Borrowing money requires careful consideration of its potential pros and cons, and money decisions are rarely simple. At the very least, you want to avoid overlooking important details that determine whether you need or can afford the loan, so here are some things to think about before committing to anything. 1. Is there a cheaper... Read More

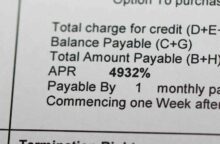

Is there anyone out there who still believes that payday lending is a respectable business? That it’s OK to charge stratospheric interest rates—often four, five or more times the amount that’s originally borrowed—to cash-strapped consumers who typically re-borrow the identical loan over and over again during the course of a year? That it’s reputable to... Read More

Student loan interest rates are going to go up. At least, that’s what the Consumer Financial Protection Bureau expects. With the intention of helping borrowers better calculate the costs of their educations, the CFPB Student Loan Ombudsman Rohit Chopra published an explanation of what to expect. The CFPB estimates interest rates for federal loans will... Read More

If you’re thinking about buying a home, you’ve probably used — or at least heard of — a mortgage calculator. These nifty tools can help you figure out the price range of homes you may be able to afford and estimate your monthly mortgage payment. With an event as big as buying a home, it’s... Read More

Even if you’re not planning to take out any loans or open credit cards in the next several months, you’ll want to make sure you’re doing everything you can to improve your credit score. There are a few reasons for this. First, if your credit score isn’t great, you should definitely be working toward a higher... Read More

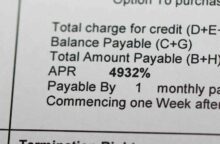

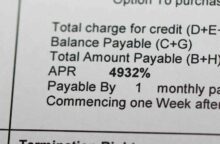

When you apply for a car loan, a credit card or a mortgage you know you’re going to have to pay interest. The question is how much you’re willing to pay in interest to borrow that money: 5%? 20%? What if you were asked to pay 300% interest? The morality of high interest rates has... Read More