Memo to American consumers: You just got screwed—again.

Memo to American consumers: You just got screwed—again.

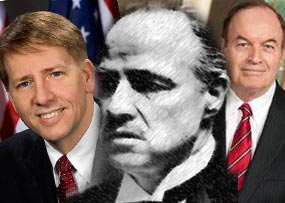

The too big to fail boys and their GOP handmaidens—the Hon. Richard Shelby, the Hon. Mitch McConnell and the other 43 legislators in the US Senate—have struck again.

Yesterday, they blocked the confirmation of Richard Cordray to be the Director of the Consumer Financial Protection Bureau, which is the first federal regulator with the sole purpose of protecting regular people from the likes of financial scoundrels.

[Related article: Senate Republicans Block New Consumer Watchdog]

Plain and simple—just like we experienced a few months earlier with Elizabeth Warren (whose potential nomination was derailed by the same band of robber-barons)—Mr. Cordray is the newest piece of road kill on the Conservative super-highway, and the American people have been hosed yet again. Now, you might not realize this, because you’re about to witness a cable news cycle full of Republican senators prattling on as to why their vote was really about accountability and good government.

Don’t buy it, my friends.

Thursday’s vote was a simple win for greed and gridlock. Republicans didn’t need to win (actually they lost, 45 to 53). To secure their next round of campaign contributions from their financial patrons, all they needed to do was stall. And in that respect, they hit the ball out of the park, because Cordray’s nomination is seven votes shy of being filibuster-proof. Ironically, Scott Brown, the Republican Senator from Massachusetts who is being challenged by Elizabeth Warren, was the only GOP Senator to vote for Cordray.

[Resource: Get your free Credit Report Card]

Thursday’s vote assures that a whole host of banks and other non-banking financial services companies won’t have a real cop on the beat until at least November 2012, when the next Presidential election is decided. And, the GOP is counting on the fact that when the smoke clears in January of 2013, they will be running the show so that they can stamp out all of this consumer protection rubbish once and for all.

Consumers obviously lost this round. But other folks lost, as well. Take, for instance, honest companies (including some of the nation’s largest banks), and anyone who cares about doing business on a level playing field in an environment of integrity.

First, a little background. Congress created the Consumer Financial Protection Bureau, which launched last summer, as part of the Dodd-Frank financial reform package. A lynchpin of the legislation, the CFPB represents the first federal agency exclusively devoted to the protection of the consumer in the financial services area. Consumer law enforcement responsibility, previously scattered among seven other financial regulatory agencies, has now been consolidated under the CFPB.

Whereas other regulators are primarily concerned with promoting the safety and soundness of the American economy (which all too often they confused with protecting the profits of big banks and Wall Street investment firms), the CFPB is a one-stop shop for consumer education, advocacy, research and enforcement. Just pay a visit to their website and take a look at the work they are doing now. They are actively collecting the stories of consumers wounded by their credit card issuers and confounded by their mortgage lenders. And just this week they released their proposal for a credit card agreement that an actual human has a shot at understanding.

[Featured Product: Looking for your credit report?]

GOP to Wall Street: “Richard Cordray Sleeps with the Fishes” (cont.) »

You Might Also Like

March 11, 2021

Personal Finance

March 1, 2021

Personal Finance

February 18, 2021

Personal Finance