You may not have heard of Comenity bank, but chances are some of your favorite merchants know them well (and you may even be using one of their store credit cards). In fact, there are more than 40 million customers in the United States with a Comenity bank account or credit card.

Comenity Bank is one of the top providers of merchant-branded credit cards, and offers cards at over 125 U.S. stores including Williams-Sonoma, Zales, Victoria’s Secret and GameStop. If your favorite merchants offer a credit card, there’s a good chance it could be a Comenity card. These cards come with a vast range of rewards, typically customized by the merchant.

To determine if a store card is right for you, it’s a good idea to first define your goals and evaluate the cards you’re considering to see how they might fit into those goals. If you decide to go ahead with an application for one of these cards, here are some things you may need to know.

How to Get a Comenity Credit Card

Many participating retailers support in-store or online applications. Your application can either be instantly reviewed (and, ideally, approved) or will be reviewed and a response will come within seven to ten working days.

While the required credit score to get a Comenity card can vary from card to card, branded credit cards often have much lower criteria than a traditional credit card and can be easier to get, though you may be paying for this access with a higher interest rate. Before you apply for any credit card, it’s a good idea to review your credit to make sure your scores will support your application. (You can see two of your credit scores for free on Credit.com.)

That said, here are a few of our favorites. (Note: Make sure you read the card terms and conditions for all the finer details.)

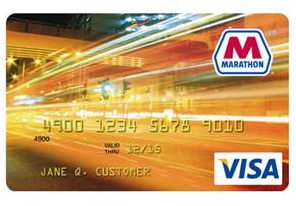

Marathon Visa

Why We Picked It: Marathon Visa’s reward structure makes it valuable for frequent drivers who fill up at Marathon gas stations, and the rewards are especially exploitable when gas prices are low.

Card Details: This card can be used anywhere Visa is accepted, but offers unlimited rebates when you spend at a Marathon gas station (both gas and in-store purchases). If you frequently fill up at Marathon locations, you can earn 25-cents per gallon if you spend $1,000 or more per month, 15-cents if you spend $500 to $999 or 5-cents if you spend less than $500. Every time you earn $25 in gas rebates, you’ll receive a Marathon Cash Card in the mail.

Annual Fee: $0

APR: There’s a variable 26.99%, 22.99% or 18.99% APR for purchases. There’s a variable 27.99% APR for balance transfers and cash advances.

BJ’s Perks Plus Card

Why We Picked It: BJ’s Wholesale Club is a popular East Coast retailer, and the membership warehouse chain’s card offers plenty of cash back rewards for purchases made both in-store and elsewhere.

Card Details: This card is exclusive to BJ’s Wholesale Club Perks Plus members, but can be used anywhere that accepts Mastercard. Members can earn 3% cash back on most BJ’s purchases online and in-store and save 10-cents per gallon at BJ’s gas locations. The card also offers 2% back at restaurants and other gas stations and 1% back on all other purchases. Cardholders can also save up to $10 on their annual BJ’s membership fee by signing up for auto-renewal. Cash back rewards can be used right at BJ’s cash registers in $20 increments.

Annual Fee: $0 (BJ’s Perks Plus membership costs $100 annually)

APR: Variable 26.99% or 16.99% for purchases based on the prime rate and creditworthiness. A fixed 28.99% for balance transfers and cash advances.

Alternative: The BJ’s Perks Elite card is the next tier up from the Perks Plus card. It offers the same cash back perks as the Perks Plus card, except for 5% cash back on most BJ’s purchases and a $25 yearly membership savings with auto-renewal. The variable APR and any associated fees are the same as the Perks Plus card. To have access to the Elite card you must have a BJ’s Perks Elite Membership, which you are eligible for if you have an existing Perks Plus membership. There is no annual fee beyond your club membership.

Note: It’s important to remember that interest rates, fees and terms for credit cards, loans and other financial products frequently change. As a result, rates, fees and terms for credit cards, loans and other financial products cited in these articles may have changed since the date of publication. Please be sure to verify current rates, fees and terms with credit card issuers, banks or other financial institutions directly.

This article last updated September 11th, 2017.