Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

An ACH transfer is an electronic method of moving money from one bank to another via the Automated Clearing House (ACH). ACH transfers are more convenient because they’re quicker than traditional transfers.

Many people don’t realize it, but ACH, or Automated Clearing House, transfers are part of everyday life. They are how your paychecks are processed through direct deposit, used for debits for routine payments and much more.

Understanding ACH transfers and payments will give you a better understanding of how your money is handled. This is advantageous because it can help you avoid missed payments, late payments, and fees by knowing when you can expect money in your account.

This guide will explain what ACH transfers are and how they work as well as their benefits and drawbacks.

Key takeaways:

- Money moved electronically through the Automated Clearing House are known as ACH transfers

- ACH transfers are used for direct deposits for paychecks and for government benefit programs

- ACH direct payments are for paying bills or sending money through apps like Zelle and Venmo

- ACH transfers typically take one to three business days

- In some cases, ACH transfers limit the amount you can transfer as well as how often

In This Piece:

- What Is an ACH Transfer?

- How Does an ACH Transfer Work?

- Types of ACH Transfers

- How Long Do ACH Transfers Take?

- How much Do ACH Transfers Cost?

- What Are the Pros and Cons of ACH Transfers?

- What’s the Difference between ACH Transfers and Wire Transfers?

- How to Make ACH Transfers Faster

- Can ACH Transfers Hurt My Credit Score?

What Is an ACH Transfer?

ACH transfers are a form of electronic fund transfers that move money between banks. Electronic funds transfers are when you move money in a non-physical way. For example, when your employer directly deposits money into your bank account rather than giving you a physical check or when you PayPal a friend, these are electronic transfers.

ACH stands for Automated Clearing House, and a clearing house is an establishment that acts as a go-between for banks to finalize a transaction.

ACH transfers can be used for the following:

- Bill payments

- Direct deposits from employers

- Direct deposits from government benefit programs

- External funds transfers

- Person-to-person payments

- Business-to-business payments

You may use ACH payments and transfers regularly without realizing it. Popular payment apps like Zelle, Venmo, and PayPal use the ACH network to send and receive money.

How Does an ACH Transfer Work?

If you want to make an ACH transfer, it’s a simple process as long as you follow these steps:

- Step one: Similar to paying with a check or receiving a check, you’ll need the name, account number, routing number, account type, and amount.

- Step two: Choose whether you want to do an ACH credit or ACH debit. ACH credits are often safer because your bank account details are hidden.

- Step three: Finalize the transfer by linking your accounts and providing the details of the transaction.

If you’re a business owner, you’ll need to set up a way to receive ACH payments from your customers. There are a variety of digital companies that provide this service like Stripe and Plaid.

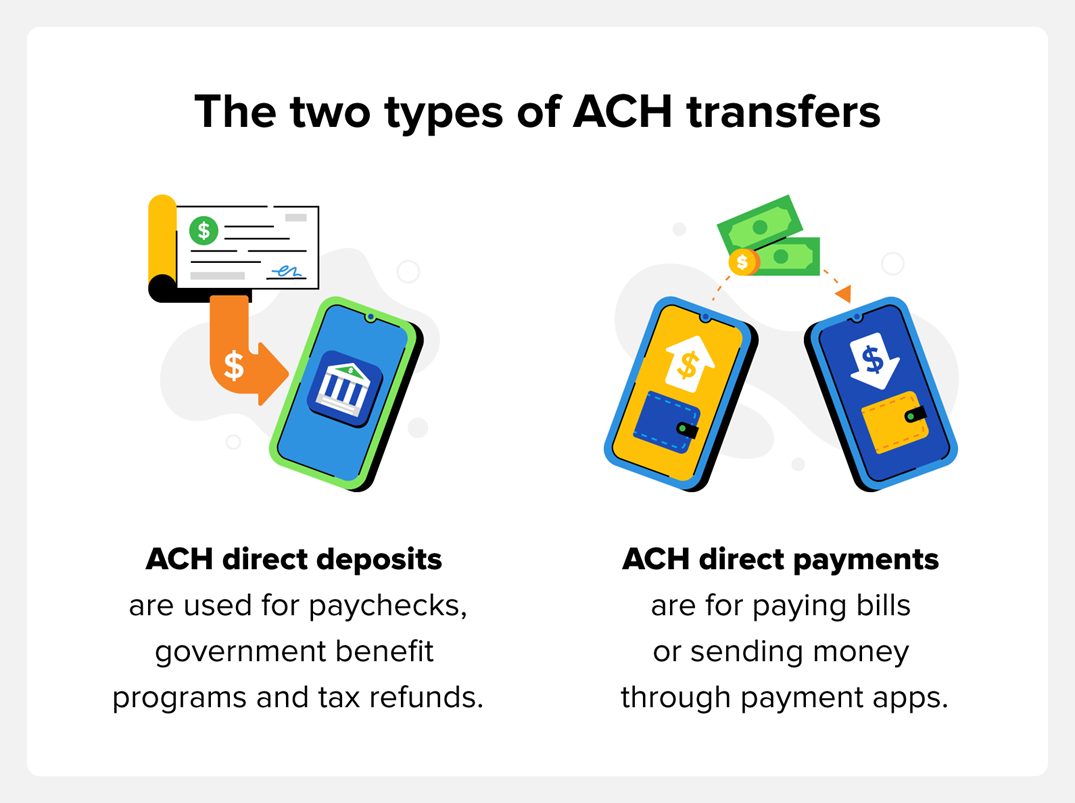

Types of ACH Transfers

There are two primary types of ACH transfers, and these have become a more convenient way of transferring money than the days of waiting for a check to clear. With the two types of ACH transfers, you no longer have to worry about bounced checks. However, you may still incur fees if you don’t have sufficient funds to cover the transaction.

