Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

Speaking with your current lender about refinancing options is a great first step if you currently have low credit.

Key Takeaways:

- Refi programs exist to specifically help low-credit applicants.

- A cosigner with a high credit score can help you successfully apply for refinancing.

- Mortgages with APR may be more costly in the long run.

When you refinance your mortgage, you’re basically replacing that mortgage with a different loan. Your lender will then use that new mortgage to pay off the old one first, so you’ll only have one monthly payment.

A refinance can have different interest rates and terms. A lower interest rate can result in less expensive monthly payments and reduce the overall cost of your loan. Conversely, shorter terms can help you pay down a new loan much faster via larger monthly payments.

It’s certainly possible to refinance with bad credit once you know your options. We’ll discuss several popular options and explain how Credit.com can help you find strong mortgage rates based on your current circumstances.

Can You Refinance With Bad Credit?

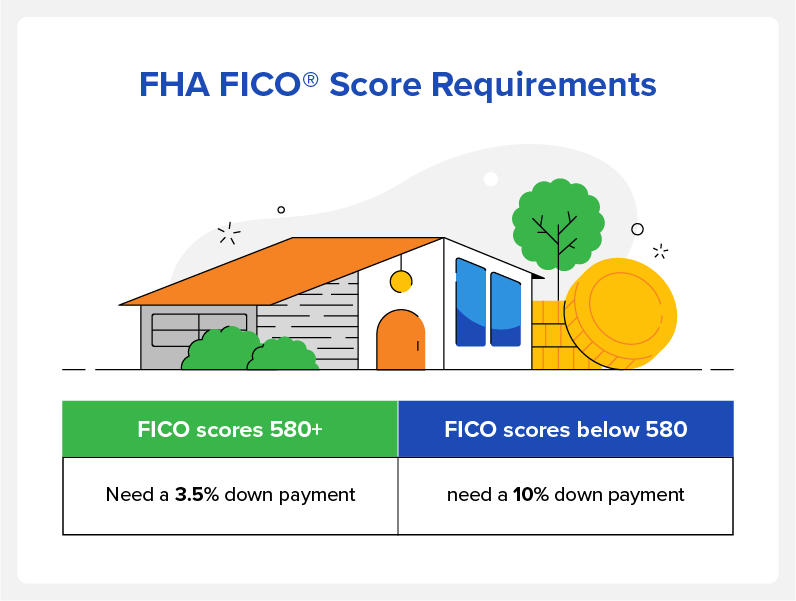

Your credit score plays a major role when you apply for a loan, but refinancing and is certainly possible. In fact, Federal Housing Administration (FHA) loans can help you secure financing with a credit score between 500 and 579 if you provide a 10% down payment.

Five Options for Refinancing With Bad Credit

It’s possible to secure new funding with low credit. Below are five of the most popular options for low-credit refinancing.

1. Talk to Your Current Lender

If you’re in good standing with your current mortgage lender, talk to them about refinance options. Being in good standing means you’ve regularly made on-time mortgage payments and haven’t had any issues with your lender.

Lenders make money on your mortgage. If you want to refinance to extend your mortgage payments—to reduce your monthly payments, for example—the lender could make more money off your loan in the future. Your current lender may want to keep your business and could be more likely to work with you.

2. Use a Cosigner

A cosigner is someone willing to help you take on the responsibility of making regular mortgage payments. Cosigners with good credit can help you secure funding you normally wouldn’t be eligible for.

Cosigners can be spouses, relatives, close friends, or business partners. If you’re attempting this approach, make sure you have a strong financial plan to show your cosigner that you’ll make timely payments. With a cosigner, your credit history is linked, so missing a payment can hurt both your credit scores.

3. Use an FHA Streamline, Simple, or Cash-Out Refinance Loan

FHA-backed mortgages are known to have less strict credit requirements, and the same applies to refinances. If you have bad credit and late payments on your credit report, you might consider FHA programs—especially if you already have an FHA loan.

