It’s a good time to sell a home. Buyers are back to fighting over properties in hot markets and that means less time sellers need to wait around.

Realtor.com says homes stayed on the market 14 days less in March 2016 than March 2015, a dramatic drop. The number of homes listed has dropped, too, meaning more buyers fighting over fewer properties.

Of course, competition means also means higher prices, and ultimately more cash at closing for sellers. You might expect folks selling in real estate hotbeds like New York and California to post big gains after sales, but you’ll be surprised at places where sellers are averaging more than $50,000 in sale proceeds, according to data provided by RealtyTrac.

Check out these average gains:

- Washoe County, Nevada (Reno) — $77,500

- Yavapai County, Arizona (Prescott)— $76,980

- Deschutes County, Oregon (Bend)— $71,600

- Weld County, Colorado (Greeley)— $66,400

- Skagit County, Washington (Rural) — $66,900

- Anchorage, Alaska — $58,956

- Charleston, South Carolina— $57,000

- Davidson County, Tennessee (Nashville)— $52,000

- Baltimore County, Maryland — $50,198

To review, that means the average gain for a home seller In Baltimore County last month was more than $50,000.

Note, the gains cover all sales, whether owners held the property for 1 year or 40 years. Nationally, sellers owned their homes on average 7.67 years, RealtyTrac says. That means folks in Prescott, Reno, or Bend averaged about $10,000 gain annually — a tidy sum.

Moving down the average dollar gain list, you still find plenty of places where it was surprisingly good to be a seller in March. Here’s a few more:

- Mohave County, Arizona (Lake Havasu City) — $43,251

- Buncombe County, North Carolina (Asheville) — $39,750

- Waukesha County, Wisconsin (Milwaukee) — $38,100

- Ada County, Idaho (Boise City)— $35,183

- York County, Pennsylvania — $35,000

- Catawba County, North Carolina (Rural) — $33,000

- Rockingham County, New Hampshire (Near Manchester) — $31,767

Of course, gains in America’s biggest cities were an order of magnitude larger, as you’d expect. In San Francisco County, the average gain was $473,000. In Santa Clara, $335,000. In New York City’s King Country, gains averaged $255,000. In Los Angeles County, a still-astounding $152,000.

“It’s absolutely a great time to sell, particularly in these markets that have seen strong price gains,” said Daren Blomquist, vice president of RealtyTrac.

It’s important to realize sellers often don’t see any of that money if they are moving into another home in the same area. Proceeds from the sale just get rolled over as a down payment on the new home. Still, those who move, or downsize, can realize dramatic (and often tax-free) gains. (If you’re planning on selling your current home to buy a new one, you should make sure your credit is in good shape before you apply for your new mortgage. You can check your credit scores for free on Credit.com to see where you stand.)

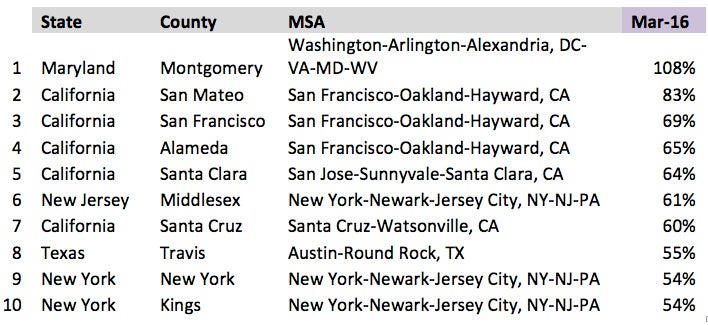

On a percentage basis, Washington D.C.-area sellers in Montgomery County (Bethesda) gained the most — a whopping 108%. San Francisco-area counties took up four of the top 10 percentage-gain slots, and three New York City metro-area counties made the top 10, also. But folks near Austin, Texas, did well, too, gaining 55% and placing 9th in the country.

It’s a bit of a surprise that D.C. and San Francisco landed atop that list, given that those markets that have cooled off a little – sale prices were actually down 2% in San Francisco in March. But here’s your explanation: Frisco prices fell following 47 consecutive months of increases.

“In those markets you have folks cashing out even as the market shows evidence of peaking,” Blomquist said. “I would suggest that folks selling now are likely timing the market quite well — whether intentionally or not.”

The Flip Side: Some Sellers Lose

Of course, not everyone is joining in the party. Americans in some communities are still losing money selling their homes. Sellers in Wayne, Michigan (near Detroit) saw their homes drop 75% in value, on average, from purchase to sale. Not far away in Saginaw, prices fell 22%. In rural Bell, Texas, prices fell 19%. Prices in two counties near Cleveland — Cuyahoga and Lorain — saw double-digit percent drops. And folks in eastern Pennsylvania — near Scranton and East Stroudsburg — also suffered double-digit losses, as did sellers in Harford County (Maryland, north of Baltimore) and Charles County, southeast of Washington D.C.

More on Mortgages & Homebuying:

- Why You Should Check Your Credit Before Buying a Home

- How to Find & Choose a Mortgage Lender

- How to Refinance Your Home Loan With Bad Credit

Image: AzmanJaka

You Might Also Like

December 13, 2023

Mortgages