Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

This monthly budget template is a tool that you can use to plan your finances for the month and see if you’re underspending or overspending based on your planned expenses and income.

The key to financial stability is the ability to maintain a proper budget every month. We recently conducted a survey and found that 27% of Americans believe they don’t need a budget.

If you’re like many Americans with bad spending and saving habits, it’s helpful to understand how a monthly budget planner can be a useful tool. Improving your budgeting skills can help you pay down debt, improve your credit score, and increase your savings.

Here, you can download our free monthly budget template that works with both Microsoft Excel and Google Sheets. It allows you to completely customize your spending, income, and bills. Along with the template, we’ll walk you through how to use it to maximize your budget planning and improve your financial future.

Creating a Budget that Works for You

Before you fill out our simple monthly budget planner, we’ll discuss the basics of creating a budget. There are a variety of budgeting methods, and you can decide which one is best for your spending habits and financial goals.

One of the most popular ways to budget is the 50/20/30 budget rule. With this method, take your total income and break it into three categories:

- Necessities (50%): Housing, utilities, groceries, and other bills

- Savings and investing (20%): Savings, 401(k), and Roth-IRA

- Wants (30%): Fun and entertainment

For example, if you made $3,000 each month, you would want to make sure that you have at least $1,5000 set aside for your rent or mortgage payments and other bills. You would also set aside $600 for your savings or investment accounts. With the other $900, you can go shopping for clothes, go out with friends, buy video games, or spend your remaining money on whatever else you enjoy doing.

What if I’m Spending More than My Budget?

With the monthly budget template, you’ll see exactly where you’re overspending and whether it’s in the wants or necessities category. Overspending in the wants category is easier to adjust, and you may need to spend less on non-necessities. If you find that you’re extra spending is on necessities, you may need to make some lifestyle changes, like turning off the lights more to save on the electric bill.

What if I Have Money left over from My Budget?

At the end of the month, your planner may show you that you have extra money left over, which is a sign that you’re doing well. With this extra money, you can adjust your budget and put it into savings or use it for fun and entertainment.

How to Use the Monthly Budget Template

First, you’ll need to download the monthly budget template and save it to your computer. From here, you can open it with Google Sheets or Microsoft Excel. Even if you’re a budgeting beginner, don’t worry because this is very easy to use.

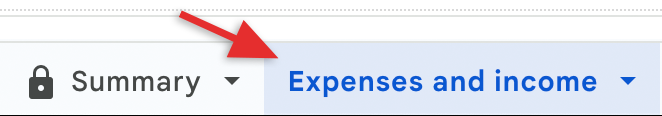

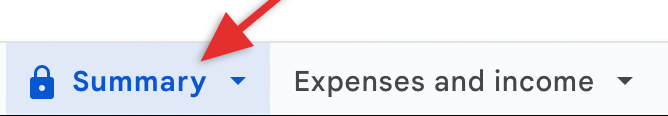

The template has two sheets. The first one is a summary and the second one is for your expenses and income. We’ll start with the ‘Summary’ tab.

Step 1:

Enter the “starting balance” into cell L8. Your starting balance is any money left over from the previous month.

Step 2:

