Get your free Vantage 3.0 credit score

Getting a handle on your credit is the first step toward financial well-being. You know it, and we at Credit.com know it. Maybe you're looking to transform your bad credit into good credit, or perhaps just want to keep track of things. But where to start?

First things first—you need to know where you’re at. That’s why Credit.com provides your free credit score from Experian®, updated every 14 days. You can stay up to date with your Credit Report Card, which keeps track of what you’re doing well and what you could improve.

Get your free credit scoreWhy Credit.com?

You can get your free credit report from all three credit bureaus, but there’s a catch—you can typically only access it once a year, and it won’t provide your score. Credit.com, however, gives you useful insight into your credit score all year round. Not only that, but we display your updated credit score every 14 days (did we mention that already?). If you’re ready to improve your credit score, our Credit Report Card will give you a personalized action plan.

We pull your credit score straight from Experian®, updated every 14 days. As one of the three major credit bureaus, Experian® is a trusted credit reporting agency.

Not only do you get to see your credit score, but you’ll also be able to see your Credit Report Card. In a nutshell, it'll grade you on the five factors that play into your credit and give you a snapshot of each new late payment, current credit utilization, new and old hard credit inquiries, and how many types of each account you have.

When you sign up for Credit.com, we’ll show you loans and credit cards that match your credit score. You’ll see a few options that could work for you, including their interest rates and annual fee. We’ll also give you education and insights on types of credit, your credit, and credit in general specific to your score.

You don’t need to sit in front of your computer to see your credit score, access your Credit Report Card, or apply for a line of credit. Credit.com gives you a free mobile app that works on Android and iOS, so you can access your score and Credit Report Card wherever you are.

We pull your credit score straight from Experian®, updated every 14 days. As one of the three major credit bureaus, Experian® is a trusted credit reporting agency.

Not only do you get to see your credit score, but you’ll also be able to see your Credit Report Card. In a nutshell, it'll grade you on the five factors that play into your credit and give you a snapshot of each new late payment, current credit utilization, new and old hard credit inquiries, and how many types of each account you have.

When you sign up for Credit.com, we’ll show you loans and credit cards that match your credit score. You’ll see a few options that could work for you, including their interest rates and annual fee. We’ll also give you education and insights on types of credit, your credit, and credit in general specific to your score.

You don’t need to sit in front of your computer to see your credit score, access your Credit Report Card, or apply for a line of credit. Credit.com gives you a free mobile app that works on Android and iOS, so you can access your score and Credit Report Card wherever you are.

Your credit score basics

How does Credit.com get my credit score?

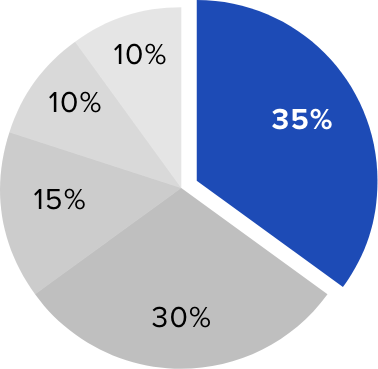

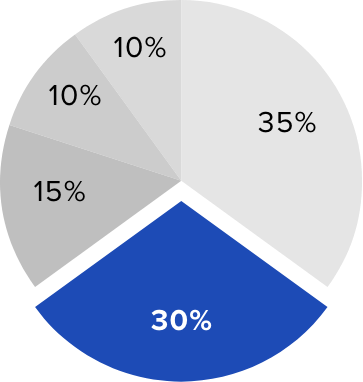

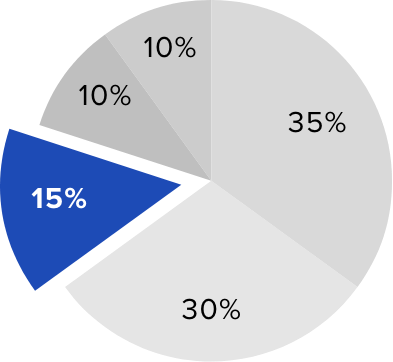

OK, we’ve established that Credit.com provides your credit score and Credit Report Card completely free of charge. But how exactly do we get your credit score? It comes directly from Experian®, one of the three major credit bureaus. Not only that, but you’ll get access to your Credit Report Card. It’ll dig into the five factors that affect your credit score—payment history, debt usage, credit age, account mix, and credit inquiries—and give you a personalized action plan to help you reach your credit and financial goals.

What's my credit score?

Your credit score is used for a lot—even if you don’t know it. Sure, you need your credit score to apply for things like credit cards, loans, and mortgages. But did you know that you may need a credit score to rent an apartment? To get decent interest rates? Trust us—you don’t want to apply for any credit line before checking your score. Plus, keeping an eye on your score can help you look out for identity theft and fraud. With your credit, it’s better to be safe than sorry.

When and why does my credit score change?

Honestly, your credit score can change whenever. It depends on many things, like whether you pay your bills on time, when you pay your balances, if/when you apply for a new line of credit, and when you open or close a new account. Plus, it can take 30 to 60 days for your creditors to report your information to the credit bureaus. Because your score can really change at any time, it’s important to keep track of it.

How to read your free credit score

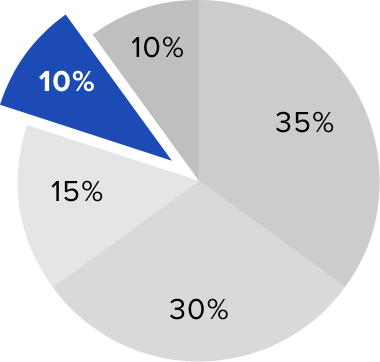

So, what exactly does your credit score mean? To understand your credit score, it's helpful to be familiar with the five ranges—Excellent, Good, Fair, Poor, and Very Poor.

Get your score for free—no credit card needed

When you sign up with Credit.com’s free account, there isn't a catch. You can access your free credit score without a credit card or hard inquiry.

Get your free credit scoreWhat factors determine your credit score?

Below are the five key factors that determine your credit score:

Need a little Extra?

Getting a handle on your credit is the first step toward financial well-being. You know it, and we at Credit.com know it. Maybe you're looking to transform your bad credit into good credit, or perhaps just want to keep track of things. But where to start?

A free credit score is a great tool for understanding, tracking, and building your credit. If you want even more insight into your credit, check out ExtraCredit®. For $24.99 a month, you can see 28 of your FICO® Scores from all three major credit bureaus. In addition to your credit scores, ExtraCredit offers opportunities to add your rent and utilities to your credit reports to add more history to your credit profile, cash back rewards when you’re approved for certain offers, exclusive discounts, $1 million identity theft coverage, and more.

Frequently Asked Questions

Get your free credit report card today

- Insight into what is helping and hurting your credit score

- Your score in comparison to U.S. averages

- Overview of late payments, credit utilization, and hard inquiries