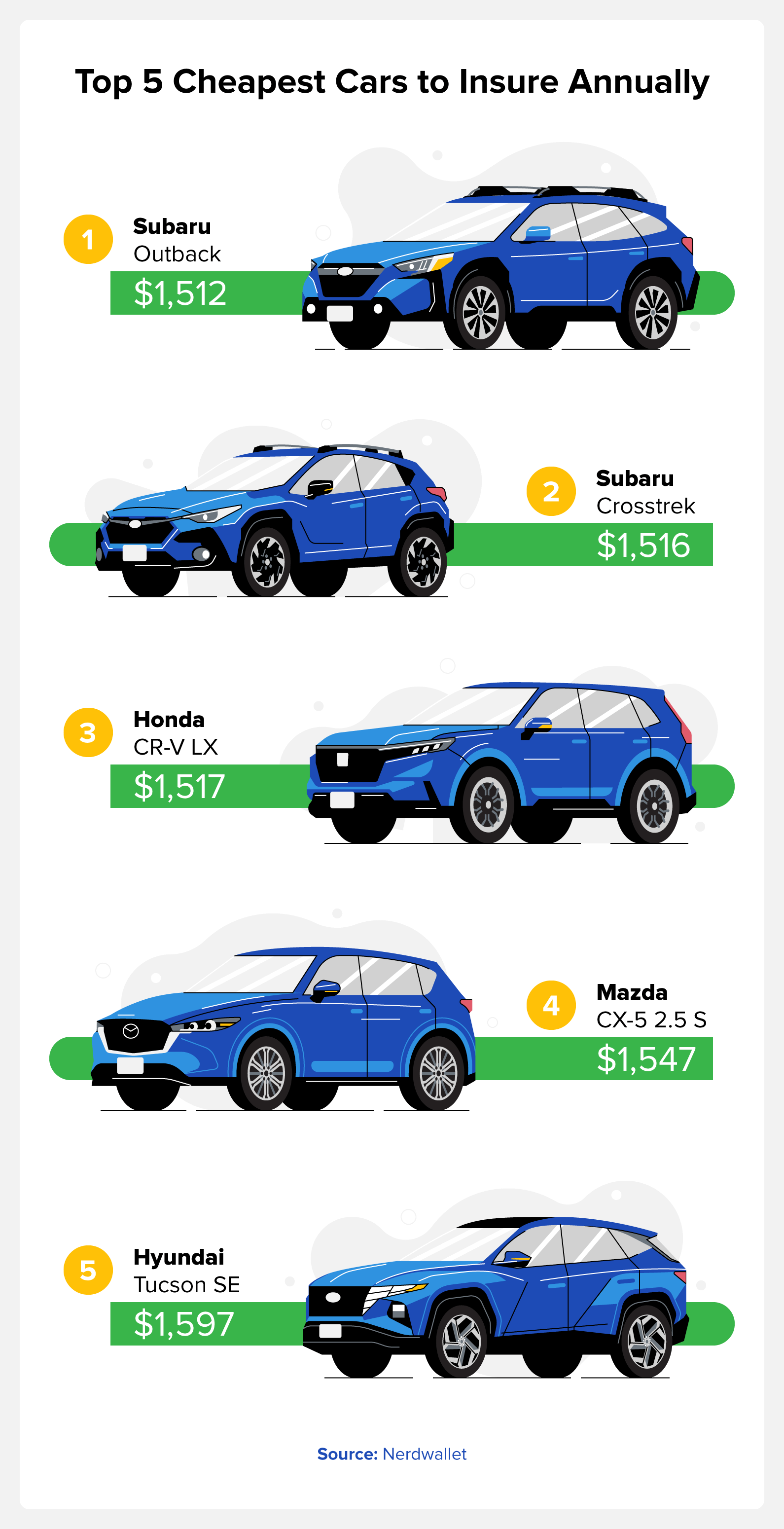

The top three vehicles with the cheapest insurance rates are the Subaru Outback at $1,512 per year, the Subaru Crosstrek at $1,516 per year, and the Honda CR-V LX at $1,517 per year.

