Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

The credit approval process varies based on the type of credit you seek. Credit cards can take several days, loans can range from days to weeks, and mortgages can take weeks to a month.

Lenders consider multiple factors when you apply for loans and credit cards, including your credit score and current finances. While the algorithms that determine your creditworthiness may be complex, the credit approval process itself is fairly straightforward.

We’ll clarify the credit approval process and share several helpful tools like personal loan and mortgage calculators. Credit.com also has credit card suggestions for bad credit and no-credit applicants that may offer higher approval rates.

Key Takeaways:

- Credit approval lengths vary based on the type of credit you apply for.

- The law requires Issuers to explain why they didn’t approve you.

- Checking your credit report before applying can help you prepare.

Table of Contents:

- What Is the Credit Approval Process?

- How Do I Apply for a Credit Card?

- How Do I Apply for a Loan?

- How Do I Apply for a Mortgage?

- What Are the 5 C’s of Credit Approval?

- Full Credit Approval vs. Prequalification

- Manage and Build Your Credit With Credit.com

What Is the Credit Approval Process?

Once you fill out an application, a lender will pull a version of your credit report and credit score. They’ll use this credit profile and other factors, like your income or debt-to-income ratio (DTI), to determine if you meet their underwriting standards.

Underwriting standards are a lender’s benchmarks for deciding who can qualify for their loans and the terms they’ll receive. A lender will offer a loan contract if you get approved, or they’ll send an “adverse action” notice if you don’t.

Thanks to the Fair Credit Reporting Act‘s risk-based pricing rules, lenders must provide a copy of the credit report and credit score used in the decision-making process when they deny someone a loan or offer less favorable terms on the financing.

How Can I Tell if I’ll Be Rejected?

Many lenders disclose general parameters regarding their underwriting standards on their websites and you can also call them directly to ask about what credit profile is needed to apply for a particular product.

Checking your credit report before applying can also help you get a better sense of your approval odds. Credit.com provides a free credit report card that highlights five factors such as your age of credit and your credit mix. You’ll also receive suggestions of where to work to improve your credit and credit approval odds.