ACH Direct Deposits

These ACH transfers are used by businesses and government programs to get people money faster. Prior to using the ACH network, you would need to receive a check, take it to the bank, deposit it, and wait for it to clear. ACH direct deposits are a way for you to receive payments, and some of the most common forms include:

- Tax refunds

- Government program payments

- Annuity payments

- Paychecks

- Employer reimbursements

ACH Direct Payments

The other type of ACH transfer is direct payments, and this is when you’re sending money to someone else. When you use one of the payment apps to loan a friend money or split the dinner bill, you’re using ACH direct payments.

When you make an ACH direct payment, you’ll see the money debited from your bank account, and the receiver will see a credit in theirs. If the app connects to your bank account, debit card, or credit card, you’ll see the funds transferred via the app, but the app will have more details for your own tracking purposes. You can often include a note in these apps to note what the payment was for.

How Long Do ACH Transfers Take?

ACH transfers can take a few hours or up to two to three business days. The National Automated Clearing House Association (NACHA) sets the rules and guidelines for ACH transfers and has the following requirements:

- Credit transfers can be processed on the same business day or between one and two business days

- Debit transfers must be processed by the following business day

Although banks must adhere to these guidelines for processing payments, it’s at their discretion whether or not they charge for expediting the process. For example, when you’re sending money through PayPal and other services, they may have an option to send the money faster for a fee.

How much Do ACH Transfers Cost?

Depending on the bank or financial institution, there may be a fee for sending money to an account at a different bank using an ACH credit transfer. These are known as “external funds transfers,” and the cost can range from $0-50.

ACH debit transfers are the types of transfers that employers use for direct deposit as well as bill payments. These types of ACH transfers are usually free unless you need to expedite the payment.

External ACH Transfer Fees

As mentioned above, the cost for external transfers can vary between banks. Below, we’ve provided the fees and delivery times from some of the most used banks in America.

|

Bank |

Fee |

Approximate delivery time |

|---|---|---|

|

Axos Bank |

$0 |

3 to 5 business days |

|

Bank of America |

$3 from account and $0 to account |

3 business days or $10 fee for next day |

|

Capital One 360 Bank |

$0 |

2 business days |

|

Chase |

$0 |

1 to 2 business days |

|

Citibank |

$0 |

3 business days or an option for free next-day delivery |

|

Discover Bank |

$0 |

1 to 4 business days |

|

Navy Federal Credit Union |

$0 |

2 to 3 business days |

|

TD Bank |

$0 |

1 to 3 business days |

|

U.S. Bank |

$0 to account and $3 from account |

2 to 3 business days and free next-day for incoming transfers |

|

Wells Fargo |

$0 |

3 business days for incoming transfers and 2 business days for outgoing transfers |

Each of these delivery times are based on the disclosures and general policies of each financial institution when using their online banking for personal accounts. It’s helpful to remember that delays can occur if there is a holding period or payment is sent after the bank’s cutoff time.

What Are the Pros and Cons of ACH Transfers?

Similar to many financial tools, there are benefits as well as downsides.

There are many reasons ACH transfers are so popular, and here are some of the advantages:

- You can use ACH payments to pay bills electronically rather than writing and mailing a check

- ACH direct deposits are more secure

- NACHA requires that transfers happen within one to two business days

- ACH transfers are often free or just a few dollars to expedite

There are also some downsides to keep in mind when using ACH transfers to receive or send payments:

- Some banks limit how many transfers you can make or how much money you can move

- Penalties may occur with too many transfers using savings accounts governed by Federal Reserve Board Regulation D

- Banks have cutoff times for processing ACH transfers, so they may take longer if you miss the cutoff

- There are fees if you have insufficient funds in your account

What’s the Difference between ACH Transfers and Wire Transfers?

The primary difference between wire and ACH transfers is that wire transfers are much faster. When wiring money within the same country, the transfer can take a few hours or as quick as a few minutes.

While wire transfers can be much faster, they also cost more. Many ACH transfers don’t have a charge, but a wire transfer may cost $20 or $30. When sending money internationally, the fee might be even more. Wire transfers are usually the better option if you need to move money quickly and can afford the fees.

How to Make ACH Transfers Faster

ACH transfers can take up to three business days, but there are a few ways you can make these transfers faster:

- Use payment apps: Apps like Zelle and others link directly with your bank, can send money in real-time and don’t charge additional fees for same-day payment.

- Know the cutoff times: Banks have cutoff times for transfers, so you can avoid a payment taking longer than expected by knowing how late you can make these transfers.

- Pay the fees for expedited transfers: Some banks have the option to send the money faster for an additional fee. This fee varies by bank.

Can ACH Transfers Hurt My Credit Score?

ACH transactions can’t hurt your credit score directly, but it is possible to acquire fees from your bank. Unpaid bank fees can be sent to collections, and then the derogatory mark can show up on your credit report and hurt your credit score.

One of the best ways to avoid hurting your credit score is to have credit monitoring so you’re notified as soon as there’s a change to your score. Credit.com’s ExtraCredit service provides credit monitoring for a monthly fee so you know when something happens or a potential error was reported. If you’re unsure of your credit health, Credit.com offers a free service as well. You can get your free credit report card here.

You Might Also Like

March 11, 2021

Personal Finance

March 1, 2021

Personal Finance

February 18, 2021

Personal Finance