Your credit score may have dropped if you applied for a new card or line of credit or were late on payments or there was fraudulent behavior on your account, among other reasons.

You check your credit score routinely, but one day, surprised, you gasp at the number, wondering, “Why has my credit score suddenly dropped!?”

Don’t panic—there are a multitude of reasons why. While this could be a sign of identity theft (more on that in a minute), other potential culprits could be the cause of this new dip in your credit score.

Below, we outline possible reasons your credit score may have dropped and what you can do to improve it if you see that sudden dip.

Why Your Credit Score May Have Dropped

1. You Applied for a New Card, Mortgage, or Loan

When you apply for a credit card, mortgage, or another loan, you’re allowing the lender to pull your credit, which results in a hard inquiry appearing on your report. One solitary hard inquiry is unlikely to drop your credit score by more than a few points. However, they do add up, so if you’ve recently applied for several loans or credit cards, this could be causing a significant drop in your credit score.

Though a hard inquiry can bring your score down up to 10 points, on average, it’s usually closer to five. If you have excellent credit and no other issues, the drop might be even less. It’s worth noting that this usually only drops for a short time. Hard inquiries can remain on your credit report for 2 years but usually only impact your credit score for those first 12, according to Experian.

When applying for credit, spread out applications over time, at least every three months or longer, if you have a lower credit score.

2. You Closed an Account

You’ve budgeted, cut the fat and finally got that credit card paid off in full—congratulations! But if you thought the next step was to close your credit card so you didn’t rack up more debt, this could be why your score dropped. Closing a credit card can cause your credit score to decrease in two ways.

- Your credit score factors in the age of your accounts and values older ones. If you close one of your oldest credit cards, the average age of your accounts drops and, in turn, causes your scores to go down.

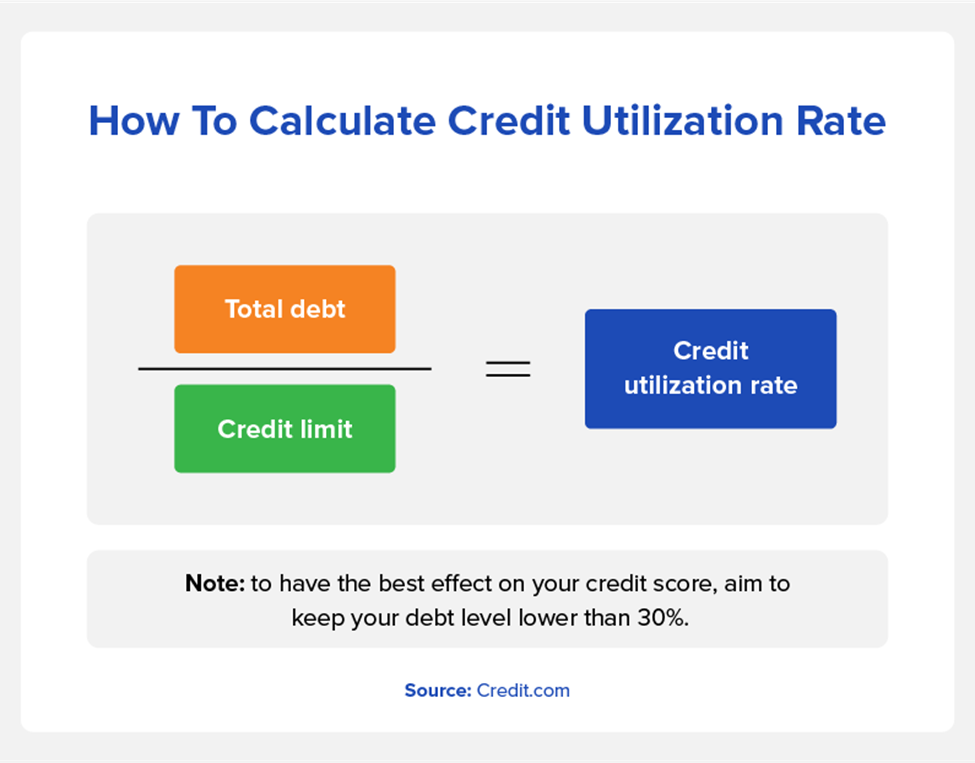

- Yourcredit utilization (how much debt you have in relation to your available credit) greatly impacts on your credit scores (accounts for 30% of your scores, in fact). It is generally a good idea to keep your debt level lower than 30%, ideally 10%, to have the best effect on your scores.

