Wondering how credit scores work? In simple terms, your credit score is a three-digit number given after a statistical analysis of your financial history. It’s basically a measure of how likely you are to pay a lender back. And the higher your credit score, the less interest you’ll pay and the more financial products you’ll gain access to.

Sounds simple, right? Actually, it’s a little bit more complicated. You might be surprised to learn, for instance, that you have more than one credit score—you actually have dozens of credit scores.

Confused about credit? You’re in the right place. We’ll begin this piece with a quick score retrieval guide, and then we’ll help you understand your credit a little better. Got burning questions about the bureaus? Don’t worry—we’ve got answers.

Getting Your Credit Score Has Never Been Easier

Developed by Fair, Isaac, and Company in 1956, the FICO scoring system initially flopped. Credit bureaus Credit bureaus didn’t adopt FICO until 1991, and consumers didn’t gain on-demand access to bona fide FICO scores until much later than that. Now, thanks to the internet, you can see your FICO score in minutes. Let’s explore two ways to get your score right now.

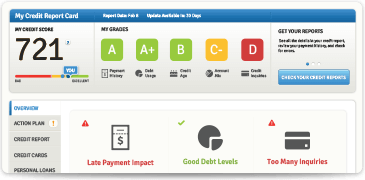

Credit Report Card

Credit.com’s credit report card is completely free. When you sign up, you get instant access to a helpful credit snapshot, which includes:

- Your Experian VantageScore 3.0 credit score

- A letter grade for each of your five main credit-influencing factors

- Your credit utilization ratio, average credit age and credit account mix

- The number of credit inquiries on your credit report

- A tracker tool to monitor and analyze changes in your credit score

- Personalized offers to help you get the best financial deals

Your credit score reflects your financial history. Factors like payment history, average account age and number of hard credit inquiries either boost or reduce your score. Generally speaking, if you consistently make payments on time, for instance, your score will increase. If you pay your bills late or miss payments, however, your score will decrease.

Your credit score isn’t the same as your credit report. Your credit report contains a breakdown of your recent—within the past seven to ten years or so—financial history. You’ll see an overview of each of your revolving and installment accounts, hard and soft inquiries , bankruptcies and more on your credit report. In contrast, credit scores are simply numbers.

One thing to note—you have a different credit score from each credit reporting company. Equifax, TransUnion and Experian all might have different information on your credit reports. That's because some lenders might report information to one major credit bureau, but not the others. So don't be surprised if you find that your Experian credit score is different from your Equifax and TransUnion scores—and the other way around.

What affects my credit score?

- Credit scores are based on more than payment history. In fact, the following five factors influence your score:

- Payment history—35%: Missed or late payments reduce your score, while on-time payments give it a boost. In short, lenders want to know that you can repay debts on time.

- Amount of debt—30%: Also known as your credit utilization, this measure gives lenders an idea of how much you depend on credit to stay afloat. Try to keep your borrowing under 30% of your collective credit limit

- Credit age—15%: This is the average age of all of your credit accounts. The older, the better. Try not to close any old credit accounts unless you really have to.

- Account mix—10%: Lenders like to see how well potential borrowers do with a range of credit products. If you have a diverse mix of installment and revolving loans, you’ll improve this part of the credit equation.

- Credit inquiries—10%: Too many hard inquiries in a short time imply risk—and so do too many accounts. In contrast, soft inquiries—like checking your own score—don’t affect your credit score at all.

Every now and again, FICO scoring models get an update. At the moment, most auto and bank card lenders use FICO 8 models, while mortgage companies rely on FICO 2, 4 or 5. The newest iteration, FICO 9, isn’t widespread yet.

Is 700 a good credit score?

If your credit score sits above the 700 mark, give yourself a pat on the back—you’re doing pretty well. You’re firmly in the good credit score range on the FICO scoring model, so you should be eligible for some decent card and loan deals. Incidentally, the average credit score in America was 710 in 2020.

Will checking my credit score hurt my score?

In a word, no. Checking your own credit won’t have any effect on your score. When you check your own credit, you create what’s known as a soft inquiry. Soft inquiries aren’t attached to requests for credit, so they don’t make a dent in your credit. Hard inquiries, which happen when you apply for credit, are attached to requests for credit, which is why they do change your credit score.

FAQs

Credit is a complex and confusing topic. In this section, we’ll answer some of the most common credit score-related questions.

How can I check my credit score for free?

To check your credit score for free, sign up for your free credit report card. It’ll give you instant access to your Experian VantageScore 3.0 credit score, which gets updated every 14 days.

What is a good credit score?

Scoring models vary, but most FICO-based models rate scores from 670 to 739 as “good.” Meanwhile, scores between 300 and 579 are “poor” and scores between 580 and 669 are “fair.” At the upper end of the scale, scores between 740 and 799 are “very good” and scores over 800 are “excellent” or “exceptional.”

How can I improve my credit score?

