Mortgage Calculator with Property Taxes and PMI

Mortgage Calculator

Monthly Payment Breakdown

-

Principal and interest

$2,200

-

Property tax+

-

PMI+

-

Homeowner's insurance+

-

HOA fees+

Total monthly payments

=

$2687

Amortization for Mortgage Loan

An amortization schedule allows you to see a detailed view of paying off your mortgage loan over time. It's broken down by your annual payments, or you can click to see what it'll look like month-to-month. It will show you how much of your payments are going toward the principal and the interest along with your remaining balance and payoff date.

Loan amount

$350,000

Total interest paid

$350,000

Total cost of loan

$350,000

Payoff date

$350,000

As of July 2045

-

Principal paid

-

Interest paid

-

Loan balance

Amortization schedule breakdown

This table lists how much principal and interest are paid in each scheduled mortgage payment.

First payment date

Estimated payoff date:

Jun 2053

| Payment Date | Principal | Interest | Remaining balance |

|---|

Buying a home is one of the biggest purchases you’ll ever make. While buying a home brings a new life, a new investment, and future memories with your family, the process can also be stressful. One way to mitigate this stress is by educating yourself as much as possible about how mortgages work and the associated costs before shopping for your dream home.

Our simple mortgage calculator shows you what your monthly payments should be based on the information you input and includes an amortization schedule to show you a monthly breakdown across the duration of your loan. For example, if you set the calculator for a 30-year mortgage, you’ll see every monthly payment for thirty years, along with how much of the payment is split between the principal and interest.

In addition to the calculator, you will learn how to find out how much house you can afford, the additional costs associated with a mortgage, and how to lower your monthly mortgage payments. All of this will allow you to be better prepared as you shop for a new home.

How to Calculate Your Mortgage Payments

The exact formula to calculate your home loan payments is complex, but fortunately, our mortgage calculator does most of the work for you.

In the “Home price” section, enter the total price of the home or what you’re willing to pay for a home. Feel free to experiment with this section, too, because as you enter more information, you may find that a certain price is outside your monthly budget. You may also find that you can afford more than you thought.

Next, enter how much money you’re putting down up front in the “Down payment amount” section. It’s recommended that you put down 20% for a home, but some loans allow you to put down much less. It’s also helpful to know that the down payment amount is subtracted from the home price because you’ll only pay back the amount borrowed after the down payment.

Finally, enter the loan term and the interest rate. As you change the inputs, you will see the mortgage payments adjust in tandem. You can then use these numbers to see what’s within your budget and what type of loan and interest rate you can afford.

You will also see that there are additional inputs for:

- HOA fees

- Property taxes

- Private mortgage insurance (PMI)

- Homeowners insurance

These are optional inputs. If you have this information, it will get you a much closer estimate of your overall monthly expenses for the home.

