to last holiday season and 62.8% said that their use of credit cards would be about the same

Debit Cards & Cash: This Year vs Last Year

- About one-fifth (20.3%) report that they plan to pay for more of their purchases this holiday season with debit cards and cash, as compared to last holiday season.

- 13.2% said that they plan to pay for fewer of their purchases with debit cards and cash, and 66.5% said that their use of debit cards and cash would be about the same.

Credit Card Rewards & Other

Among those consumers who plan to use credit cards to pay for fewer of their gifts this holiday season than last, the primary reasons for doing so are:

- Trying to avoid using credit cards (out of principle) – ~20%

- Have less income, financial situation is worse – ~15%

- Prefer cash – 10%

- Have been able to save for this year’s gifts – 10%

- Trying to pay off debt so don’t want to incur more – 10%

Why Pay Cash?

Among those consumers who plan to use cash and debit cards to pay for more of their gifts this holiday season than last, the primary reasons for doing so are:

- Trying to pay off debt (29%)

- Prefer cash (10%)

- Have more income this year (10%)

- Have been able to save for this year’s gifts (8%)

The Impact of Debt on Holiday Spending

Debt is still putting a damper on this holiday season for many shoppers. Those consumers who plan to use credit cards less than last holiday season have much higher outstanding (unsecured) debt than those who plan to spend more. 43.1% of those who plan to use credit cards less this holiday season report they have more than $10,000 in outstanding debt, compared to 27.7% of those who plan to use credit cards for more of their gift purchases.

Conclusions

Overall, the Credit.com 2013 Holiday Survey results indicate that even though spending will likely remain flat, there are strong indications that people are less likely to make those purchases with credit cards than with cash or debit cards.

“It’s great that many consumers are trying to be careful about only buying what they can afford during the holidays,” says Gerri Detweiler, Credit.com’s director of consumer education. “But those who use cash and debit cards should keep in mind that credit cards offer greater protection if they are lost or stolen, or if there is a problem with a purchase.”

About the Survey

Credit.com 2013 Holiday Shopping Survey was based on data collected from 426 US consumers, aged 18+, using SurveyMonkey Audience, over the period November 18 -19, 2013. Information on how respondents are recruited can be found here.

About Credit.com

Credit.com is a trusted source of financial information for consumers. Founded in 1994, and run by leading credit & money experts, Credit.com offers the latest news, advice, and free, easy-to-use tools to help consumers gain valuable insight, save money and make smarter financial decisions. Its flagship product, the free Credit Report Card, has been recognized as an innovative consumer finance tool by CNN, Wall Street Journal, Fast Company, and others.