Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

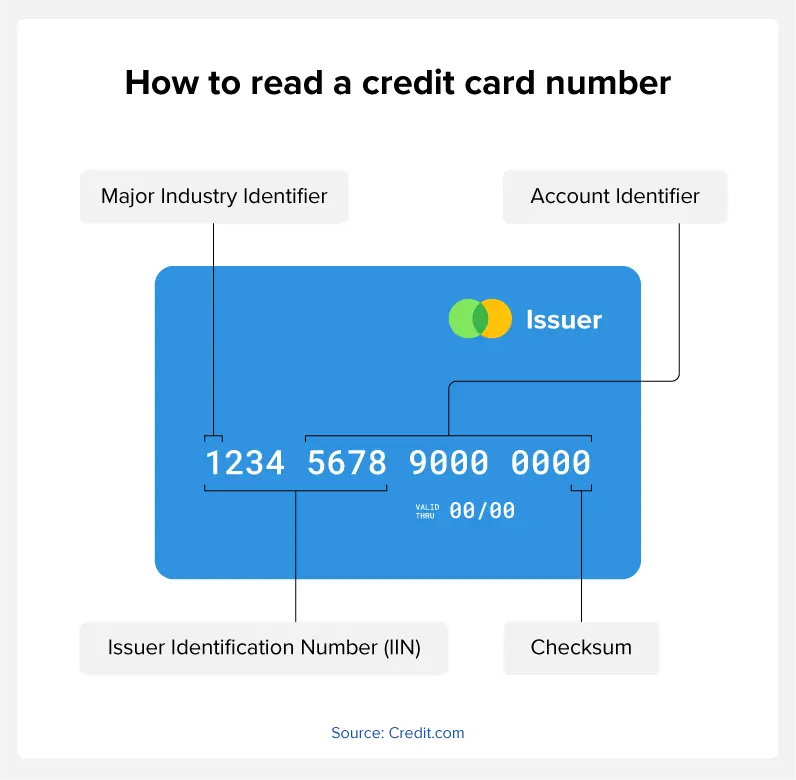

A credit card number is the specific number attached to your credit card. It includes a major industry identifier number, your account identifier, and a checksum.

The number on your credit card is more than a passcode to payments when you swipe your card. Many of the digits have a specific meaning. Find out what a credit card number is, what it means, and why it matters.

What Is a Card Number?

A credit card number is a unique number that helps identify your account and card. This number makes it possible for you to pay with the card and for money to be taken out of the right account.

Think about it similarly to your checking account number. Your personal checks are printed with a specific series of numbers. First is the routing number, which indicates which bank the check draws on. Next is the account number, which tells which account the money should come from.

Credit card numbers work the same way. Each part of that long number has a specific function. These are standardized by the International Organization for Standardization (ISO).

Your credit card number is often located on the front of your card above your name, but it may also be located on the back, depending on your card’s style.

What Do Credit Card Numbers Mean?

You can break each credit card number into sections, and each section reveals specific information about the account.

Industry Identifier

The first six to eight digits reveal the credit card network and the card’s industry.

The first digit in any credit card number tells you what type of card it is—Visa, Mastercard, Discover, or Amex. Card numbers of each type always start with the same number:

- 3: American Express or cards under the Amex umbrella

- 4: Visa

- 5 or 2: Mastercard

- 6: Discover

American Express goes even further by starting card numbers with either 34 or 37, depending on the secondary branding on the card.

If your credit card number starts with any other digit, it refers to the industry that issues the card:

- 1 – 2: Air travel and financial services

- 7: Petroleum

- 8: Health care and telecommunications

- 9: Government and other industries

That first digit plus the next five in the credit card number is called the Issuer Identification Number (IIN) or Bank Identification Number. This identifies the credit card company and its network, similar to the bank routing number on a personal check.

In some cases, the IIN may be eight digits. To allow for more IINs to support growing needs, the ISO is requiring the financial industry to move to eight-digit IINs.

Account Identifier

The rest of the digits identify the account and cardholder information. This portion of your credit card number changes if your card is lost or stolen and you need a new card.

Within the account identifier, the last four digits are particularly important to you. If you save a credit card in an online account or other database, the information has to be encrypted. Employees of that company can’t just look up accounts and see full credit card information. They’re usually only able to see the last four digits.

You might be asked to confirm those numbers to ensure the right card is being charged. You might also be asked to confirm them when buying something online with a saved card number to ensure you’re really you and not someone who’s hacked into an account.

You can’t tell a credit card number by the last four digits. However, you could find a credit card you’ve saved in an account, such as on Amazon, by the last four numbers. Those are the only digits you’ll be able to see when you look at the saved payment methods in your account.