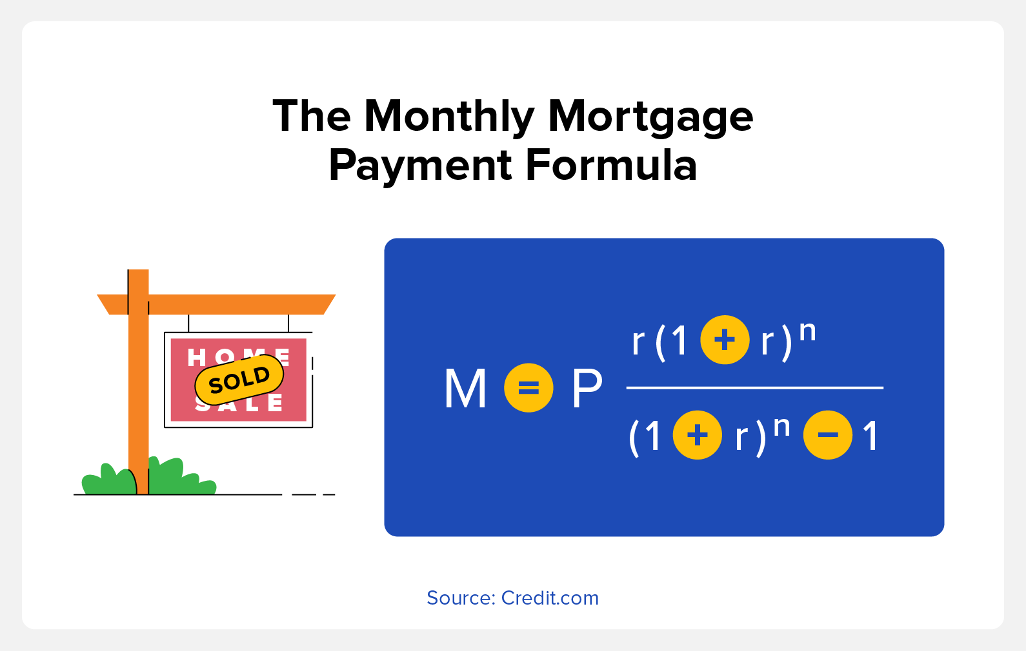

Mortgage Calculator Formula

For those interested in the exact formula, the following will allow you to calculate mortgage payments manually:

Symbol key:

-

M

Monthly mortgage payment

-

P

Principal loan amount

-

r

Monthly interest rate

Home loans use an annual interest rate, so you'll divide that rate by 12.

For example, if your interest rate is 6%, the monthly rate would be .005.

-

n

Monthly mortgage payment

To find this number, multiply the years of the loan by 12, which is just the number of months in a year.

If it's a 30-year mortgage, multiply that by 12, and it'll be 360. A 20-year mortgage would be 240.

How Mortgage Calculators Help

It's best to avoid buying a house you can’t afford, as this can push your monthly budget to the limit to make mortgage payments. A mortgage payment will most likely be your largest monthly expense, so it’s beneficial to have an idea of what you can afford beforehand.

By using our mortgage calculator, you can adjust the numbers to see what makes sense for you and your family.

The calculator can help with homebuying aspects, like:

- The term of the loan: The term of the loan can change how much you’re paying for the house due to the interest. The calculator will help you determine whether you can pay off the home sooner with a shorter loan term or if it’s better to have lower monthly payments with a longer loan term.

- The mortgage type: The two common types of mortgages are fixed-rate and adjustable-rate mortgages. Adjustable-rate mortgages may give you a lower interest rate for the first one to 10 years of owning the home, but a fixed rate is more consistent.

- How much you can afford: Knowing what price range to look for can save you time during the homebuying process. You may find that homes in a certain price range push the monthly mortgage payments outside of your budget.

- How much to put down: A larger down payment can reduce your mortgage payments, but down payments can be tens of thousands of dollars. The calculator can help you see how much you may need to save before looking for a home.

How to Find Out How Much House You Can Afford

Before buying a home, it’s helpful to know how much house you can afford, which includes the overall cost of the home, the monthly payments, and all associated costs. There are many considerations for deciding how much you can pay for a home, but there are some helpful rules of thumb as well.

Many experts suggest using the 28% rule when deciding how much of your income should go toward your mortgage payment. The idea is to avoid spending more than 28% of your gross monthly income on your mortgage. For example, if you made $4,000 before taxes, you would want to keep your housing costs below $1,120.

Using the example above, here’s what it would take to buy a $300,000 home:

- 25% down payment of $75,000

- 30-year loan term

- 4.5% interest rate

With these numbers, the monthly payments would be just over budget by $20 at $1,140. As you can see, this would take a large down payment and a great interest rate.

If you’re married or have a dual-income household, your combined monthly income may allow you to afford a more expensive home.

One important thing to remember if you’re transitioning from renting to buying is that you’ll also have additional costs. Not only are there optional fields in the calculator, like HOA fees and insurance, but you may have additional utility bills. It’s also helpful to have an emergency fund for unforeseen home repairs.