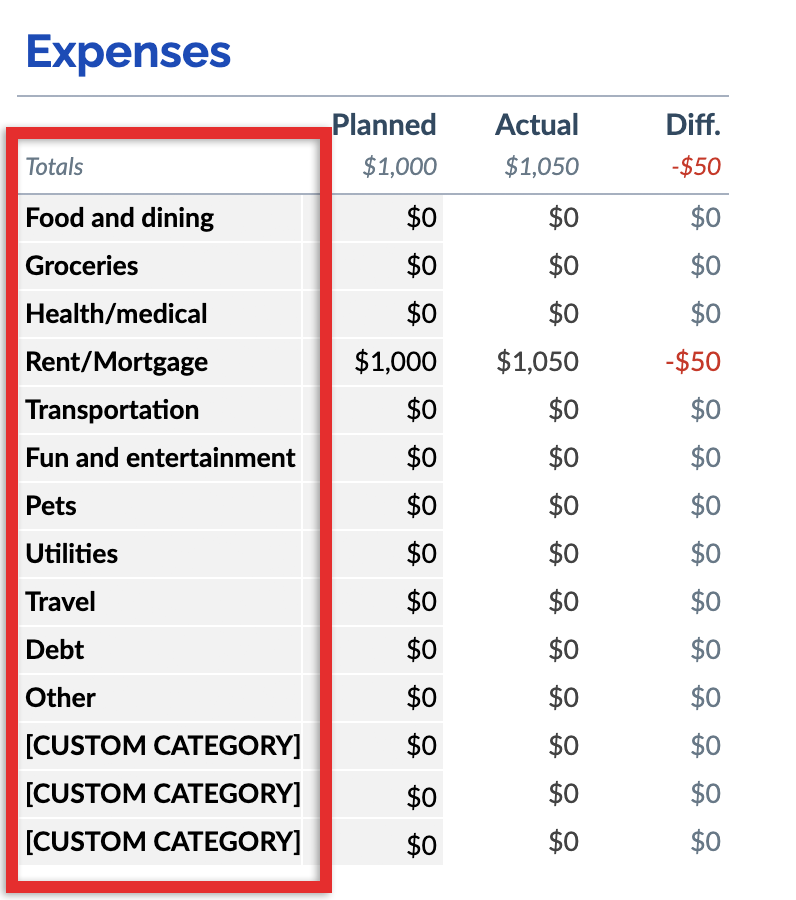

Begin filling out your expense categories. This budget planner is completely customizable, so begin filling out the categories that match your spending each month. In the template, you’ll notice that we filled out the categories with some common expenses people have each month.

To change the categories, click the cell that you would like to change and type in the new category. If you don’t need all of the categories, you can leave them blank.

Step 3:

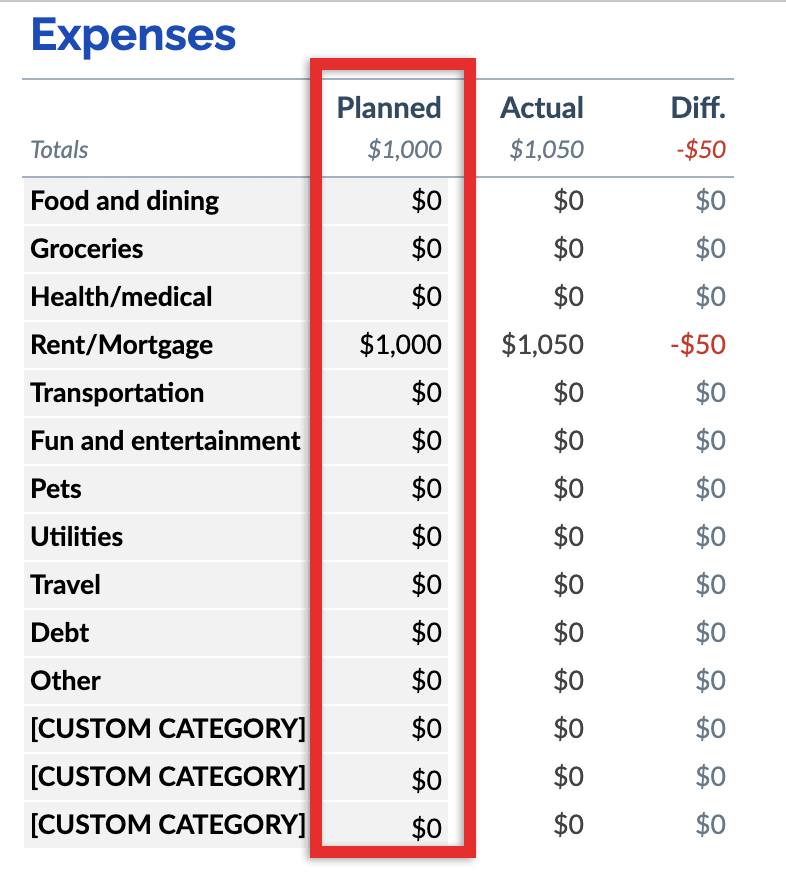

Next, you’ll fill out the “Planned” column for each of the categories. At the beginning of each month, you should have a good idea of what you think you’ll spend on each category, like groceries, bills, paying off debt and rent.

For example, if your rent is $1,000, you’ll fill in cell D31 with “$1,000.”

You can fill these categories out by clicking on the cell and typing in the amount. You can leave the “Actual” and “Diff.” cells alone for now. We’ll come back to those later.

