Living with debt has become an unfortunate reality for many Americans, as an estimated 80 percent have some form of debt. According to the Federal Reserve, the total consumer debt has been steadily increasing over the past four years, hitting $3.918 trillion as of July 2018. This number excludes mortgage debts which push the total household debt to an astonishing $13.29 trillion.

On one hand, debt can actually be a positive. It allows you to do things that wouldn’t otherwise be financially feasible, like purchasing a home, getting an education or buying a car. However, debt comes with a price — literally. As default rates rise during hard economic times Americans’ credit scores plummet and with them their ability to take out loans in the future.

Knowing that Americans are plagued by so much debt, we asked over 1,500 of them what they would be willing to do to erase their debt.

Key takeaways

- 16 percent of those surveyed would trade four-plus years of their lives to be debt-free.

- 3 in 4 wouldn’t erase their debt when given the choices of redoing high school, spending five years in prison, joining the army or donating a kidney.

16 percent would put their life on hold for four-plus years to get rid of debt

A surprising number of respondents say they would be willing to redo high school, join the army or spend time in prison — all decisions that would take up four-plus years of their lives. Based on the current U.S. population that’s 52 million Americans!

Unlike the hypothetical options of redoing high school or spending time in prison, several programs actually do exist to help military members repay student loans, most notably the the Post-9/11 GI Bill and the College Loan Repayment Program (CLRP). CLRP exists as an incentive to attract new recruits to the U.S. military by granting up to $65,000 per recruit towards student loan forgiveness. While the terms differ by branch, military members must remain on enlisted active duty while enrolled in the program to qualify for CLRP. There’s no doubt that joining the military is a huge, life-changing decision, but the financial benefits are undeniable.

Considering the amount of time it would take to pay off the average American’s debt, spending four years in high school might be a solid trade off — if you can handle the homework.

While donating a kidney is generally motivated by altruism, our survey found that 10 percent of respondents are actually willing to “donate” a kidney to erase their debts. Interestingly, a 2013 study co-authored by researchers from the University of Calgary, found that paying $10,000 per kidney would actually save money over the current donation system. The ethics of commercial organ trade are still in question, but it begs the question — would people do it? $10,000 may pale in comparison to the average American’s debt which is closer to $100,000, but based on our survey it seems that some Americans would at least consider it.

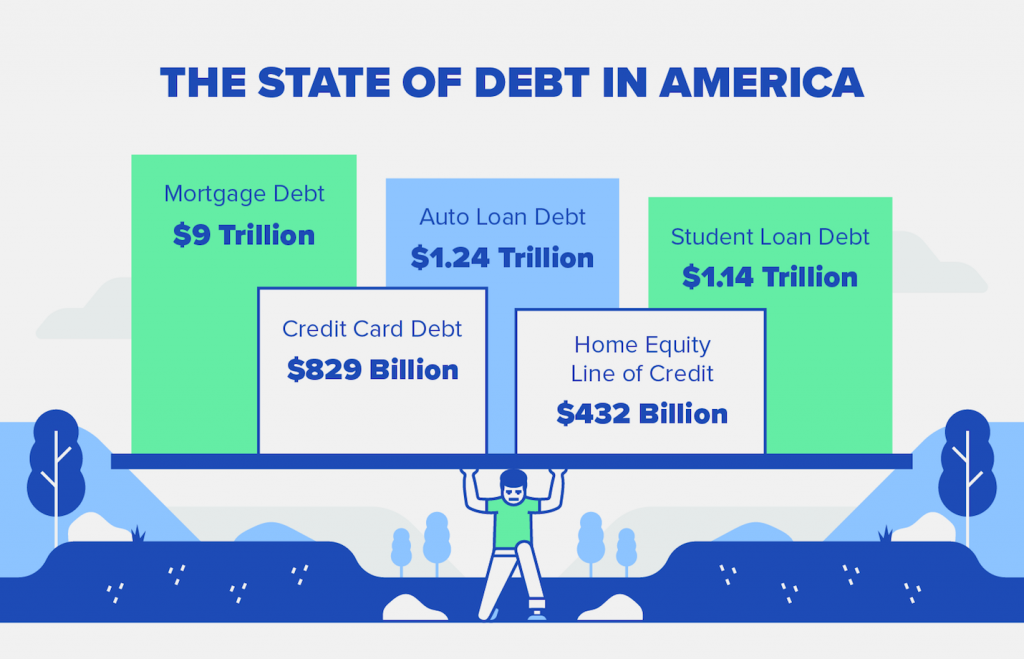

We asked respondents to answer what they would do to erase all their debt, but let’s take a look at the different types of debt that Americans have to get a sense of why they might be in debt in the first place.

Mortgage debt continues to be the largest contributor — currently at $9 trillion and growing. This is six times as much as the current amount of student loan debt which is $1.14 trillion!

General credit card debt only makes up about 6 percent of the total household debt at $829 billion. This is a considerable decrease from the 2008 recession when credit card debt reached an all-time high of $1.028 trillion. This shift has likely impacted Americans’ current perception of credit cards considering a recent study on credit card fears revealed that 22 percent of Americans say their biggest fear about owning a credit card is accruing debt.

One thing is clear — Americans are seriously in debt. It’s obvious that there’s no quick fix for remedying debt, but the idea is certainly enticing. People’s willingness to go to the extreme to erase their debt may be more closely tied to debt from non-essential spending that they regret, but actually Americans don’t regret a lot of the debt they’re in. 7 in 10 Americans believe that debt is a necessity even though they prefer not to have it, with a large majority of household debt coming from positive actions like getting an education or buying a house. When it comes down to it, the only way to pay off your debt, no matter why you have it, is by putting in the hard-work and making smart financial decisions.

Sources: The Pew Charitable Trusts | Federal Reserve Bank of New York | NCBI | The Balance Careers | Money | Federal Reserve