Your Credit Journey

Are you new to the world of credit? Maybe you’re just starting your credit—and adulting—journey. Maybe you’ve known about credit, but you’ve never made a foray into the financial world. Or maybe you just moved to the United States and you have to start over in a new system. No matter your circumstance, starting your credit journey can be daunting.

You see, one of the many catch-22s of the financial world is that you need credit to get credit. And you need credit to build your credit. So if you don’t have a credit score, you can’t get approved for the credit lines you need to build your credit. Sounds complicated, right? It doesn’t have to be. At Credit.com, we’ve got a few tools that’ll help you build your credit and help add more to your score.

Where to Get Started

Before we dive into a few great credit-building products, there are a few things you should know. First things first: your credit score won’t boost up overnight. These things take time, so don’t be disappointed if you don’t see the results you want right away.

In order to get results, you should start implementing these smart financial and credit habits right away:

- Pay your bills on time

- Keep your utilization low

- Monitor your credit

- Become an authorized user

Pay Your Bills On Time

This might be one of the most important tips we can give you. Payment history makes up a good chunk of your credit score. That’s because lenders like to see that you have a history of paying your bills on time. So do whatever you need to, like setting reminders, to make sure you pay all your bills on time—every time.

Keep Your Credit Utilization Ratio Low

Your credit utilization ratio is the amount of debt you have compared to your total credit limit. Experts recommend that you keep your credit utilization ratio at no more than 30%. So if you have a total of $2,500 in credit limits, you should have no more than $750 of total debt. This is a great way to make sure that your debt doesn’t get out of hand and your credit score stays where you want it to be.

Monitor Your Credit Score and Credit Reports

Start familiarizing yourself with your credit scores and credit reports. You should always check your credit scores and reports, but especially when you’re getting started. You can see what’s negatively and positively impacting your score, plus keep an eye out for signs of identity theft. Keeping an eye on your credit score and reports will also give you a good idea on what you can improve on.

Become an Authorized User

If you have a trusted friend or family member with a credit card that they use responsibly, you can ask them if they’ll add you as an authorized user. Mention to them that you don’t even have to use their credit card or account. If this family member pays their bills on time, and if the credit card issuer reports to all three major credit bureaus, this could have a positive impact on your credit report and score. If you go this route, make sure that you act responsibly: your actions can affect their credit as much as their actions can affect yours.

The Tools You Need if You’re New to Credit

The financial and credit world can be tricky to navigate–especially if you’re new. Luckily for you, we’ve got some tools and suggestions that can help. Here are a few places you can start.

Credit Report Card

Remember when we said that knowing your credit score is important? If you’re looking for a free platform that provides your credit score, sign up for our free Credit Report Card. You’ll get access to your Experian VantageScore 3.0 credit score for free, updated every 14 days.

Not only that, but you’ll get graded on the five factors that go into your credit score: payment history, credit utilization, credit age, account mix, and inquiries. That’ll give you key insights into where you’re currently at and what you can do to improve. Plus, you’ll receive personalized credit offers based on your credit score so you know what you’re more likely to get approved for.

ExtraCredit®

If you need a more comprehensive and in-depth credit solution, you might need ExtraCredit®. For $24.99 a month, you’ll get access to five features:

- Track It. With this feature, you get 28 of your FICO® scores.

- Guard It. This feature automates some monitoring to help protect your identity and your credit.

- Build It. Get your timely rent and utility payments reported on your credit file. This lets you get credit for bills you’re already paying.

- Restore It. ExtraCredit users get an exclusive discount to a leader in credit repair.

- Reward It. You can get a $5 sign-up bonus and cash rewards as high as $2500 by applying for and getting approved for offers through the ExtraCredit portal, which can be accessed online or through the Credit.com ExtraCredit app.

While all five features are incredibly useful, you might particularly benefit from Build It. If you’re paying your rent and utility bills on time, shouldn’t you get credit? We definitely think so. Build It will add your rent and utility payments as tradelines; rent is reported to the three major credit bureaus and utilities are reported to TransUnion. This is especially useful for those new to credit—even if you don’t have a line of credit to report to the credit bureaus, your on-time rent and utility payments will steadily help build your credit profile.

Secured Credit Cards

Most credit cards require a credit score to qualify. And many require good or excellent scores—especially those with rewards and competitive interest rates. But if your credit score is practically nonexistent, that means getting a credit card feels basically impossible. That’s where secured credit cards come in.

Instead of requiring a credit score, secured credit cards use a security deposit for collateral. And that security deposit becomes your credit limit. Typically, issuers require a minimum security deposit of around $200 and allow a maximum up to about $1,000. Secured credit cards are ideal for those with no credit because many don’t require a credit score to apply, and you’ll be able to build your score once you start using your card responsibly.

Here are a few secured credit card options to consider.

OpenSky® Secured Visa® Credit Card: This secured credit card requires a refundable deposit that’s as low as $200. It reports to all three credit bureaus, plus you can get considered for a new credit line increase after six months. It has a 25.64% (variable) ongoing APR and an annual fee of $35.

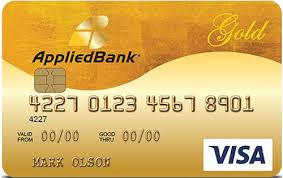

Applied Bank® Secured Visa® Gold Preferred® Credit Card: This card has the lowest ongoing APR out of the bunch, coming in at 9.99% fixed. It also requires a minimum deposit ranging from $200 to $1,000, and a $48 annual fee. And like the other credit cards on this list, this card reports to all three credit bureaus.

Credit Builder Loans and Accounts

Much like credit cards, most loans require decent credit—unless you’re willing to settle for high interest rates. But if you don’t have the credit needed to get a loan, it feels like you don’t have any options. So what can you do?

Enter credit builder loans. Credit builder loans are typically pretty low—under $1,000—and have shorter repayment periods between 6 and 24 months. Unlike traditional loans, the money you borrow sits in a secured savings account or a certificate of deposit (CD) until you pay it all off. If you take out a credit builder loan, make sure you’re paying it off responsibly and on-time—make sure your lender reports to at least one of the three major credit bureaus. If they don’t, this method won’t help you build your credit history.

Additionally, you could use a credit builder account to build your score. Ideal for those with low credit or a thin credit file, credit builder accounts can help get your score where you want it to be.

Start Building Your Credit Today

When you have little-to-no-credit and you’re new to the financial world, getting started can feel daunting. But you don’t have to do it alone. With some good financial habits, and with the help of a few tools, you can get your credit where you want it to be.

Disclaimer

*Your 7 day trial will begin after agreeing to these terms and submitting your ExtraCredit® sign-up. After your trial period, your subscription will automatically continue on the same day every month as the day you started your trial membership. The free trial is available for new ExtraCredit customers only. The credit card you provided will be charged $24.99 (plus any applicable tax) on the next business day and monthly; after your trial period unless you cancel. You may cancel at any time by downgrading your service level in your settings or by contacting us at support@credit.com. Dishonored payments will result in an automatic downgrade to the free Credit.com product.