Step 4:

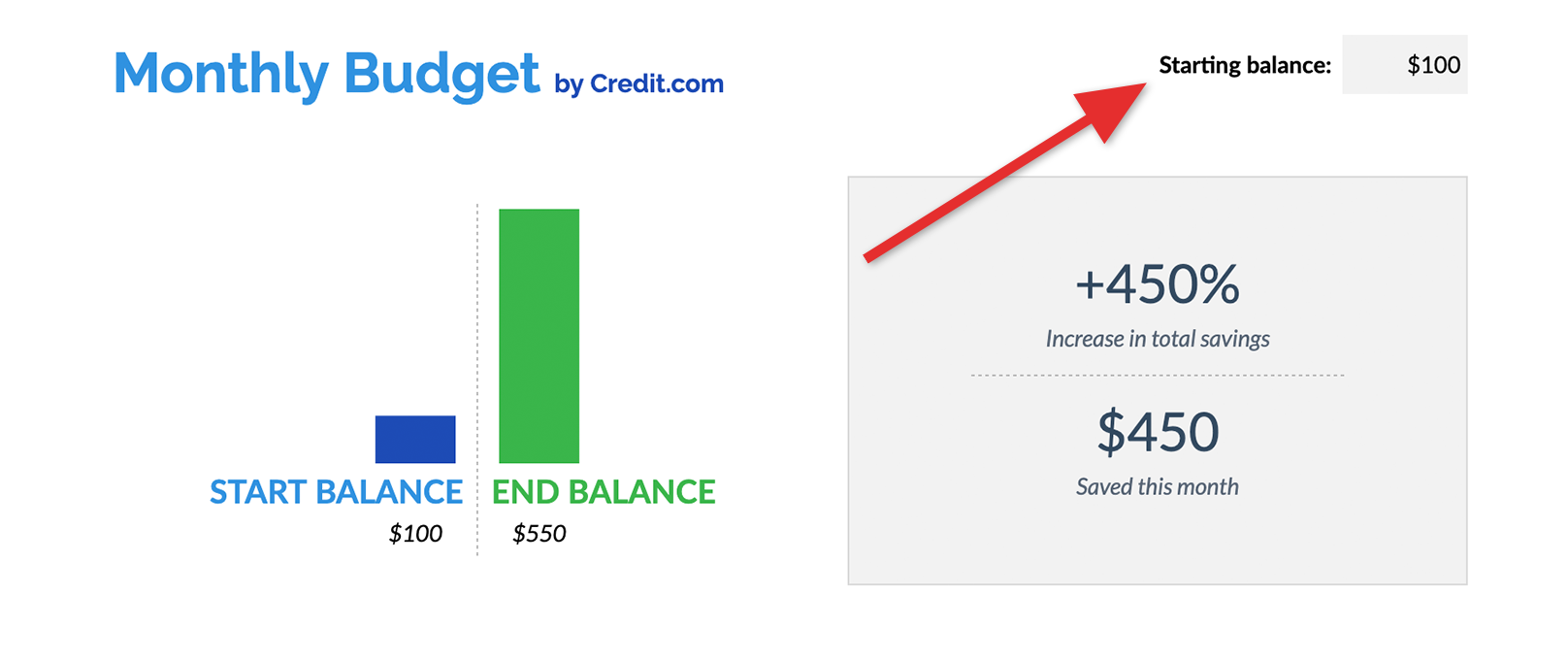

Now, you’ll fill out the Income section. This section is for all of the money you’ll receive throughout the month. Similar to the “Expenses” section, just fill out the cells in the “Planned” column.

If you have a salary position, it will be a little easier to fill out the section. If your position is hourly or commission based, you can put in a rough estimate of what you believe you’ll take home.

We have provided some common categories, but these cells are customizable as well. So, if you have extra sources of income like a side hustle or freelance work, you can add them here.

If you’re saving for a trip, a large expense or one of your children’s college funds, you can create a custom category for that as well.

Step 5:

You’re now done with the “Summary” tab, so now you can click on the “Expenses and income” tab.

Step 6:

On the “Summary” tab, you may remember the column that said “Actual” next to the “Planned” columns, and that’s what you’ll fill in now on the expenses and income tab. We’ll start with the “Expenses” section.

Here, you’re going to keep a detailed account of all of your spending throughout the month. Regardless of what you’re spending on, no matter how small, it’s helpful to make sure you enter everything in the budget planner to have an accurate view of your spending.