Nobody wants to pay too much for car insurance, so if you’re in the market for a new vehicle, it can be beneficial to know the cheapest cars to insure. You may not realize it, but your location can also determine how much you’re paying for car insurance. According to a recent study by Value Penguin, some states saw a much higher change year over year than others—Arizona, for example, saw an average insurance increase of 15.6% between 2021 and 2022. During that same period of time, the national average for car insurance increases was only 8.4%.

Whether you’re shopping for a new vehicle or you want to see where your vehicle stands relative to the insurance cost of other vehicles, we’ll cover it all here. We’ll go over the cheapest and most expensive cars to insure, along with tips to save you money on your insurance rates.

Table of contents:

- The Top 10 Cheapest Cars to Insure

- Cheapest Cars to Insure by Type

- What Factors Make a Vehicle Expensive to Insure?

- Most Expensive Cars to Insure

- 5 Tips to Get Cheaper Car Insurance

The Top 10 Cheapest Cars to Insure

When looking for the cheapest cars to insure, the average cost of car insurance for a variety of models is pretty low. The Subaru Outback is the cheapest car to insure at an annual rate of $1,512, but you may be surprised to see some larger vehicles on this list as well.

|

Make |

Model |

Annual Premium |

|---|---|---|

|

Subaru |

Outback |

$1,512 |

|

Subaru |

Crosstrek |

$1,516 |

|

Honda |

CR-V LX |

$1,517 |

|

Mazda |

CX-5 2.5 S |

$1,547 |

|

Hyundai |

Tucson SE |

$1,597 |

|

Ford |

Escape |

$1,609 |

|

Jeep |

Wrangler Sport |

$1,617 |

|

Nissan |

Altima |

$1,641 |

|

Toyota |

Tacoma SR |

$1,647 |

|

Ford |

F-150 XL |

$1,651 |

Cheapest Cars to Insure by Type

It’s a common misconception that an inexpensive, small vehicle is the cheapest type of car to insure. Various factors determine the insurance rate for different vehicles, such as safety ratings, so a more expensive vehicle may actually be cheaper to insure. Whether it’s a new or used car, knowing some of the facts may help you find a great vehicle with a low insurance rate. These rates may also help you find the cheapest cars to insure for young drivers in the household.

Top 25 Cheapest Popular Car Models to Insure

The following table includes a list of 25 of the best-selling vehicles along with their median annual insurance rate and the manufacturer’s suggested retail price (MSRP). To put it into perspective, we’ve also included the insurance cost as a percentage of the MSRP.

