Credit.com: resources for mastering your credit & finances

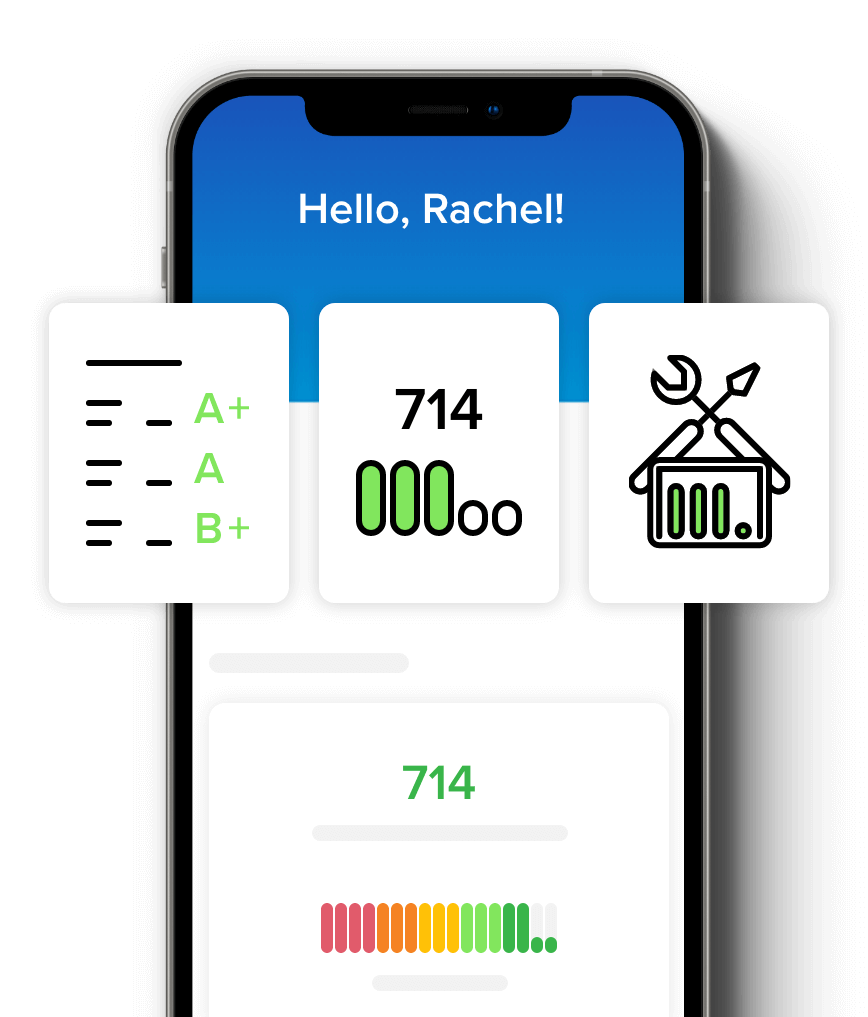

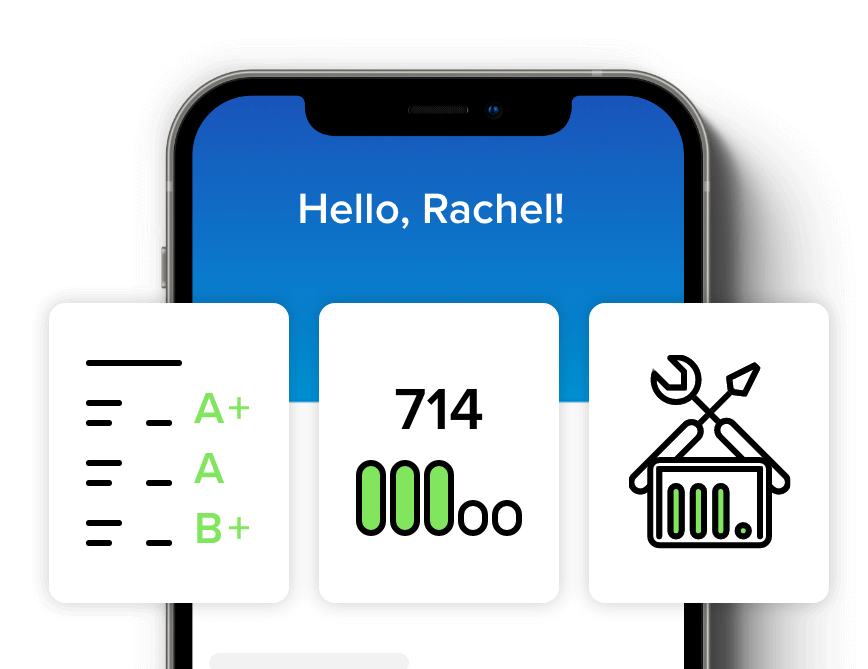

Free credit score

Credit builder

Credit Report Card

Know where you stand when it comes to your credit with a free Experian credit score and Credit Report Card.

See your score for free

Sign up now

As mentioned in

Everything your credit needs in one convenient place

How your credit could impact your interest rate

Generally speaking, the lower your score, the higher your interest rate. This means bad credit could lead to bigger monthly payments, and that extra cost adds up fast. Find out where you stand and see how much interest you could save with better credit.

A better interest rate could save you xxx on your

Get a free Credit Report Card now to learn how you can take back control of your credit

Get started

Disclaimer: The average personal loan amount is based on data from TransUnion. The 5 year personal loan APRs are estimated based on a loan amount of $8,085 and FICO scores between 300 and 850. Calculations were made using the Bankrate calculator on Oct 6, 2022.

Monitor every aspect of your credit—updated every 14 days

Go beyond your score with our free Credit Report Card

A better way to monitor & manage your credit

-

Free score

Get an updated Experian credit score every 14 days at zero cost to you. Better yet, you can access your score at any time with our mobile app.

-

Credit Report Card

Take a closer look at your credit with a detailed breakdown of each credit factor, including what you’re doing well and how you can improve.

-

Personalized recommendations

As you work towards your credit goals, we’ll send you personalized credit card and loan offers to take maximize your credit.