First, add the date of when you spent the money. If you click on the cell, it will automatically show a calendar with that day’s date. Should you forget to input an expense, you can select a previous date.

Next, input the dollar amount.

In the “Description” column, you can type in any details you’d like. Keep it simple or put something more specific so you recognize the expense when you come back to it.

For example, it may be difficult to remember your exact spending if you write “night out” for fun and entertainment. That expense would be easier to remember if you wrote, “Amusement park with friends.”

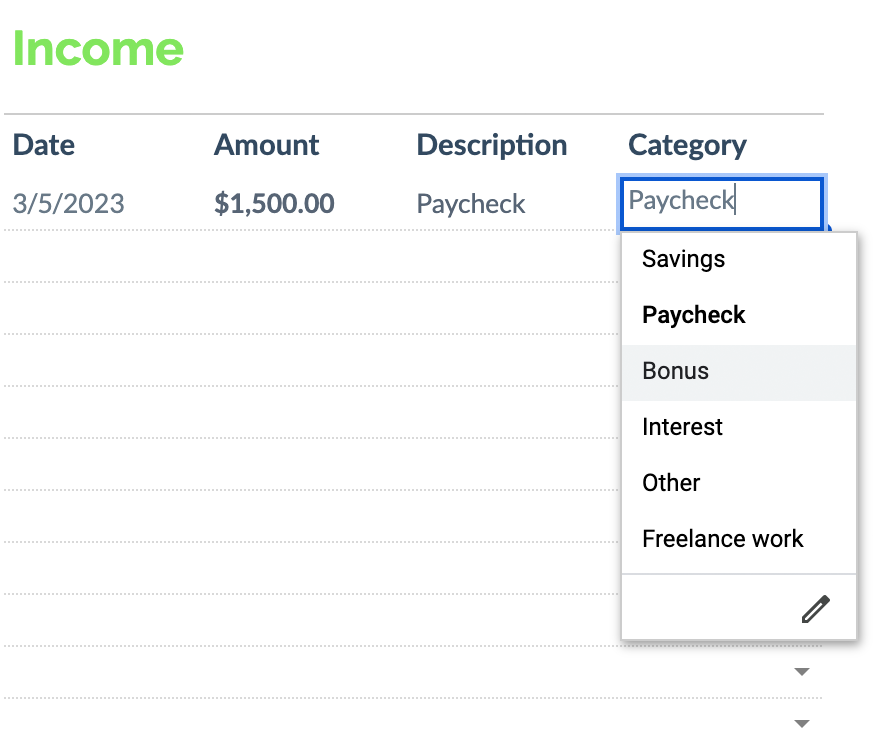

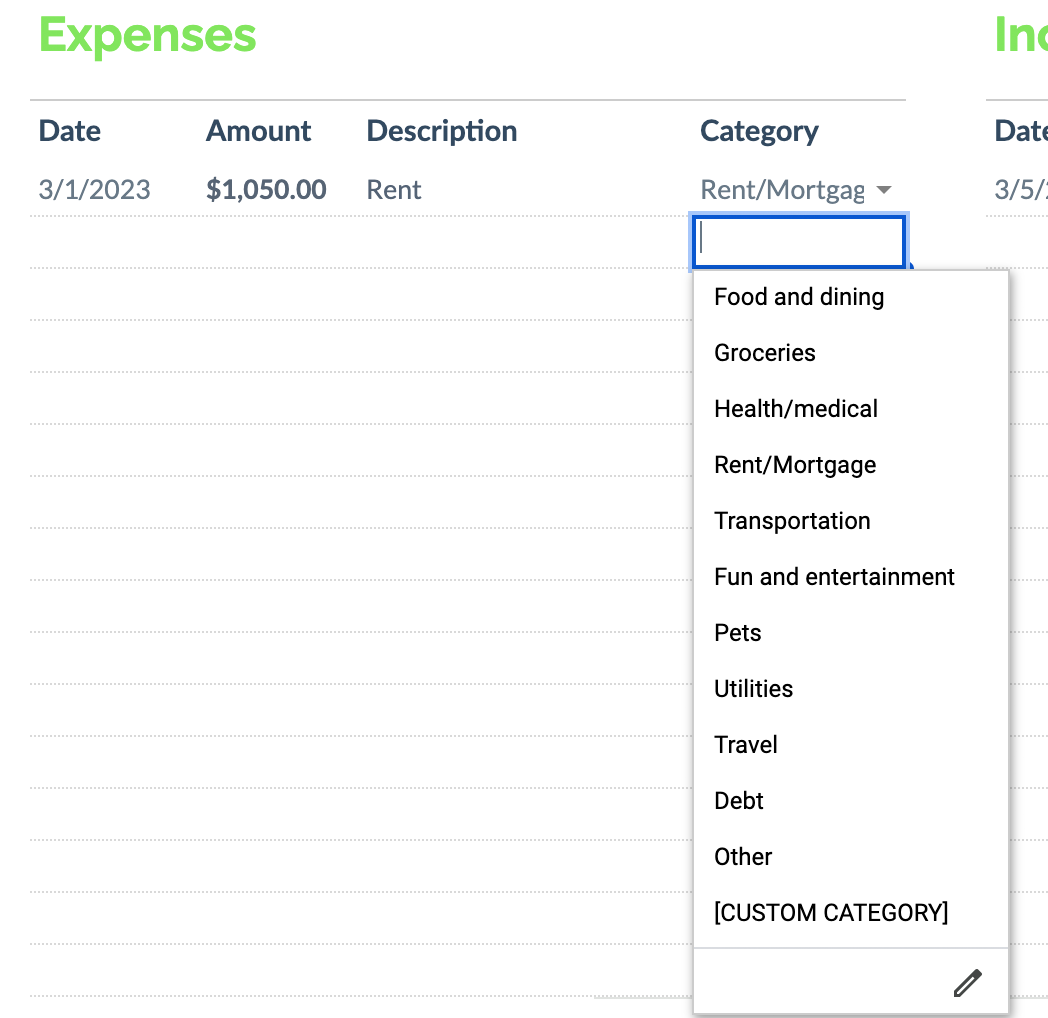

After that, you’ll choose the category. This is a drop-down menu, so when you click on it, it will show all of the categories from the “Summary” tab. The drop-down will include any custom categories you added as well.

Step 7:

For this step, you’ll repeat step six, but you’ll add all of the money that’s coming in. This includes your regular paychecks, your side hustles, company bonuses, and other sources of income.

And that’s all there is to it! If you would like to see an example of what this budget template looks like filled out, download the example template.

Now, we’ll go over how to assess your budget template at the end of the month.

Assessing Your Budget at the End of the Month

At the end of each month, you should find some time to sit down and take a look at the “Summary” tab. As you put in all of your information throughout the month, the “Summary” tab was calculating everything for you to review.

This will help you see where you’re overspending and underspending, and some of the information may surprise you. Overall, this is to help you with long-term planning and see where you need to make adjustments.