|

Vehicle Make and Model |

Median Insurance Premium (Annually) |

MSRP |

Insurance as % of MSRP |

|---|---|---|---|

|

1. Subaru Outback |

$1,512 |

$28,395 |

5.30% |

|

2. Subaru Crosstrek |

$1,516 |

$23,645 |

6.40% |

|

3. Honda CR-V |

$1,517 |

$28,410 |

5.30% |

|

4. Mazda CX-5 |

$1,547 |

$26,700 |

5.80% |

|

5. Hyundai Tucson |

$1,597 |

$26,900 |

5.90% |

|

6. Ford Escape |

$1,609 |

$28,000 |

5.70% |

|

7. Jeep Wrangler |

$1,617 |

$31,195 |

5.20% |

|

8. Toyota Tacoma |

$1,647 |

$28,250 |

5.80% |

|

9. Ford F-150 |

$1,651 |

$33,695 |

4.90% |

|

10. Toyota RAV4 |

$1,652 |

$28,275 |

5.80% |

|

11. Chevrolet Equinox |

$1,695 |

$26,600 |

6.40% |

|

12. Toyota Highlander |

$1,716 |

$39,020 |

4.40% |

|

13. GMC Sierra 1500 |

$1,751 |

$37,200 |

4.70% |

|

14. Nissan Rogue |

$1,751 |

$27,760 |

6.30% |

|

15. Chevrolet Silverado 1500 |

$1,762 |

$36,300 |

4.90% |

|

16. Ford Explorer |

$1,780 |

$38,570 |

4.60% |

|

17. Toyota Corolla |

$1,800 |

$21,700 |

8.30% |

|

18. Toyota Camry |

$1,822 |

$26,320 |

6.90% |

|

19. Honda Civic |

$1,832 |

$23,750 |

7.70% |

|

20. Honda Accord |

$1,844 |

$27,295 |

6.80% |

|

21. Jeep Grand Cherokee |

$1,883 |

$40,030 |

4.70% |

|

22. Ram 1500 |

$1,897 |

$37,410 |

5.10% |

|

23. Nissan Altima |

$1,641 |

$25,490 |

7.90% |

|

24. Tesla Model 3 |

$2,296 |

$40,240 |

5.70% |

|

25. Tesla Model Y |

$2,530 |

$52,630 |

4.80% |

Top 5 Cheapest Trucks to Insure

There are many affordable trucks to insure—some are even cheaper to insure than certain sedans. According to J.D. Power, the Ford F-150 is the top-selling truck in America, and the data shows it’s also one of the cheapest trucks to insure.

|

Truck Make and Model |

Average Annual Premium |

|---|---|

|

Ford F-150 |

$1,753 |

|

GMC Sierra |

$1,867 |

|

Chevrolet Silverado 1500 |

$1,989 |

|

Toyota Tundra |

$2,064 |

|

Nissan Titan |

$2,285 |

Top 5 Cheapest SUVs to Insure

Not only are SUVs spacious, but many are also family vehicles, so they come with high-end safety features. These features make some SUVs cheaper to insure than other popular vehicles on the market. The Subaru Outback takes the top spot on this list, and it’s also rated one of the safest midsize vehicles by the Insurance Institute for Highway Safety.

|

SUV |

Average Annual Premium |

|---|---|

|

Subaru Outback |

$1,603 |

|

Honda CR-V |

$1,635 |

|

Honda Pilot |

$1,726 |

|

Ford Escape |

$1,734 |

|

Honda Odyssey |

$1,735 |

What Factors Make a Vehicle Expensive to Insure?

