Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

You need decent credit to take out a loan, but you can’t build good credit if you don’t have a credit card, a loan, or another type of credit history in the first place. It feels impossible, but you’re not alone—nearly everyone with thin credit history has the same issue.

If you’re ready to build your credit, you could take out a credit builder loan. But what is a credit builder loan, and how can it help you improve your credit?

Luckily for you, we’re here to answer your questions. We’ll guide you through the advantages of credit builder loans and tell you where to find financial products you can use to create a well-rounded credit report. By the time we’re done, you’ll know how to achieve a credit score you can be proud of.

What Is a Credit Builder Loan?

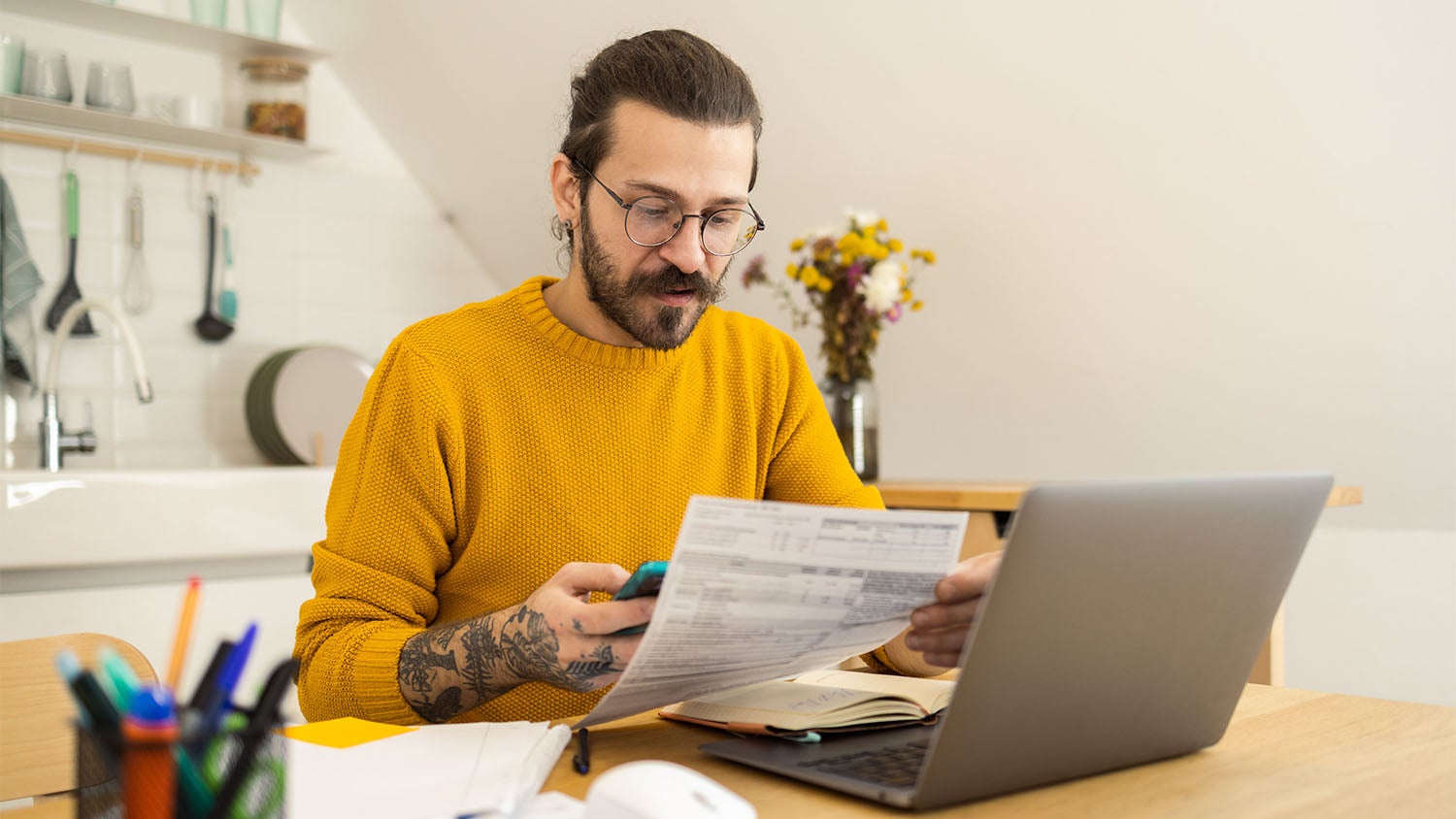

In short, a credit builder loan can help you jump on board the credit train. Credit builder loans are for low amounts—usually under $1,000—and they have short repayment periods. Most credit builder loan repayment terms range between 6 and 24 months.

How Do Credit Builder Loans Work?