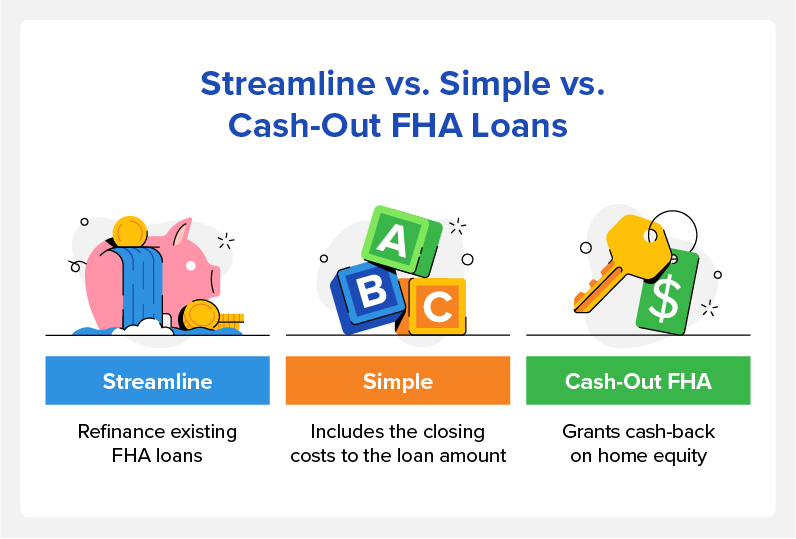

Streamline FHA Refinance

Streamline FHA refinance programs are for those with an FHA mortgage who want to refinance with an FHA loan. Your mortgage must be current, and you can’t get more than $500 cash out of this refinance. Appraisals aren’t a requirement for these loans.

There are two types of streamline loans:

- Credit qualifying: You provide the income and credit documentation you normally would when getting a mortgage. If you’re taking one of the borrowers off the mortgage during the refi, you must use this option.

- Noncredit qualifying: At least some credit review—and a review of past performance on your existing mortgage—is required. But it may not be as comprehensive as a credit-qualifying loan.

Simple Refinance

Simple refinance is another option that doesn’t allow cash out. This program is only relevant for refinances on primary residences or secondary residences with HUD approval. You also have to be up-to-date on mortgage payments.

Cash-Out Refinance

FHA cash-out refinance programs let you get some cash back during refinance if you have equity in your home. You’re limited to 85% to 95% of equity, depending on the status of your current mortgage.

To qualify, you must have had the property for at least 12 months and made the last 12 mortgage payments in the month they were due. Other credit and financial factors may also apply.

4. Apply for a VA Refi Program

The VA provides several refinance options for those who are eligible because they’re qualifying veterans, active-duty service members or eligible family members. As with FHA refinance options, you can find programs that support straight or cash-out refinance.

Interest Rate Reduction Refinance Loan

This is a refinance option that gets veterans a lower interest rate on their mortgage. Here’s who’s eligible:

- Veterans

- Active-duty service members

- Members of the National Guard or Reserves called to active duty

- Some surviving spouses

- Current Reserve and National Guard members (after six years of qualifying service)

Cash-Out Refinance

This VA refinance has the same eligibility requirements as the Interest Rate Reduction Refinance Loan. The loans typically come at market rates and include a VA funding fee.

5. Consider the USDA Streamlined Assist Refinance Program

The United States Department of Agriculture (USDA) offers a few refinance programs but notes that the Streamlined Assist refi is the most popular. It doesn’t require an appraisal unless a subsidy is involved. A full credit review is not required. However, the loan must have been paid on time for the previous 12 months and is only available for certain types of homes.

Improve Your Credit Before You Refinance

If you can’t find a refinance that works with your credit score—or you don’t find one that works for you—you might want to improve your credit before applying for a refi. Start by accessing 28 of your FICO® scores via ExtraCredit® to see where you stand.

You can improve your credit by:

- Making on-time payments. Payment history accounts for a large part of your credit score.

- Paying down revolving credit, such as credit cards. Credit utilization is another big part of your score.

- Dispute credit errors on your report with the credit bureaus to repair your score.

Find the Right Mortgage for You

No matter where you’re at, finding a mortgage is an exciting—and overwhelming—process. Whether you’re ready to start looking for a refinance now or want to wait until you’ve improved your credit, Credit.com can help you with your goals.

We offer tools that help you find competitive mortgage rates and provide a mortgage calculator for anticipating your financial needs.

You Might Also Like

December 13, 2023

Mortgages