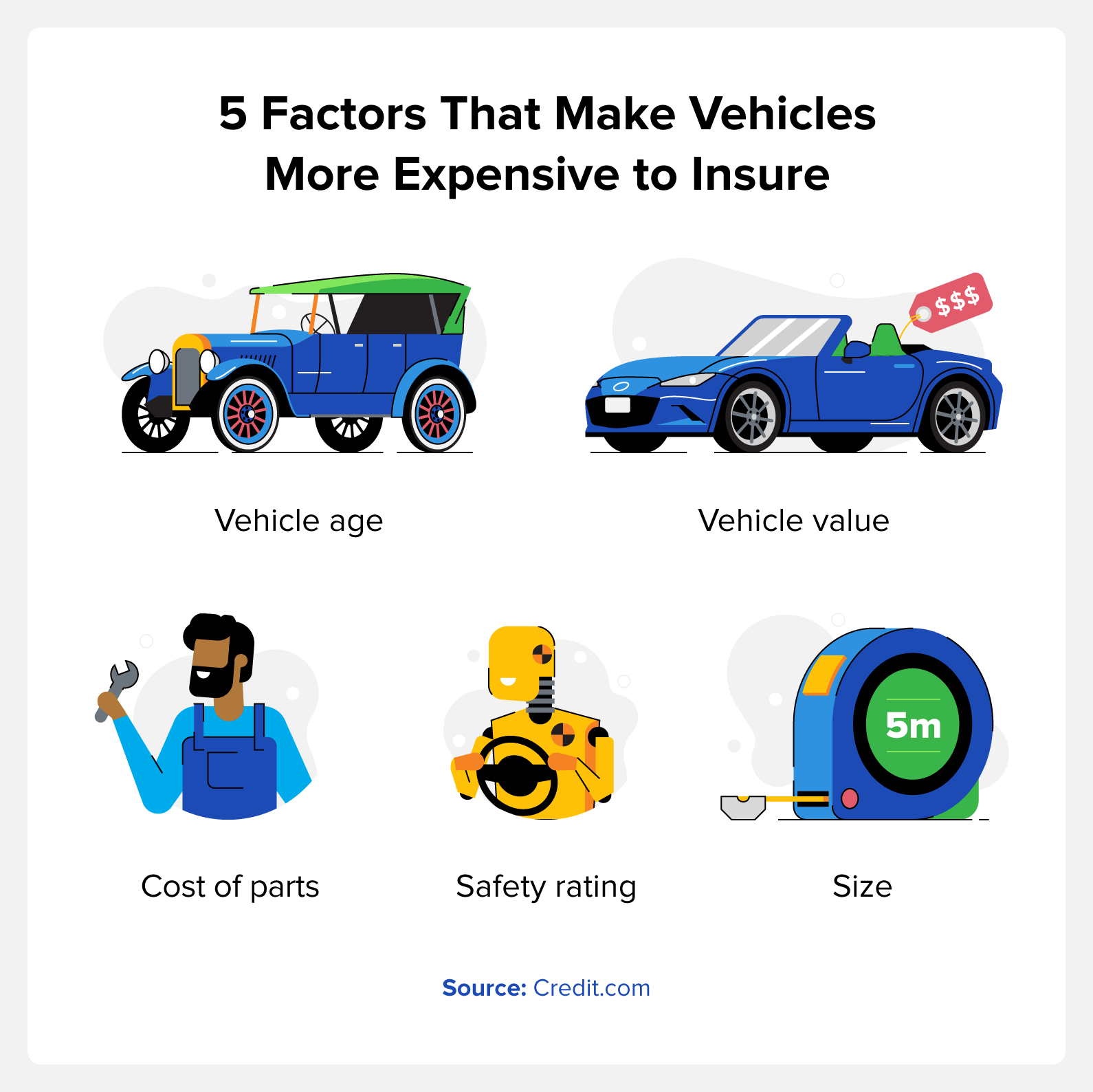

The primary factor that makes a vehicle more expensive to insure than another is the risk. Insurance companies calculate the risk for different vehicles based on how many claims people file for those vehicles, plus the cost of the repairs. While this data can’t predict the likelihood of someone getting into an accident, the data gives insurers a rough idea.

Insurance providers look at how much a vehicle costs to repair and the likelihood of the vehicle being in an accident. For example, insurance rates are higher for sports cars because people who buy sports cars are more likely to speed and drive recklessly, based on the data.

Some of the most common factors that make vehicles more expensive to insure include:

- Vehicle age: An older vehicle may not have the newest safety features, but premiums may be lower on some older vehicles if the average repairs cost less.

- Vehicle value: When cars are more expensive, they’re often more expensive to insure as well.

- Cost of parts: Some vehicles have more expensive and specialty parts, which cost more to replace if the vehicle is in an accident. Various trim features in a vehicle can also raise the price of premiums.

- Safety rating: Many insurance policies also cover physical injuries to you or another driver, which is why safety ratings play a major role in determining the cost of insurance.

- Size: Although a larger vehicle may be safer, it can also cause more damage if it’s involved in an accident.

Most Expensive Cars to Insure

If you’re thinking about purchasing a new or used vehicle, it’s helpful to know which types of vehicles typically have the highest rates. They include:

- Sports cars

- High-end luxury vehicles

- Electric vehicles

- Cars that attract thieves

These vehicles are more expensive than others primarily due to the overall cost of repairs. For example, while electric vehicles may save you money on fuel, the cost of the battery can range from $4,000 to $20,000. There are also certain vehicles that thieves commonly target. A recent article from MoneyGeek[1] listed the following as the top 10 most stolen vehicles in America:

- Chevrolet trucks

- Ford trucks

- Honda Civic

- Honda Accord

- Toyota Camry

- GMC trucks

- Nissan Altima

- Honda CR-V

- Jeep Cherokee and Grand Cherokee

- Toyota Corolla

5 Tips to Get Cheaper Car Insurance

Whether you want cheap insurance for your new vehicle or to lower the rate for your current vehicle, these five tips may help.

