How Much Money Do You Lose to Taxes, and Do You Care?

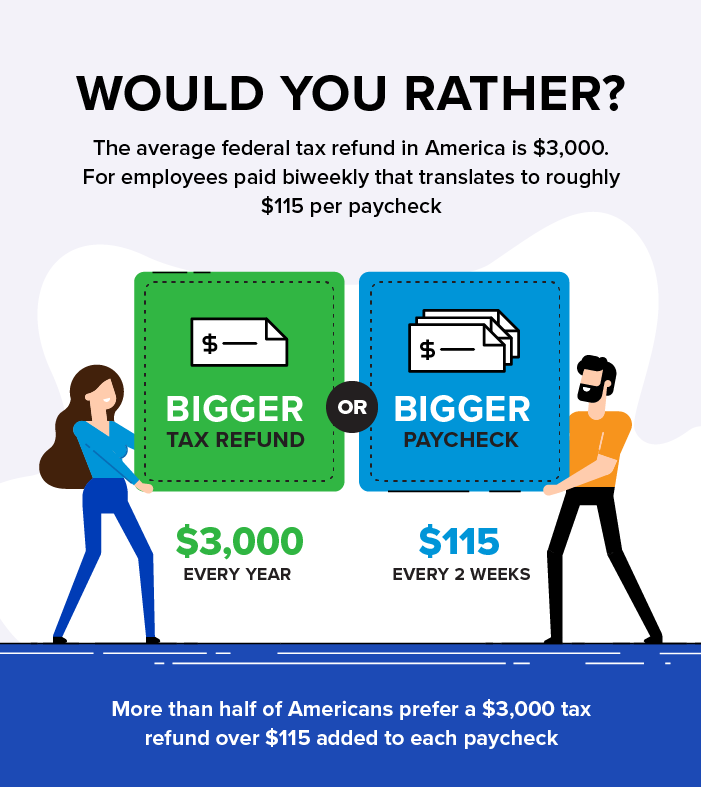

About half of Americans would rather get a bigger tax refund than an extra $115 per paycheck, according to a recent survey Credit.com conducted. But a bigger tax refund isn’t always a good thing. Learn more about what you can do with a larger paycheck.

Methodology

Note: This survey was conducted for Credit.com using Suzy.com. The sample consisted of a total of 1,028 responses per question and is not statistically representative of the general population. This survey was conducted in October 2022.

In This Piece

- More Than Half of Americans Prefer a Larger Tax Refund

- What Can You Do with a Bigger Paycheck Instead?

- How Can You Earn More Money Throughout the Year?

- Ways to Get a Bigger Tax Refund

More Than Half of Americans Prefer a Larger Tax Refund

We asked more than 1,000 people aged 18 to 99 whether they’d like a $3,000 tax refund or $115 more in take-home pay on each paycheck. Surprisingly, 52% of the respondents in our tax refund survey said they’d take the bigger tax refund.

Men were more likely to choose the bigger tax refund, at 54.2%, and millennials aged 25 to 34 were the most likely age group to choose the bigger tax refund. People aged 18 to 24 were least likely to say they’d take the bigger tax refund.

It’s important to note that in many cases, getting a tax refund means you overpaid the IRS throughout the year. You could’ve kept the money yourself and put it to work for all those months instead of letting the government earn interest on it. If you’re not sure what your tax refund might look like, see how you can maximize your tax refund so you can plan ahead.

What Can You Do With a Bigger Paycheck Instead?

To find out how much money you lose to taxes, learn how to read a pay stub so you can add up your tax payments. If you’re paying too much and getting a refund every year, you can adjust your withholdings to get more out of your paycheck every payday. Here are a few things you can do with a bigger paycheck:

- Invest more in retirement. When you’re paying less to the federal or state government every pay period, you have more money to invest in retirement. If you were already getting along without this extra money every pay period, it might be a good idea to contribute it to a 401(k) or other tax-deferred accounts. If your employer offers a contribution match, this is a great way to maximize retirement savings.

- Pay off more debt. Alternatively, funnel that extra money every paycheck into paying off debt. Every little extra bit you can pay off each month cuts down on long-term interest expenses, so you may be able to save yourself a lot in the long term.

- Invest in savings accounts. Sock the money away in savings accounts with high-interest yields for an easy, safe way to earn a little money on your cash. Savings accounts also ensure your money is readily available if you need it.

How Can You Earn More Money Throughout the Year?

What if you’ve already adjusted your tax withholdings so you’re not losing money every pay period to taxes unnecessarily? If you want more take-home income every month, you may have to look for other ways of earning money, including:

- Side hustles. Join the gig economy to make extra money delivering groceries or food, writing content for others, doing surveys or market research, babysitting, walking dogs or any number of other tasks. Remember that, as a freelancer, you’ll be responsible for paying taxes on anything you earn via a side hustle.

- Investments. Make investments so your money is working for you. You might invest in stocks and bonds, more conservative options like CDs or property you can rent or flip for a profit.

- Asking for a raise. Boost your paycheck by asking for a raise if you think you’ve earned it, your current job duties have grown and aren’t in line with your pay or you haven’t had a cost-of-living adjustment in some time.

- Getting help with finances. Get help managing your finances so you can reduce your debt or interest payments. If you can lower how much you need to pay on debt every month, you have a lot more discretionary income to work with.

Ways to Get a Bigger Tax Refund

If after everything above you still agree with the 52% of respondents in our survey who said they’d rather have a bigger tax refund, there are some things you can do to get one. They include:

- Adjusting your withholdings so more is taken out in taxes each paycheck. Note that this will reduce how much you take home out of each paycheck.

- Maximizing your tax refund. While you can do your taxes for free, you may find paid tax filing software has more options for increasing your refund via credits and deductions.

- Get expert help with taxes. Work with professionals who can help you learn more about your tax situation and how you can maximize your refund. Start with information on Credit.com to get help with your taxes.