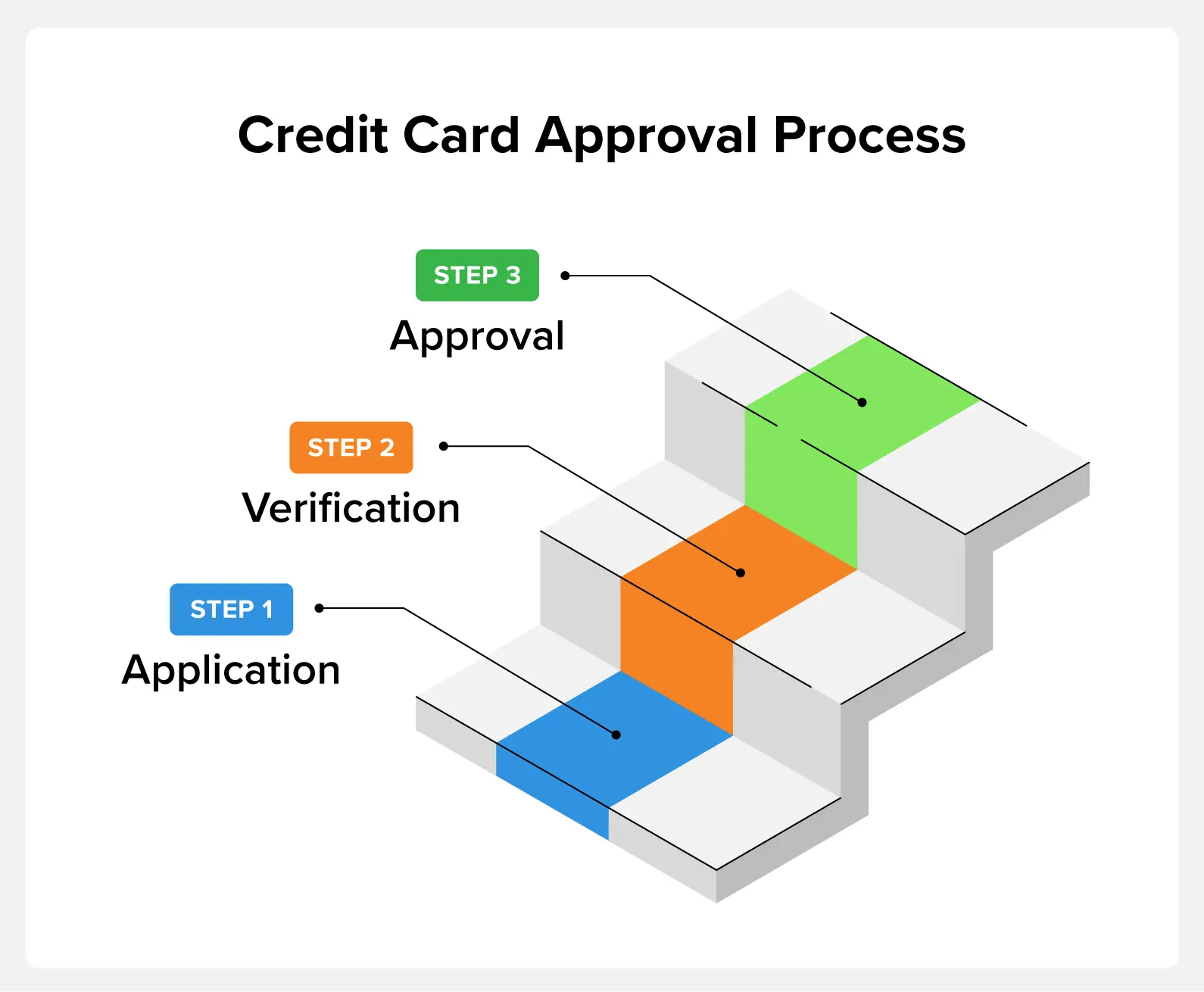

How Do I Apply for a Credit Card?

The fastest way to get approved for a credit card is to apply online. Many issuers offer instant approval to online applications that can give you an answer within minutes. You can also apply by mail or phone for most commercial institutions.

When you apply for a credit card, an issuer will pull your credit—which acts as a hard inquiry that briefly impacts your credit. Issuers will also ask you for additional information, like your income, to determine whether to approve you for credit and a certain credit limit.

Once approved, you’ll likely receive a physical credit card within 10 business days. Issuers might also let you add a card to your digital wallet shortly after you’ve been approved. If you are turned down for a credit card, issuers must send you a letter explaining their decision.

How Do I Apply for a Loan?

Applying for a car loan or personal loan is also an easy process, with many lenders offering online applications. You can find out if you are likely to be approved before you apply by asking about the minimum credit standards required for the loan.

Some lenders list credit qualifications, such as minimum credit scores, right on their websites. How quickly you are approved for a loan depends on the lender, but you may receive an answer within 24 hours or even within the hour. If a lender turns you down for a loan, they will send you a letter explaining why you did not qualify.

How Do I Apply for a Mortgage?

Applying for a mortgage involves more paperwork—and time—than credit card or loan applications. However, getting preapproved for a mortgage can speed up the homebuying process.

After you complete the preapproval process, you may have to supply some additional supporting documents. Once all the necessary documents are submitted and reviewed, you will receive one of four possible decisions on your home loan—approved, approved with conditions, denied, or suspended.

If your loan application is suspended, more documentation is required. If your loan application is approved with conditions, there are specific criteria you must meet before you will receive the full approval of your loan. And if your mortgage application is denied, you will receive a notice in writing explaining why.

