Who doesn’t love earning rewards with a credit card? If you said, “not me,” stop reading. The rest of you read on because we’re talking about the propel credit card, aka the Wells Fargo Propel American Express Card. And it’s one good rewards credit card with:

- No annual fee

- 30K bonus points with $3,000 spent on purchase in the first 3 months—a $300 cash redemption value

- 3X points when eating out or dining in

- 3X points at gas stations, with rideshares and on transit

- 3X points on travel, including airfare, hotels, homestays and car rental

And those are just the highlights of this card.

The Propel Credit Card Welcome Offer

One thing that makes credit card offers appealing is the welcome offer, aka the sign-up bonus. And the Wells Fargo Propel American Express Card’s sign-up bonus is pretty sweet. The card lets new cardholders earn 30K bonus points when they spend $3,000 in purchases in the first three months. Those points have a $300 cash redemption value. That’s a 10% return on your money!

Oh, and you won’t pay a dime in interest on that $3,000 either. The propel credit card has another sign-up bonus—an introductory APR of on purchases. Plus .

After those 12 months, the ongoing APR is still pretty reasonable at .

Earn Powerful Rewards with the Wells Fargo Propel American Express Card

Sign-up bonus reward points aside, the Wells Fargo Propel American Express Card offers rock-solid ongoing rewards program too. In fact, it offers triple rewards on many purchases.

The Wells Fargo Propel American Express Card offers 3X the points on eating out and ordering in. So if you want a pizza delivered to your house, you earn the same amount of bonus points as if you dine in.

Cardholders also earn 3X the points at gas stations, rideshares and for transit. Drive a lot? You might as Wells get rewarded for it right? If driving isn’t for you, you still earn 3X the points for buying rideshares or paying for transit. No matter how you choose to get around, you get rewarded. How sweet is that?

You also earn 3X the points for travel making the propel credit card a travel rewards card too. So if getting around for you involves getting out of town, you earn 3X points on flights, hotels, homestays and car rentals.

But that’s not all. Any other transaction earns you 1X points.

More Benefits of this Card

As if all those rewards aren’t enough, the Wells Fargo Propel American Express Card has no annual fee—nada, never. That’s right the annual fee is and that’s not just for a limited time. That’s always.

There’s also no limit on how much cash back you can earn? And as long as you keep your account open, your points never expire.

And, we’re not done yet. If you pay your monthly cell phone bill with your Wells Fargo Propel American Express Card, you get up to $600 of protection against covered damage or theft of your phone, subject to only a $25 deductible.

And if getting out of town for you means getting out of the country, this card charges foreign currency conversion fees, aka foreign transaction fees.

Things to Consider

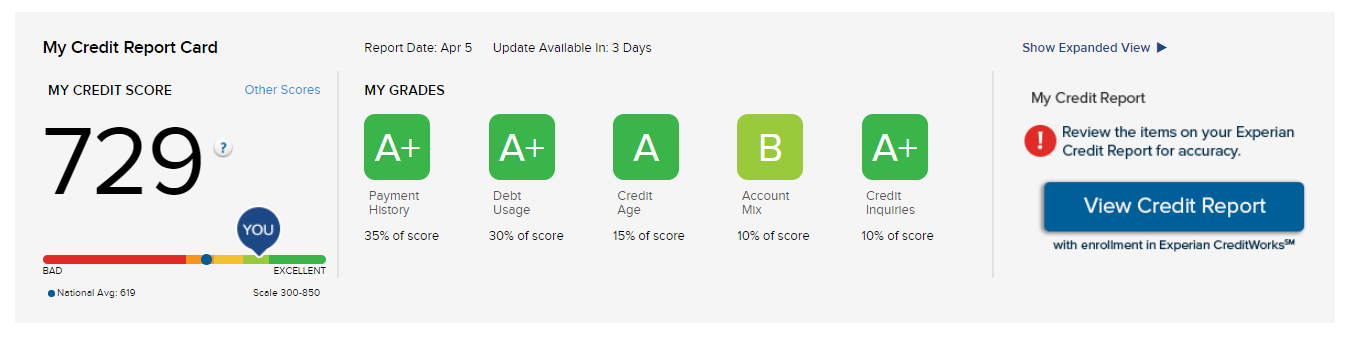

Every silver lining can have a cloud. And the Wells Fargo Propel Card does require good or excellent credit to qualify. If you don’t know your score, you can find out right now right here on Credit.com. Simply sign up for your free Credit.com account to get your free Experian credit score and find out what your credit rating is.

If your score makes your chances of getting approved for this card cloudy, never fear. There are plenty of credit cards—even rewards credit cards—for fair credit and even bad credit or no credit.

And regardless of whether you get this card or another, keep an eye on your credit utilization. That’s the ratio of how much of a balance you have compared to your credit limit. Ideally, you want your ratio to be nor higher than 30%. You can keep an eye on your ratio inside your Credit.com dashboard under “Debt Usage.”

Happy rewards!

At publishing time, the Wells Fargo Propel American Express credit card is offered through Credit.com product pages, and Credit.com is compensated if our users apply and ultimately sign up for these cards. However, these relationships do not result in any preferential editorial treatment. This content is not provided by the card issuers. Any opinions expressed are those of Credit.com alone and have not been reviewed, approved or otherwise endorsed by the issuers.

Note: It’s important to remember that interest rates, fees and terms for credit cards, loans and other financial products frequently change. As a result, rates, fees and terms for credit cards, loans and other financial products cited in these articles may have changed since the date of publication. Please be sure to verify current rates, fees and terms with credit card issuers, banks or other financial institutions directly.