Canceling your credit card is as simple as paying off your remaining balance, collecting any unused rewards and contacting your card issuer to close the account.

If you’re wondering how to cancel a credit card, you should know that you risk harming your credit score and losing out on credit card rewards. As stated by Equifax®, one of the three major credit bureaus, closing your credit card not only impacts the length of your credit history, but it also affects your credit utilization ratio. These two factors are a combined 45% of your overall credit score.

To help you feel more confident making the decision about whether to cancel a credit card, we’ll go over reasons to close your credit card account, how to easily cancel one, as well as some simple steps to protect your credit score. We’ll also discuss how you can avoid leaving free money on the table when you close the account.

Table of contents:

- Should you cancel a credit card?

- How to cancel a credit card in 7 steps

- Does closing a credit card hurt your credit?

- FAQ

Should you cancel a credit card?

Ideally, you shouldn’t cancel your credit cards unless necessary. Tanza Loudenback, CFP and author of multiple finance books, says, “It pays to hang on to old ones, even if they’re collecting dust.” As you’ll learn, closing your account can lead to a drop in your credit score, which can make it difficult to open new lines of credit.

Closing a credit card shortens the length of your credit history, changes your credit utilization ratio, and may also affect your credit mix by reducing the various types of credit you have access to—all three of these factors weigh on your credit score.

Also keep in mind that if you’re not using a credit card, the card issuer may send a notice that they’re closing the account due to inactivity. If you’re not being charged any fees on the card, it may be a good idea to negotiate with the issuer to keep the card open. One way to do this is to assure them you’ll start using it monthly, and you can make small charges with groceries and gas or whatever you choose.

Reasons to cancel your credit card

There are, of course, situations in which canceling your credit card may be a good idea, including:

- Fees: Some cards come with monthly or annual fees. If you’re not using the card, you can save money by closing the account.

- Separation or divorce: If you’re separating and have a joint account, your credit will still be attached to your ex-spouse or partner, which means you’re liable for charges they make.

- Temptation: If you’re trying to break a spending habit, once you pay the card off, you may want to close the account to avoid the temptation of spending.

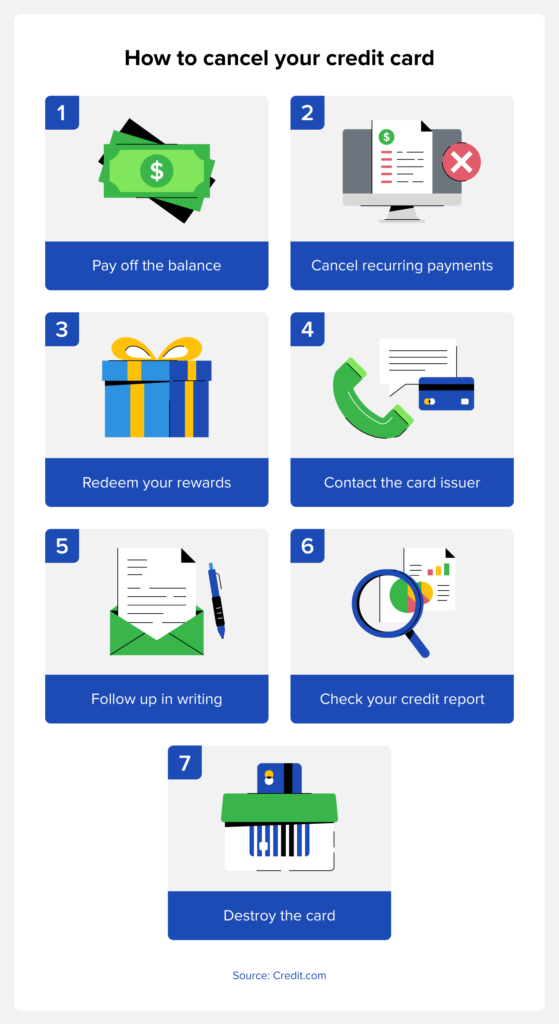

How to cancel a credit card in 7 steps

Now that you know when it may be time to close a credit card account, follow the below steps to learn how to cancel a credit card properly. Doing so will help you avoid a larger dip in your score than necessary while also making sure you’re receiving all the benefits possible.

1. Pay off the balance

Before closing your account, ensure the balance is paid in full. Leaving a balance on the account can lead to derogatory marks on your credit score.

2. Cancel recurring payments

If you have recurring payments, you’ll want to cancel them before closing the account. Be thorough when you check so you don’t accidentally miss a bill payment. The best way to do this is to go through one of your monthly statements to see what was charged.

3. Redeem your rewards

Many credit cards have rewards in the form of cash back or points for different stores and companies. You can redeem your reward points, and sometimes you can use them toward your remaining balance.

4. Call the card issuer or visit the website

Oftentimes you can cancel your credit card account through the issuer’s website, but it may be a good idea to call and follow up as well.

5. Follow up in writing

When canceling credit cards or doing anything that may affect your credit score, it’s smart to follow up in writing. This gives you documentation just in case the account continues to show up on your credit report.

6. Check your credit report

Within 30 days after closing your credit card account, check your credit report to ensure the account no longer appears. If it does, you’ll need to contact your card issuer to resolve the situation. If they’re unable to help, you’ll need to contact the three credit bureaus with your documentation of closing the account.