Typical Costs Included in Mortgage Payments

Our mortgage calculator can help you find the minimum monthly mortgage costs, but there are some additional costs to consider:

- Principal: The loan amount, which reduces as you make your payments.

- Interest: Interest is the fee lenders charge when they loan you money, and it’s in the form of an annual rate.

- Property taxes: The government charges taxes on your home and land, which is divided into 12 annual payments through your mortgage. These taxes are paid by the loan servicer.

- Homeowners insurance: This insurance provides coverage for your home should there be a fire, home break-in, or weather events like storms or trees falling over. This insurance is often divided into 12 annual payments, much like your taxes.

- Private mortgage insurance (PMI): Lenders often require PMI should you put less than 20% down on your home, and it protects lenders should you default on your mortgage.

- HOA fees:Depending on where you buy your home, you may be in a neighborhood with a homeowners association that charges a monthly fee. These fees are often paid directly to the association.

How to Lower Your Monthly Mortgage Payments

You can lower your monthly payments by considering the following:

- Buy a less expensive home: Lowering the price range of your potential home is the easiest way to reduce your payments.

- Find the lowest interest rate: When buying a home, it’s helpful to shop around for the best interest rate. One way to get a better interest rate is to improve your credit score.

- Put down a larger down payment: A larger down payment reduces the amount you will borrow, which can lower your monthly payments. It may also help you avoid paying PMI if you can put down 20% or more.

- Choose a longer loan term: A longer loan term will spread out the payments over more years, thus lowering the monthly payments.

Helpful Mortgage Terms You Should Know

When buying a home, you may come across several unfamiliar terms. The following are some common mortgage terms you may see while researching your new home and finding the right lender:

- Home price: The home price is the total estimated cost of the home.

- Down payment: This is a percentage of the home price that you pay the seller.

- Loan amount: The loan amount is the amount of money you borrow, which is the home price minus the down payment.

- Loan term (years): Lenders provide home loan options in increments of years. The most common loan terms are 10, 15, 20, and 30 years. A shorter loan term comes with higher monthly payments, but you’ll pay off the loan faster. A longer loan term will reduce the monthly price but raise the overall price you pay for the home due to interest.

- Interest rate: This is an annual percentage that the lender charges as a fee for lending money.

- Loan start date: The start date is the date of your first mortgage payment.

How Your Credit Score Affects Your Mortgage Payments

To get the best interest rate for your home, it’s helpful to have a good credit score. Having a low credit score raises your interest rate, and in some cases, you may not qualify for a loan if your score is too low.

If you’re unsure about your credit score, a great place to start is by getting your free credit report card, which comes with a graded snapshot of your credit health. Here at Credit.com, we also have our ExtraCredit® service that shows you 28 of your FICO® scores, including mortgage specific scores You can test it out with our 7-day free trial today!

Legal disclosure: The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Information on this website may not be current. This website may contain links to other third-party websites. Such links are only for the convenience of the reader, user or browser; we do not recommend or endorse the contents of any third-party sites. Readers of this website should contact their attorney, accountant or credit counselor to obtain advice with respect to their particular situation. No reader, user, or browser of this site should act or not act on the basis of information on this site. Always seek personal legal, financial or credit advice for your relevant jurisdiction. Only your individual attorney or advisor can provide assurances that the information contained herein—and your interpretation of it—is applicable or appropriate to your particular situation. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, contributors, contributing firms, or their respective employers.

Advertiser disclosure: The offers that appear on Credit.com’s website are from companies from which Credit.com receives compensation. This compensation may influence the selection, appearance, and order of appearance of the offers listed on the website. Compensation is not a factor in the substantive evaluation of any product. However, this compensation also facilitates the provision by Credit.com of certain services to you at no charge. The website does not include all financial services companies or all of their available product and service offerings.