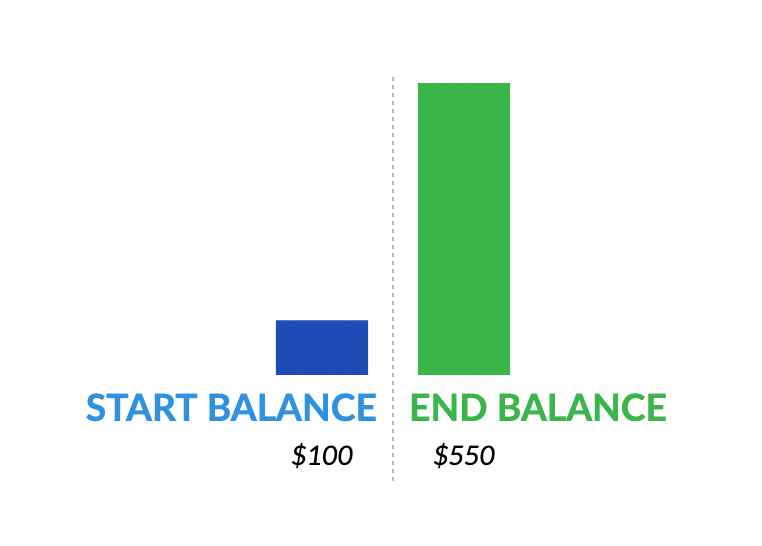

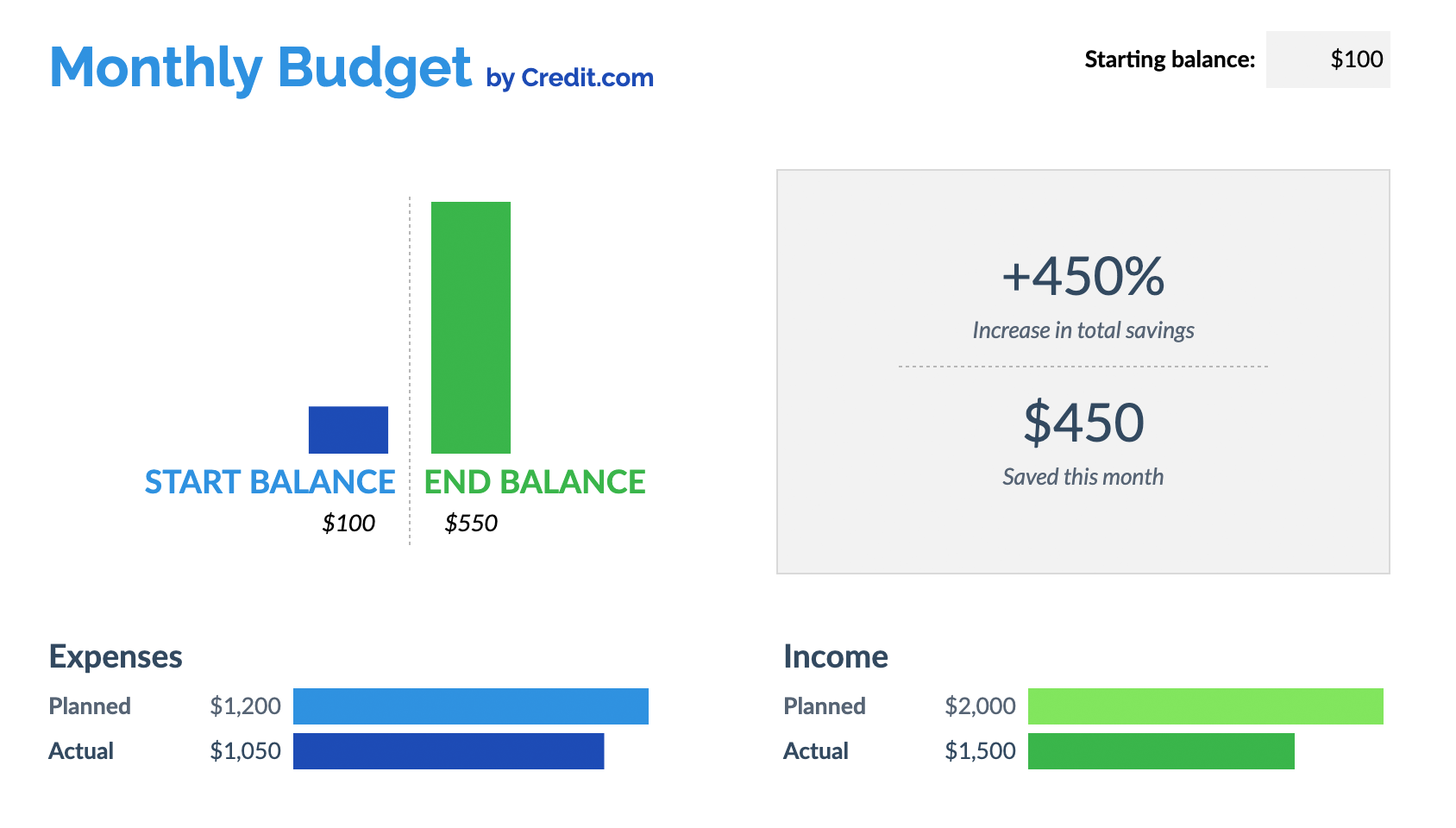

The Starting Balance and Ending Balance

The starting balance and the ending balance are the most satisfying parts of looking at your end-of-month summary. This data shows you how much you’re saving on a month-to-month basis.

Ideally, the right bar will be higher than the bar on the left. This means that you saved more this month than you did during the previous month.

Alternatively, if the dollar amount is in the negative, it means that you overspent, and the bar won’t be visible.

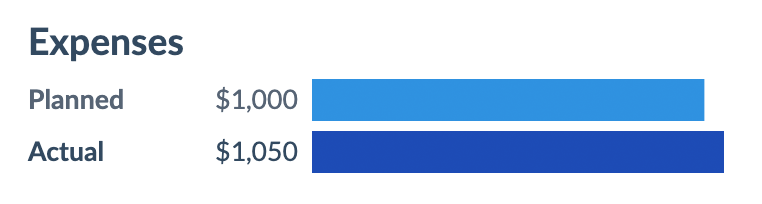

Planned Spending vs. Actual Spending

At the beginning of the month, you filled out all of your planned expenses. In the “Expenses and Income” tab, you filled out your actual expenses. This bar chart is comparing what you planned to spend versus what you actually spent that month.