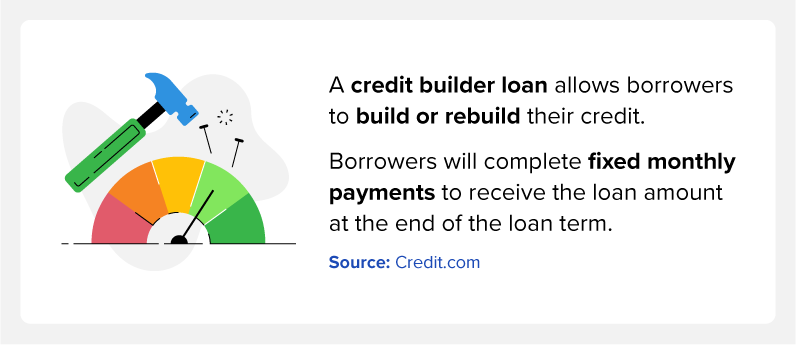

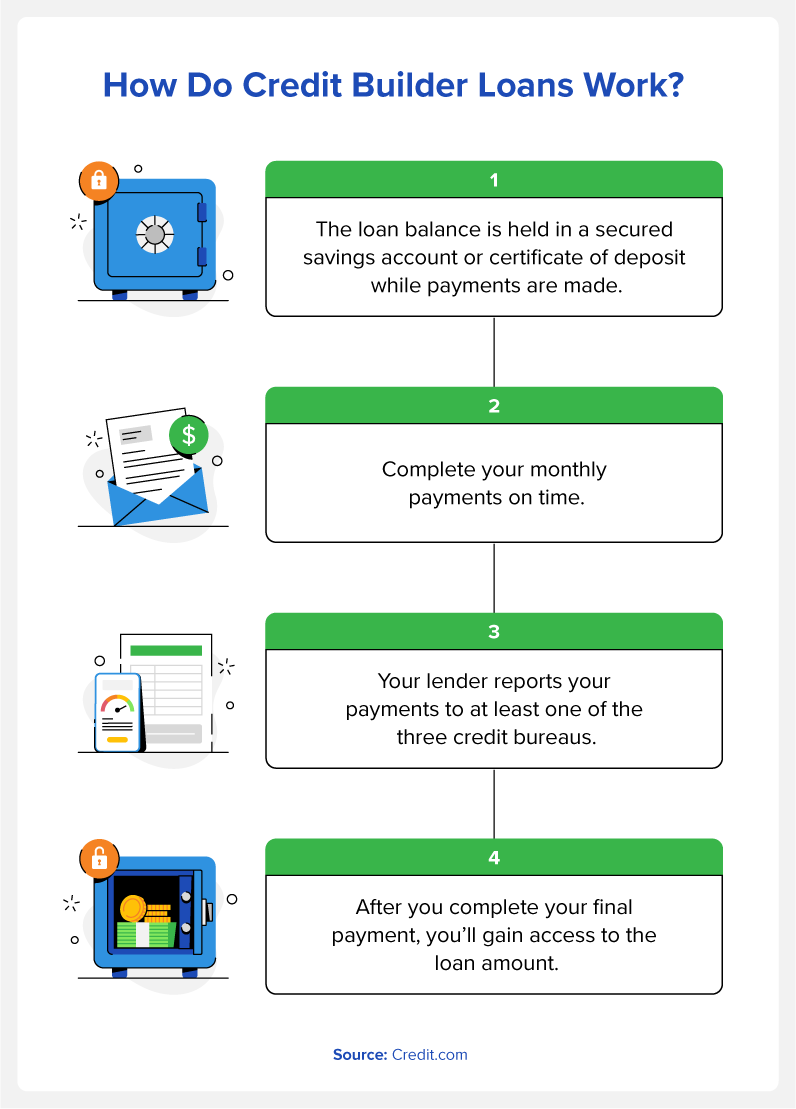

Credit builder loans work differently than regular loans. When you take out a regular personal loan, the lender deposits a set amount of money into your bank account, which you can use for a preapproved process—to buy a car or to consolidate credit cards, for example.

When you opt for a credit builder loan, the money you borrow goes into a secured savings account or a certificate of deposit (CD), where it sits until you pay off the loan. You gain access to your money after you make your final loan payment. Also, your lender will probably report to at least one of the three credit bureaus.

How Are Credit Builder Loans Managed?

We’ve already mentioned that, unlike regular loan funds, credit builder loan funds are only released after you make your final loan payment. Generally speaking, lenders wire transfer funds into checking or savings accounts. Some lenders also return a portion of the interest you’ve paid—minus fees—but that isn’t a universal policy, so check the small print before you sign up for your loan.