- You can improve your credit score in numerous ways, all of which take time to make an impact. Let’s look at five of the top contenders:

- Always pay your bills on time—or better still, early

- Pay off some of your debt, and keep balances low to reduce your credit utilization

- Don’t open too many new accounts

- Check your credit report frequently and challenge mistakes

- Report any suspicious activity as soon as you see it

Most derogatory marks fall off credit reports after about seven years. Some bankruptcies stick around for ten years. When negative items eventually vanish, scores generally improve.

What is the credit score for beginners?

There isn’t a specific credit score for beginners. People who are newly eligible for credit or move to different countries and have to rebuild credit histories generally have thin credit files. Thin credit files don’t contain much information, so they’re hard to use as the basis for credit scores.

Your credit report card isn’t a full credit monitoring solution, but it does give a you great credit overview. You can use the information in your credit report card to start improving your credit or to check your credit score before applying for a new card or loan. Your Experian VantageScore 3.0 updates every 14 days, so keep checking back.

ExtraCredit

- If you want to dive deeper into your credit profile, sign up for ExtraCredit. This credit solution comes with the following features:

- 28 of the real FICO scores lenders use to calculate your eligibility

- Credit reports from all three bureaus—Equifax, Experian and TransUnion

- Five encompassing credit tools—Build It, Guard It, Track It, Reward It and Restore It

- Credit monitoring and credit alert features to keep you in the loop

- Identity theft protection and insurance to safeguard your ID

- Generous cashback offers via Reward It

- Discount to one of the leaders in credit repair to help you work on your score

A fully loaded monitoring product, ExtraCredit takes the mystery out of credit. You’ll see what a lender sees when they check your reports, and you’ll get insider tips and personalized guidance to help you work on your score. ExtraCredit also includes dark web monitoring and real-time security alerts to keep your data safe.

ExtraCredit’s benefits don’t end with data safety. If you have a limited credit history or want payments you already make added to your credit profile, you can report your on-time rent payments, utility payments and more with Build It. In a nutshell, ExtraCredit can help you take full control over your financial profile.

Understand Your Credit Scores

- Good, fair, poor—all credit scores need a closer look. Knowledge is power, and most consumers feel more empowered after they learn about credit scores. Without further ado, let’s review what goes into a credit score:

- What is a credit score?

- What affects my credit score?

- How do I get my free score/check my credit scores?

- Why do I have more than one credit score?

- Will checking my credit score hurt my score?

What is a credit score?

A credit score is a personalized three-digit number based on a consumer’s credit history. Lenders use credit scores to decide whether or not to offer people credit. There are several different credit scoring models, but FICO is the most commonly used. FICO scores range between 300 and 850—the higher your score, the better your creditworthiness.

With that said, pushing your credit score into the “very good” or “exceptional” range will increase the number of affordable or low-interest financial products you qualify for. You can use ExtraCredit’s personalized tips and tricks to help you get there.

How do I get my free score/check my credit scores?

If you want to keep track of your credit report, you have three main options. Only two of them include your credit score, though. Here’s a brief overview of each option:

AnnualCreditReport.com

Thanks to an amendment to the 1970 Fair Credit Reporting Act (FCRA), all U.S. consumers get one free credit report from each credit bureau once a year. To claim your reports, visit AnnualCreditReport.com, call 1-877-322-8228 or send an Annual Credit Report Request Form to Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281. Importantly, your free annual reports do not include credit scores.

Credit Report Card

For a quick and helpful credit overview, sign up for your free credit report card at Credit.com. You’ll see your Experian VantageScore 3.0 credit score right away, and you’ll also get a letter grade for each of the five factors that influence your credit score. The credit report card is free, but it doesn’t include your full credit reports.

ExtraCredit

To develop a really in-depth understanding of your credit, choose ExtraCredit. For an affordable monthly fee, you can look at all three of your credit reports whenever you like—and you gain access to 28 of the FICO scores lenders use to make decisions. You can use ExtraCredit to delve deep into your own history, and see the areas you would most like to work on.

Why do I have more than one credit score?

Many people believe that they only have one credit score. In reality, they have numerous scores—hundreds, in fact—calculated using various scoring models. We mentioned FICO 2, 4, 5, 8 and 9 models earlier, but VantageScore and other systems also come into play. Jointly owned by all three credit bureaus, VantageScore has an output range of 501 to 990.

On top of this, credit bureaus each hold different information about consumers. Your credit card or car loan might report to TransUnion, for example, but not to Experian. You might have a mistake on one credit report but not another. All of these differences influence your credit scores.

A word about “educational” credit scores: Many free apps generate educational credit scores, which aren’t always based on up-to-date information. These can be helpful from a snapshot perspective, but they don’t usually match what lenders see.

If you have a thin file, you might be unscorable. If you have no credit history at all, you might be completely invisible to all three credit bureaus. In either case, the path to a scorable credit file lies in credit utilization. Many consumers begin with a prepaid or credit-builder credit card and move up from there.

Take control of your credit score with Credit.com

Great credit scores don’t happen by accident. You can’t get where you want to be without insight into your credit score. If you’re ready to learn more about your own credit profile and make some changes, sign up for an ExtraCredit free trial today.