Checksum

The final digit is the checksum. Sometimes called the check digit, it is a way to verify the validity of a credit card using the Luhn algorithm.

Here’s how it works:

- Starting from the first number of your credit card number, double every other digit.

- If doubling results in a two-digit number, add those two digits together.

- Add up all the doubled numbers.

- The credit card number is valid if the number you reached in step three is divisible by 10.

Vendors use this algorithm to determine whether or not your credit card number is valid when you type it in online.

How to Protect Your Credit Card Number

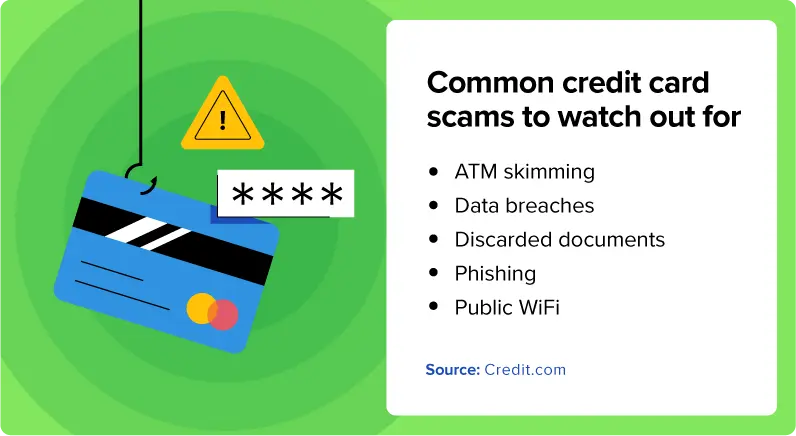

Credit card fraud impacted nearly half a million consumers in 2022 and is the most common type of identity theft. Sadly, scammers can get your credit card number in many ways:

- ATM skimming: People install credit card skimmer devices on public card terminals such as gas stations or outdoor ATMs. These devices store the data on your credit card’s magnetic strip for scammers to download and use.

- Data breaches: There were more than 2,800 data breaches in 2023. A data breach occurs when secure data is accessed through unauthorized means, often because of a hacker. The largest data breach occurred in 2013 and involved the unauthorized access of more than three billion records.

- Discarded documents: While bills and statements often don’t include your full credit card number, people may be able to gather enough information to determine your credit card number.

- Phishing: These scams are fraudulent emails, texts, or phone calls that try to convince you to share your personal information to verify your identity.

- Public Wi-Fi: Free public Wi-Fi is convenient but often unsecured. Hackers may be able to access your data through spyware or ransomware.

To protect your credit card information, take the following steps:

- Avoid using public Wi-Fi when making online purchases or accessing account information.

- Shred documents related to your credit card and always cut up old cards.

- Don’t give out your account information.

- Use strong passwords.

- Enable two-factor authentication for your accounts.

- Don’t give out personal information over the phone or online without verifying the validity of the request.

- Use a virtual card number, which is a unique number connected to your actual credit card number.

- Monitor your credit card statements carefully.

- Monitor your credit score regularly with Credit.com’s Credit Report Card.

Credit Card Number FAQ

Below you’ll find additional information about credit card numbers.

How Many Numbers Are in a Credit Card?

Typically, credit card numbers are 16 or 15 digits. Only American Express uses the 15-digit format. Around 2020, Visa started issuing some cards with 19-digit card numbers, which aren’t typical in the United States.

What Other Numbers Are on a Credit Card?

You’ll also find a few other numbers on your credit card:

- The expiration date: Every few years, credit card issuers will send you a new card for security reasons. This expiration date may be on the front or back of your card and is formatted with two digits for the year, a slash, and the last two digits of the year. For example, if your card’s expiration date is May of 2030, the expiration date would read 05/30. In this case, the card would stop working on May 31, 2030.

- Card verification value (CVV): The security code, called a card verification number, is typically a three- or four-digit code on the back of your card. Vendors ask for it whenever they do not physically see your card, such as when you make a purchase online or over the phone.

Finding the Right Credit Card

Before applying for a new credit card, determine what kind of credit card you should get. For example, if you want to maximize rewards, you may want a cash-back card with perks that match your budget. If you’re looking to build credit, you may need to apply for a secure credit card that’s easy to get with lackluster credit.

To understand what options might be right for you, check your credit. This helps you know what type of credit card you might be approved for.

Next, educate yourself about applying for a credit card online. Review options that seem appropriate for you and pick the best one—you can get started in our credit card marketplace. Then, gather all the information you need and apply.

You Might Also Like

April 9, 2024

Credit Cards

October 21, 2020

Credit Cards

August 3, 2020

Credit Cards