Americans of all ages grapple with the cost of higher education, whether it’s trying to save for the future, choosing a college or repaying student loan debt. Tuition and fees at U.S. colleges has increased an average of 5% every year for the last decade, and the $1.2 trillion in outstanding student loan debt is projected to grow. In the next few weeks, Credit.com will explore several of the answers, opinions and theories out there about why these numbers keep going up.

A four-year education at a public college is on track to cost $94,800 by 2033, according to data from the College Board. Yep, you’re looking at nearly $100,000 for four years at an in-state public school, if tuition and fees increase by 5% annually, as they have for the past decade. Of course, if you don’t have kids yet (2033 is 18 years from now), it could cost even more.

Legislators and other U.S. leaders, including the President, have called for improved access to affordable education. So how did we get to this 5% annual hike in tuition and fees? Why is college so expensive?

Here’s an answer for you:

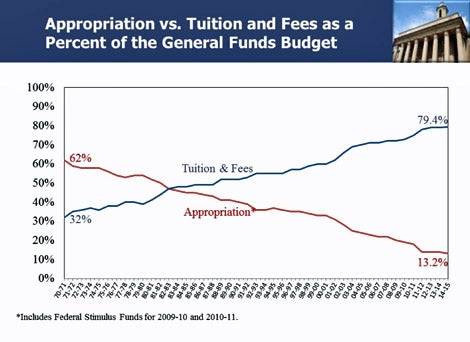

This is a graph made publicly available on the website for Penn State’s budget office. It shows where the money for the general funds portion of the overall budget — 40% of the 2014-15 budget is general funds — comes from. For this academic year, 79.4% of that budget comes from tuition and fees, and 13.2% comes from the state. About 40 years ago, state money made up more than half of this budget.

Penn State has the second-most expensive in-state tuition and fees in the country, and the priciest is 133 miles west at the University of Pittsburgh. There’s a reason for those high sticker prices: State appropriations for higher education in Pennsylvania declined 11.4% in the past five years. Only Arizona and Louisiana cut more from their state school systems (15.9% and 13.2% respectively), according to Grapevine, an annual report from Illinois State University on state support of higher education. Speaking of Arizona: The state just cut all funding for its community college system, Inside Higher Ed reports.

“As far as tuition goes — for public institutions, it is a well-documented fact that our state appropriations — which subsidize the tuition for in-state students — have been eroding for decades,” wrote Lisa Powers, director of the Penn State office of strategic communications, in an email to Credit.com. “Penn State is currently at the same funding level from the state that we were at in 1996, when we served about 20,000 fewer students than today.”

State funding isn’t the only thing determining how much students in Pennsylvania or any other state have to pay to get a degree — the “why is college so expensive?” question has many answers — but it highlights an industry-wide predicament: If one money source isn’t cutting it, whether it’s the government, fundraising campaigns or alumni donations, it has to come from somewhere. The state appropriations issue is much more significant in some states (like Arizona, Louisiana and Pennsylvania), but nationwide, state appropriations have increased about 9% over the last five years.

Consider the fact that tuition and fees outpaced inflation in their steady climb over the last several years, while wages have stayed the same or fallen, according to 2014 analysis from the Pew Research Center. Those statistics can make that upward-trending tuition-and-fees figure seem even more daunting and intensify the country’s ongoing concern about student loan debt. Government funding (or the lack thereof) isn’t the only thing affecting education prices, but it appears to be a significant part of the many things affecting students’ access to affordable education. (Credit scores can also play a role, specifically if you need private student loans to subsidize your child’s education costs. You can check two of your credit scores for free on Credit.com to see where you stand.)

More on Student Loans:

- How Student Loans Can Impact Your Credit

- Can You Get Your Student Loans Forgiven?

- Strategies for Paying Off Student Loan Debt

Main image: iStock; graph: Penn State University Budget Office

You Might Also Like

April 11, 2023

Uncategorized

September 13, 2021

Uncategorized

August 4, 2021

Uncategorized