The housing market has been making significant strides for more than a year, but now worries about a constrained availability of property could lead to fewer transactions.

The housing market has been making significant strides for more than a year, but now worries about a constrained availability of property could lead to fewer transactions.

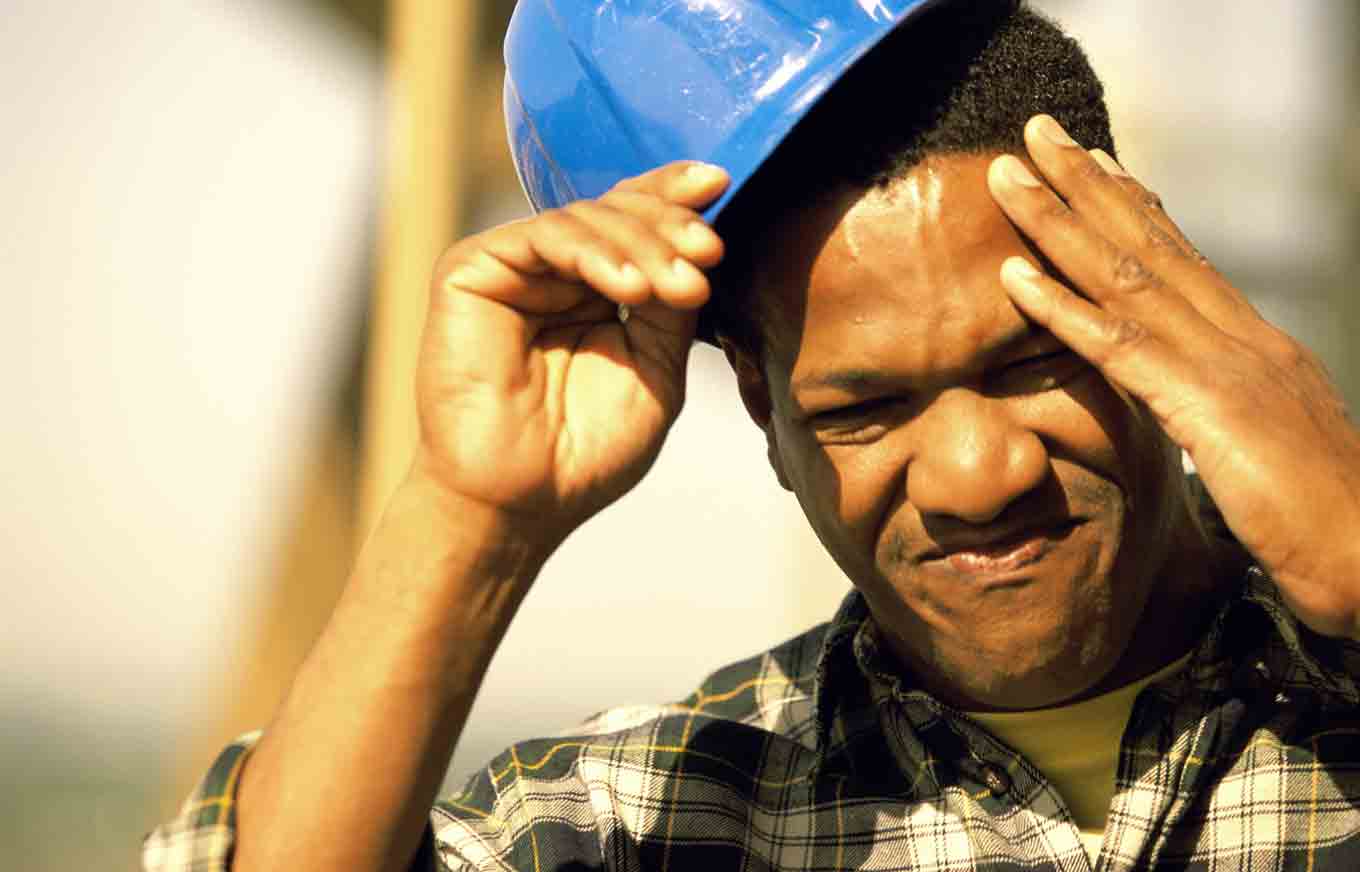

The still-limited inventory of existing homes for sale across the country has proven a major driver of price increases in the last year, but buyer frustration could continue to mount simply because there may not be enough workers nationwide to build new residential housing at a rate fast enough to meet demand, according to a new forecast from Fitch Ratings.

The U.S. Bureau of Labor Statistics found that the number of carpenters working nationwide declined by more than half between 2007 — when the housing downturn was just getting under way — and 2012, to about 471,000 from slightly less than 970,000. Moreover, only about 5.8 million construction workers were employed through the end of May, down from more than 8 million during the peak of the housing boom.

In all, this means that there could be as few as 1.1 million housing starts next year, the report said. Under normal conditions, that number would be closer to 1.5 million, but even if there is an uptick in building projects, the lack of workers could likewise pose significant difficulties. In all, commercial construction spending is expected to grow just 5 percent through the end of this year, and 6 percent in 2014.

“We believe the degree of labor shortage will depend on the pace of recovery. If the pace is moderate (which we expect) in 2013 and 2014, the shortage will only be prominent in certain markets,” the report said. “But, if we have a more V-shaped recovery, the labor shortages will probably be more pronounced.”

It should be noted, though, that these shortages will likely be concentrated, rather than spread out evenly across the country, the report said. For instance, states like California, Florida, Nevada and Arizona, where the downturn hit hardest and prices are largely growing quickly, will likely see more worker shortfalls than other places going through more moderate recoveries.

Interestingly, it’s believed that dropping affordability – a result of rising prices and higher interest rates – could also dissuade some borrowers from entering the market, which in turn may serve to temper additional recovery going forward.

Image: Purestock

You Might Also Like

December 13, 2023

Mortgages