Closing a credit card will automatically lower the ceiling of your available credit, and any balances you do carry will take up a larger portion of your available credit. A utilization that’s too high can negatively impact your credit score.

3. You Have Late or Missed Payments

Your payment history is the biggest influencer of your credit scores, accounting for 35% of the scores. Even a single late payment can cause a hit to your credit scores. According to FICO®, these missed payment dings can cause your credit score to drop significantly and late payments can stay on your credit report for seven years. They can do lasting damage, especially if you forget about the payment and it goes to collections.

Lenders report late payments to credit bureaus 30 days past due, so as long as you’re making that late payment within 30 days, you should be all set, but it’s best to always be aware of your payment agreement terms and understand the consequences of being late with your specific lenders.

4. Your Account Went to Collections

If you’ve left a credit account unpaid for too long, your lender or issuer may send it to collections. Having a collection account appear on your credit reports will damage your scores. They indicate serious delinquencies and tell creditors that you might be a risky bet.

5. There Is Inaccurate or Fraudulent Information on Your Credit Report

Inaccurate information on your credit report can come in many forms. Accounts you don’t own, payments you didn’t miss, and inquiries you never initiated can all land on your credit report due to a clerical error of some variety. But if it’s on your credit report, it could be dragging your scores down. Dispute this information immediately to help ensure you have an accurate credit report and help to maintain your correct credit score.

As mentioned earlier, a sudden drop in your credit scores can signal fraud. Review your credit frequently to help you monitor this. You can see your VantageScore 3.0 for free, updated every 14 days, on Credit.com. If you think you’re a victim of identity theft, this guide can help you figure out what to do next.

6. You Paid Off Debt

If you recently paid off an installment loan—such as an auto loan, mortgage, personal loan, etc.—your score may drop a bit. This seems counterintuitive, right?

When this loan disappears from your credit report, it’s showing one less line of credit to your name, so your score takes a temporary hit. However, this should recover in a few months, and it’s still worth celebrating the financial freedom of paying off debt.

FAQs

How Can I Improve My Credit Score if It Drops?

If your credit score takes a hit, there are a handful of ways you can help improve it:

- Review your credit reports regularly. You won’t know the health of your credit score unless you check it regularly (from all three consumer reporting agencies). These checks will help you identify any sudden dips or changes.

- Keep track of that credit utilization rate. As described above, it’s best to keep your credit utilization rate below 30%. Paying your balance early and decreasing your spending will help here, but you can also ask your lender for a credit limit increase to help lower the rate.

- Keep debt to a minimum. Be realistic about what you can and can’t pay off at the end of the month, and avoid purchases that will rack up the debt. Spend responsibly and pay bills on time. The goal is to have a balance of $0 at the end of each month.

- Be mindful of how many accounts you’re opening. As mentioned above, opening a new card can trigger a hard inquiry on your account, affecting your score. Additionally, too many cards can lead to irresponsible spending and a piling of debt.

Are There Discrepancies Between Bureaus?

In short, yes. You have several scores, all of which may be just a bit different, as not every issuer or lender reports to every bureau.

The three major credit bureaus—Experian®, Equifax®, and TransUnion®—all maintain different versions of your credit report, and you can get copies of these for free every 12 months by visiting AnnualCreditReport.com. Lenders and creditors don’t always report information to all three bureaus, and the bureaus don’t share information, so you’ll want to review each of them for discrepancies or errors.

Why Did My Credit Score Drop 20 Points? 40 Points?

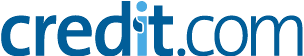

Your credit score may have dropped by 20 points due to any of the above reasons. The most likely reasons are: your balances increased, you recently closed accounts, you applied for new lines of credit, or there is inaccurate or fraudulent information on your account.

If your credit score dropped by 40 points, this is likely due to late payments that continue to compound on past-due bills. Any significant increase in credit utilization will contribute to this credit score drop.

Monitor Your Credit with Credit.com

It’s important to regularly monitor your credit score to make sure it’s in good to excellent standing. Understand and keep track of this by signing up for ExtraCredit. If you notice a drop, do your best to figure out why that’s the case and work to improve your credit score as quickly as you can.

Do you know your credit score?