- Be a good driver. This sounds obvious, but it’s a must. When you’re a good driver, you save money on insurance. This means avoiding car accidents, DUIs, and other major violations.

- Consider the insurance cost when buying a new vehicle. A vehicle’s make and model alone can make car insurance more expensive. Remember this when you’re buying a new vehicle, because not only will you have monthly car payments when financing a car, but you’ll also have insurance premiums.

- Shop around. Like many other expenses and purchases, it’s a good idea to get multiple quotes before settling on an insurance company.

- Look for discounts. Some insurance providers offer discounts, so be sure to ask. You may also receive discounts for bundling your auto and home insurance through one provider.

- Improve your credit score. Your credit score may impact your car insurance rate, so make sure you watch for derogatory marks on your credit report that can lower your score.

FAQ

Here, we go over some of the most common questions people have about car insurance rates.

What Type of Car is the Least Expensive to Insure?

Subaru holds the top two spots for the cheapest cars to insure: the Subaru Outback and the Subaru Crosstrek.

Why Are Some Cars Cheaper to Insure?

Some cars are cheaper to insure because they’re cheaper to repair, have better safety features, and are a low-risk for insurance providers based on their data.

Is Insurance Cheaper for Older Cars?

Insurance for older cars is not necessarily cheaper than newer cars. If an older vehicle is more expensive to repair or has poor safety features, it may have higher rates. on the other hand, older vehicles that meet current safety standards and are inexpensive to repair may have lower rates than some newer vehicles.

What’s the Most Expensive Car to Insure?

Out of the top 25 most popular vehicles in the United States, the Tesla Model Y is the most expensive car to insure, and the Tesla Model 3 is the second most expensive.

How Your Credit Score Affects Your Car Insurance Rate

Many people don’t realize that not only does your credit score affect the cost of your vehicle, but it can also affect your insurance rates. If you have derogatory marks on your credit report from late payments, missed payments, or collections, you may face higher insurance premiums.

Before you shop for auto insurance, it’s helpful to know your credit score. You can receive a free credit report card at Credit.com, and our ExtraCredit® subscription offers even more credit management tools.

Methodology

Data was sourced from Quadrant Information Services and provided to NerdWallet[1] and Bankrate[2] . Both studies analyze data from ZIP codes throughout all 50 states and Washington, D.C., and are weighted based on geographic region and population.

NerdWallet’s research used data from Kelley Blue Book for the top 25 best-selling models, along with rates from different ZIP codes in the United States. NerdWallet based its data on both male and female drivers 35 years old with good credit and clean driving records using the following coverage limits:

- $100,000 bodily injury liability coverage per person

- $300,000 bodily injury liability coverage per crash

- $100,000 property damage liability coverage per crash

- $100,000 uninsured motorist bodily injury coverage per person

- $300,000 uninsured motorist bodily injury coverage per crash

- Collision coverage with $1,000 deductible

- Comprehensive coverage with $1,000 deductible

The Bankrate study analyzed rates for a 40-year-old female and male who have clean driving records and good credit. Rates are for full coverage and are based on the following limits for a 2021 Toyota Camry that drives five days per week and roughly 12,000 miles per year:

- $100,000 bodily injury liability per person

- $300,000 bodily injury liability per accident

- $50,000 property damage liability per accident

- $100,000 uninsured motorist bodily injury per person

- $300,000 uninsured motorist bodily injury per accident

- $500 collision deductible

- $500 comprehensive deductible

You Might Also Like

March 11, 2021

Personal Finance

March 1, 2021

Personal Finance

February 18, 2021

Personal Finance