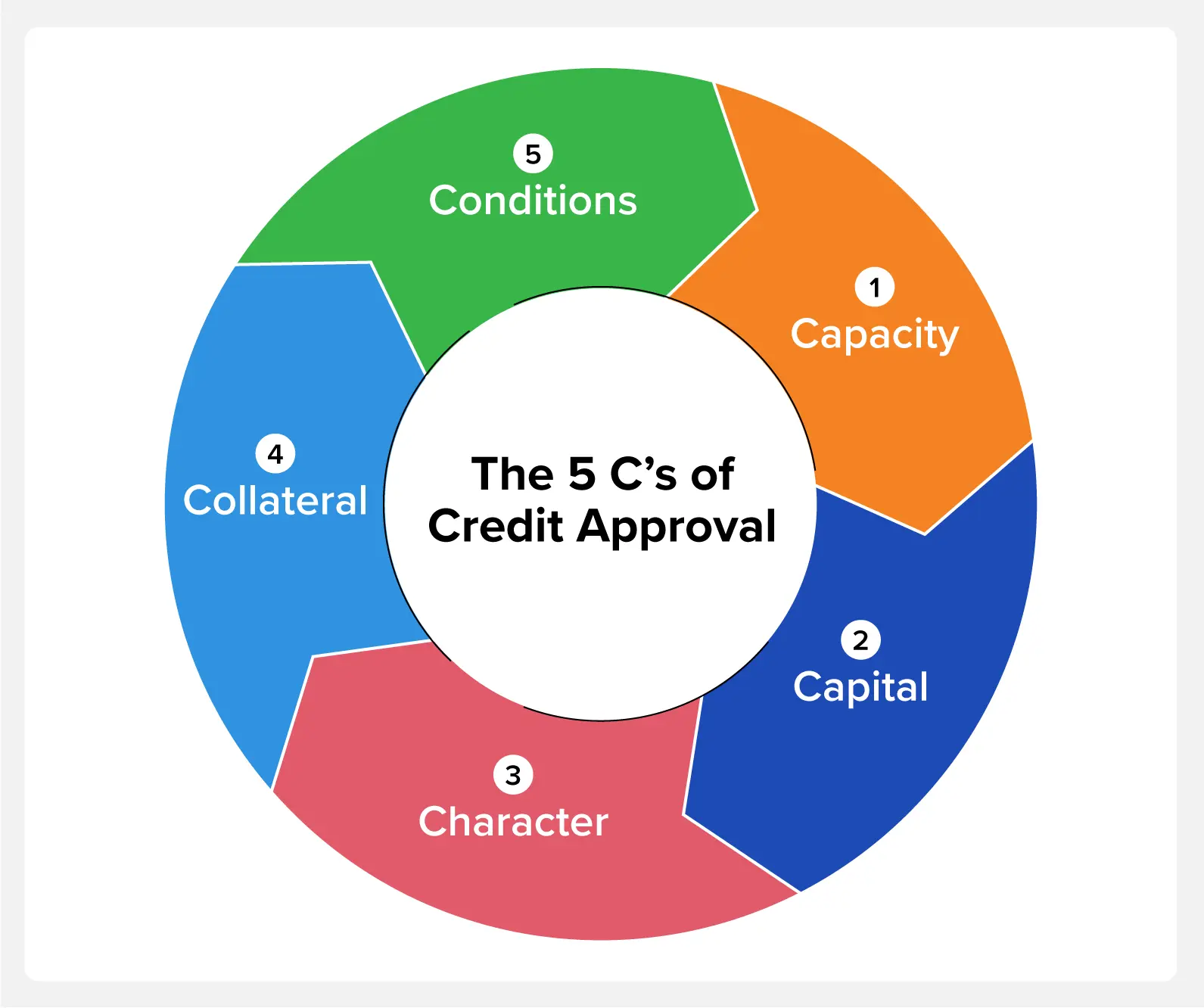

What Are the 5 C’s of Credit Approval?

The 5 C’s of credit approval are a group of factors issuers use to appraise applicants. They serve as catchall considerations for factors, such as income and credit history.

Here’s a brief explanation of each of the 5 C’s.

- Capacity: This gauges if an applicant has the financial capacity to handle a loan based on their cash flow.

- Capital: This is the amount of money and assets that a borrower has overall.

- Character: This measures an applicant’s creditworthiness, credit history, and personality to an extent.

- Conditions: This refers to the conditions of the economy at the time an application is submitted.

- Collateral: These are the assets an applicant can offer to help secure a loan.

How Can I Improve My Credit Approval Odds?

The 5 C’s of credit can all increase your credit approval odds. Here are a few examples of this idea in action.

- Showing proof of employment can display your capacity to handle new credit.

- If you have the capital to do so, making a large down payment can drastically boost your credit approval odds.

- Consistently making timely payments can demonstrate strong character when applying for credit.

- Spacing out your applications across six months could result in better conditions for credit approval.

- Offering collateral such as real estate, cash, or rare items can increase your approval odds and lower your interest rate.

Full Credit Approval vs. Prequalification

Full credit approval paints a clear picture of the terms and conditions that an applicant will receive with a loan. Lenders usually offer full approval after thoroughly reviewing an applicant’s employment history, income, and credit.

Prequalification, however, occurs when lenders make offers based on a cursory look at an applicant’s information. It’s worth noting that prequalified offers aren’t always exact—you may receive a prequalification letter in your mailbox for a 5% APR credit card, but that number could change when you apply.

Manage and Build Your Credit With Credit.com

Credit plays a significant role in qualifying you for attractive loans, mortgage rates, and new credit cards. Credit.com can help you learn where your credit currently stands and offer tips on what areas of your credit you need to work on to help you steadily improve your scores.

You Might Also Like

June 4, 2024

Building Credit

April 30, 2024

Building Credit

April 30, 2024

Building Credit