If the planned amount is less than the actual amount, it means that you spent more than you were planning to during the month. To see exactly where you overspent, you can look below at the “Expenses” section, and in any category where you spent more than you planned, you’ll see a negative amount in the “Diff.” or “Difference” column.

For example, if you planned on spending $200 on groceries but spent $300, you’ll see -$100.

If you were keeping detailed track of your spending on the “Expenses and Income” sheet, you can go through the month and get an idea of when and where you spent your money. From here, you can begin planning for the next month.

Now, you may see that the number in the “Diff.” column is a positive number, and this means that you budgeted well and spent less than you planned.

Planned Income vs. Actual Income

Your income is a combination of your regular paychecks, savings and additional sources of income. If the “Planned” amount is equal to the “Actual” amount, you’re doing well. If the “Actual” amount is higher than the “Planned” amount, you’re doing even better. That means you made more money or put more in savings than you originally planned.

You may look at the bars and find that the “Actual” amount is lower. If this is the case, you may need to pick up extra hours at work or see if you can find additional side work.

Savings

Ideally, you’ll notice that each month, you’re saving more and more money now that you’re tracking your income and expenses. This section will show you exactly how much you saved compared to the previous month.

The top row shows your savings as a percentage, and the bottom shows the dollar amount.

How to Create a New Monthly Budget Template

Your first month of budget tracking is complete, and after assessing your spending, you’ll want to create a new spreadsheet for the new month.

Google Sheets

To create a copy, click on “File” on the top bar and then select “Make a copy.” By default, it will name the file “Copy of [file name].” To keep things organized, you may want to name the file with the month and year.

For example, you could name it “March 2023 Monthly budget template.”

Microsoft Excel

When creating a copy for Microsoft Excel, you’ll need to navigate to the folder where you saved the file. Next, you can simply select the file, copy it, and then paste it into the same folder. You can do this by right-clicking on the file or using keyboard shortcuts:

- Windows shortcuts: Ctrl+C to copy and Ctrl+V to paste

- Mac: Cmd+C to copy and Cmd+V to paste

To change the name of the file, you can right-click and select “Rename.”

FAQs

Now that you have your monthly budget template to plan your expenses and income, you may have some additional questions. Below, we answered some of the most common budgeting questions.

How Do You Write a Budget for the Month?

There’s no one-size-fits-all budget for everyone because it’s unique to you and your financial goals. Earlier, we mentioned the 50/20/30 budget rule, but we have some helpful resources on budgeting to get you started as well:

- The Best Budgeting Methods: A Complete Guide

- Budgeting for Beginners

- 12 Top Budget Categories You Need in Your Plan

- Budgeting and Saving Money

What Is the 75/15/10 Plan?

The 75/15/10 plan is a budgeting strategy geared toward saving and investing. For every dollar you make, 75 cents goes toward spending, 15 cents goes toward investing, and 10 goes toward savings.

What Is the 70/20/10 Money Rule?

The 70/20/10 money rule is for those looking to save more, pay off debt, and cut back on recreational spending. With this budget strategy, 70 percent of your income goes toward living expenses and 20 percent goes toward repaying debt or saving and investing. The remaining 10 percent is for fun and entertainment.

How a Budget Can Help Improve Your Credit Score

If you have a low credit score, it can lead to higher interest rates as well as bigger deposits if you’re looking to rent a home or turn on certain services. A lower credit score may be the result of too much debt, missing payments, or they may be due to an error. When you stick to a monthly budget, you can allocate money to repaying debt and ensuring you have enough to pay your credit card bill on time.

If you’re unsure what your credit score is or where your credit score stands, Credit.com will provide you with a free credit report card by clicking here.

You Might Also Like

April 17, 2023

Budgeting and Saving Money

April 3, 2023

Budgeting and Saving Money

March 8, 2023

Budgeting and Saving Money

![Average Electric Bill by State [2023]](https://www.credit.com/blog/wp-content/uploads/2024/10/average-electric-bill-hero.webp)