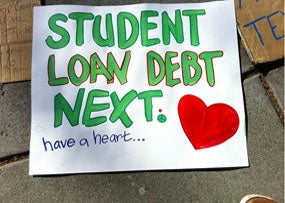

The amount of federal and private student loan debt held by Americans, which is expected to top $1 trillion this year, has now surpassed credit card debt. And given the persistently high unemployment rate, it should come as no surprise that more Americans are defaulting on their student loans.

The amount of federal and private student loan debt held by Americans, which is expected to top $1 trillion this year, has now surpassed credit card debt. And given the persistently high unemployment rate, it should come as no surprise that more Americans are defaulting on their student loans.

In September, the Department of Education released fiscal year 2009 student loan default rates, which had, “risen to 8.8 percent, up from 7.0 percent in FY 2008… default rates increased for all sectors: from 6.0 percent to 7.2 percent for public institutions, from 4.0 percent to 4.6 percent for private institutions, and from 11.6 percent to 15 percent at for-profit schools.”

[Related Story: How Millenials Can Take Control of their Finances and How Parents Can Help]

Making matters worse for those in debt, student loans are not dischargeable in bankruptcy proceedings (unless you can convince the judge that you are experiencing a particularly severe and ongoing hardship). This generally means that regardless of your situation (jobless, homeless, broke), the student loan debts are going to stay with you. The government can even garnish your wages if you are in default.

We spoke to Mark Kantrowitz about this issue and some options for people facing this difficult situation. Kantrowitz is publisher of the FinAid and Fastweb web sites and author of the Amazon.com bestseller Secrets to Winning a Scholarship. He has testified before Congress about student aid on several occasions and is on the editorial board of the Council on Law in Higher Education.

[Featured Tool: Worried about bad credit? Get your free Credit Report Card]

Credit.com: How much can the government take from someone’s wages?

Kantrowitz: The federal government has very strong powers to compel repayment of defaulted federal education loans, including garnishment of up to 15% of the borrower’s take home pay and interception of income tax refunds, both without needing a court order.

Credit.com: Is there any way to stop them from garnishing wages?

Kantrowitz: Borrowers do have a one-time opportunity to rehabilitate their loans by making 9 out of 10 consecutive full voluntary on-time monthly payments. Wage garnishment is involuntary, so that doesn’t count. But the payments are supposed to be reasonable and affordable, so there is some room for negotiation. Once the loan has been rehabilitated, the wage garnishment and refund offset orders are lifted, and the borrower can switch into income-based repayment to get an affordable monthly payment.

[Featured Product: Need help paying for school? Check out these student loan options.]

Credit.com: Is it possible to settle the debt in other ways?

Kantrowitz: Defaulted borrowers have the option of making a lump sum payment of what they owe. Sometimes this settlement can be for less than what they owe, such as waiving the collection charges or knocking off 10% of the total debt.

Image: a.mina, via Flickr.com

You Might Also Like

August 26, 2020

Student Loans

August 4, 2020

Student Loans

July 31, 2020

Student Loans