Want to keep close tabs on your credit?

Consider a credit monitoring service. With credit monitoring, you’ll receive updates alerting you of any changes in your credit file.

Some services monitor your credit reports from each of the three major credit reporting agencies — Experian, TransUnion and Equifax. Others only monitor your credit reports from one or two of the credit reporting agencies.

Prices vary as do the additional services offered. Some credit monitoring services will monitor your Social Security number as well, in case you are worried that this number has been compromised in some way.

When are credit monitoring services important? There are instances when you’ll want to keep an extra close watch on your credit.

For example, if you are or suspect you may be the victim of fraud or identity theft you will want to make sure a thief isn’t opening new credit accounts in your name or charging one of your current accounts to the hilt this month or six months from now.

Or maybe there has been a mix-up in your credit file and someone else’s credit record, with some less-than-stellar activities, has been mixed together with yours.

You may want to take extra care with your credit if you are going through a breakup or divorce and are concerned a significant other or roommate may be impacting your credit in a negative way.

Keeping a close eye on your credit is especially important if you have plans to buy a home or car within the next year and want to ensure your credit record is as good as possible so you can qualify for the best interest rates.

There are ways of monitoring your credit without paying for a credit monitoring service.

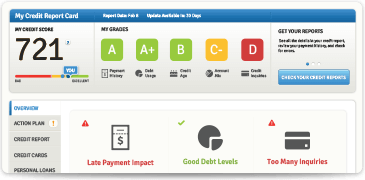

You can get a free credit score once a month plus a customized action plan from experts for improving your score — all for free on Credit.com.