7. Destroy the card

It’s important to protect yourself from identity theft or someone trying to make charges on your card, so once you’ve completed the previous steps, you can physically cut up or shred your old card.

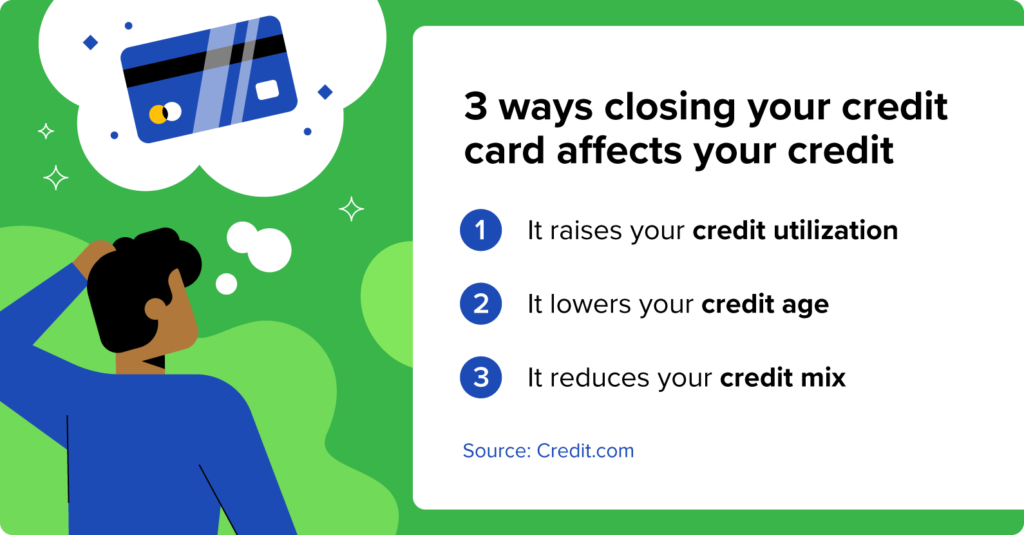

Does closing a credit card hurt your credit?

Closing a credit card account can affect your credit score for up to 10 years, according to Experian®. This happens because it changes three of the five factors that contribute to your overall credit score.

The FICO® scoring model is the most common form of credit scoring, and this is how they weight their scores:

- Payment history: 35%

- Credit utilization: 30%

- Credit age: 15%

- Credit mix: 10%

- New credit: 10%

How canceling a credit card affects credit utilization

Credit utilization is the ratio of how much you owe versus your max limit of all your lines of credit. For example, if you have two credit cards with a max limit of $1,000 each and one with a max limit of $3,000, your total max limit would be $5,000. If you owe $1,000 between the three cards, your utilization ratio is 20%.

Capital One recommends keeping your utilization ratio at 30%or less. Using the previous example, a 20% utilization ratio would be helpful for your credit score. If you were to have an outstanding balance of $3,000, your utilization would be at 60%, which is much higher than the ideal 30% or less. With a high utilization ratio like this, it can harm your credit score.

How closing a credit card affects your credit mix

Credit mix refers to the various types of lines of credit you have. The primary types of credit according to FICO include:

- Credit cards

- Retail accounts

- Installment loans

- Mortgage loans

To maximize your credit score, you’ll want a well-rounded mix of these lines of credit. And when you close a credit card, your credit mix will be reduced.

How closing a credit card affects your credit age

Creditors like to see that you have experience managing lines of credit, which is why the age of your credit card accounts is so important. This scoring factor is usually the average length of all your lines of credit. If you close an old account, this will lower the average age, lowering your overall credit score.

FAQ

There’s more to know about canceling your credit card, so here are some answers to the most frequently asked questions.

Should I cancel unused credit cards or keep them?

It’s typically a better idea to keep your unused credit cards rather than cancel them so you don’t lower your credit age. The most common reason to cancel an unused card is when you’re being charged monthly or annual fees.

Do negative marks from a closed credit card stay on my report?

Yes. Closing a credit card doesn’t erase your credit history. If you have late or missed payments on a credit card, those will continue to stay on your credit report for up to 10 years.

Can I cancel a credit card online?

Yes. Many credit card companies allow you to cancel your card through their website.

What if my credit card has a balance when I close it?

You will still owe any balances remaining on your credit card, so it’s a good idea to ensure the balance is paid in full before you close it to avoid any missed payments that could hurt your score.

You can still close the account while you have a balance, but you’ll still be responsible for it, and it will continue to accrue interest. It can be easy to forget about the outstanding balance after closing the account, so it’s best to pay it off before closing the account.

How to repair your credit after closing your credit card

There are a few reasons you may need to close your credit card account, such as fees on an unused card or going through a separation or divorce. Although your credit score will likely be affected negatively, there’s still a lot you can do to rebuild your credit score.

Here at Credit.com, we have a variety of services like our ExtraCredit program that can help you work to repair and rebuild your credit score. We’ll also provide you with a free credit report card that can help you make a plan to improve and maintain your credit score. Sign up today to get started on your credit-building journey!