If you want to, you can repay the loan early. Think seriously before doing this, though, because it’ll cut short your positive payment history. If you do repay your loan early to avoid interest fees, you may still have to wait to withdraw your money if it’s being held in a CD.

Fees associated with credit builder loans include:

- Administrative fees: You’ll usually pay these fees before you get approved for the loan. It’s usually a one-time fee to set up the credit builder loan.

- Annual percentage rate (APR): Your APR is the interest rate on the loan. These are fixed rates but can fluctuate depending on the size of your loan and your lender.

- Late fees: Late fees occur if you make a late payment or miss a payment.

To achieve the best possible payment history, pay on time every month—and complete your entire loan term.

Is a Credit Builder Loan Worth It?

Many people find credit builder loans very useful. If you’re willing and able to set aside a monthly payment and can wait for your loan funds, assuming on-time payments and no other negative factors, you might enjoy a credit score improvement at the end of your loan term. Plus, you could qualify for lower interest rates—and as your credit improves, you’ll be that much closer to getting approved for an auto loan or a mortgage.

Who Benefits from a Credit Builder Loan?

Those with poor or nonexistent credit history benefit the most from a credit builder loan. Borrowers who make on-time monthly payments can build or rebuild their credit, as well as improve their savings.

How to Apply for a Credit Builder Loan

You’ll likely not have to go through a traditional credit check when you apply for a credit builder loan. Your lender could review your banking history using a consumer reporting agency like ChexSystems. They’ll look for red flags such as bounced checks or numerous overdraft fees.

When applying for a credit builder loan, the lender will likely require the following:

- Full name, Social Security number, and date of birth

- Residential address and contact information

- Bank routing and account numbers

- Photo identification, such as your driver’s license or U.S. passport

- Employment information and proof of income

- Housing payments

Where Can You Get a Credit Builder Loan?

You can apply for a credit builder loan at institutions that also offer conventional loans, including:

- Credit unions: There are credit unions that offer credit builder loans. However, you must be a credit union member to apply for a loan. To join a credit union, you must live in the region and typically need to meet a deposit requirement.

- Community banks: These banks are locally owned and operated, and they’re unrelated to large national banks. Unlike traditional banks, community banks are more likely to offer credit builder loans to support the local and regional community as well as businesses.

- Online lenders: You can find online lenders who offer credit builder loans. Before applying, confirm the lender is licensed within your state.

- Lending circles: These involve groups of people who deposit their money in a shared fund. Every member receives the shared fund on a monthly rotation until every member has received the money. You can find local lending circles in your community.

Explore these various institutions to determine which one aligns most with your financial needs and lifestyle.

What Is a Credit Builder Card?

Credit builder cards work in a similar way to credit builder loans. They’re designed to help new consumers build credit, and they’re also aimed at people looking to improve their credit. Credit builder cards usually have low credit limits and higher APRs because people with thin or poor credit scores are considered higher risk than those with established good credit. You can avoid paying interest by paying off your credit builder card in full every month.

Other Ways to Build Your Credit Score

Credit mix accounts for 10% of a consumer’s FICO® score. A good credit mix includes revolving credit accounts, like credit cards and store cards, and installment credit accounts, like car loans and personal loans.

To improve your credit, you should:

- Make payments early in each billing cycle

- Keep your credit usage low

- Avoid applying for too many financial products at once

Over time, your credit will likely improve, and you’ll be able to upgrade to great-value credit cards and low-interest loans. You can also try the following options to help build your credit.

Becoming an Authorized User

An authorized user is a secondary account holder on someone else’s credit account. You can ask a relative or friend with a good credit history to add you as an authorized user to their account. You’re not responsible for completing payments to the account. However, the credit payment history will reflect on your credit report. So, if the primary account holder completes payments on time, your credit may improve.

Obtain a Secured Credit Card or Store Card

You’ll need to make a minimum deposit to receive a secured credit card, which then becomes your credit limit. You can use this card similarly to traditional credit cards by making purchases with the card and paying the balance by the monthly due date. Be sure your provider reports to the three credit bureaus so you can successfully build credit.

Take Out a Personal Loan

If you have a poor credit history, you may be able to qualify for a personal loan. Unlike a credit builder loan, with a personal loan, you’ll receive the loan amount up front and pay it off over time. However, with a secured loan, you’ll need to put up collateral, such as a car. If you fail to make the payments, you risk losing your collateral.

Find the Right Credit Builder Loan for You

Getting a credit builder loan could be a great financial move for you. Most credit builder loans are for small amounts and have a short repayment schedule, so they’re easy to manage. But take a good look at your goals and finances before making any decisions, just to make sure that it’s the right step for you.

Looking for the right credit builder loan for your financial situation? Find a selection of loans and other financial products at Credit.com.

You Might Also Like

June 14, 2023

Credit 101

January 25, 2022

Credit 101

February 19, 2021

Credit 101