An eighth of Americans buy gifts for more than one romantic partner.

This post originally appeared on Finder.com

Roses are red. Violets are blue. But when did Valentine’s Day become a celebration for more than two? In 2021, 32.9 million Americans — or 12.89% of the adult population — plan to buy a Valentine’s Day gift for more than one romantic partner, according to a recent survey from Finder.com. That’s a drop of more than half when compared to 2020’s 26.77% of adults who planned to buy a gift for more than one romantic partner last year.

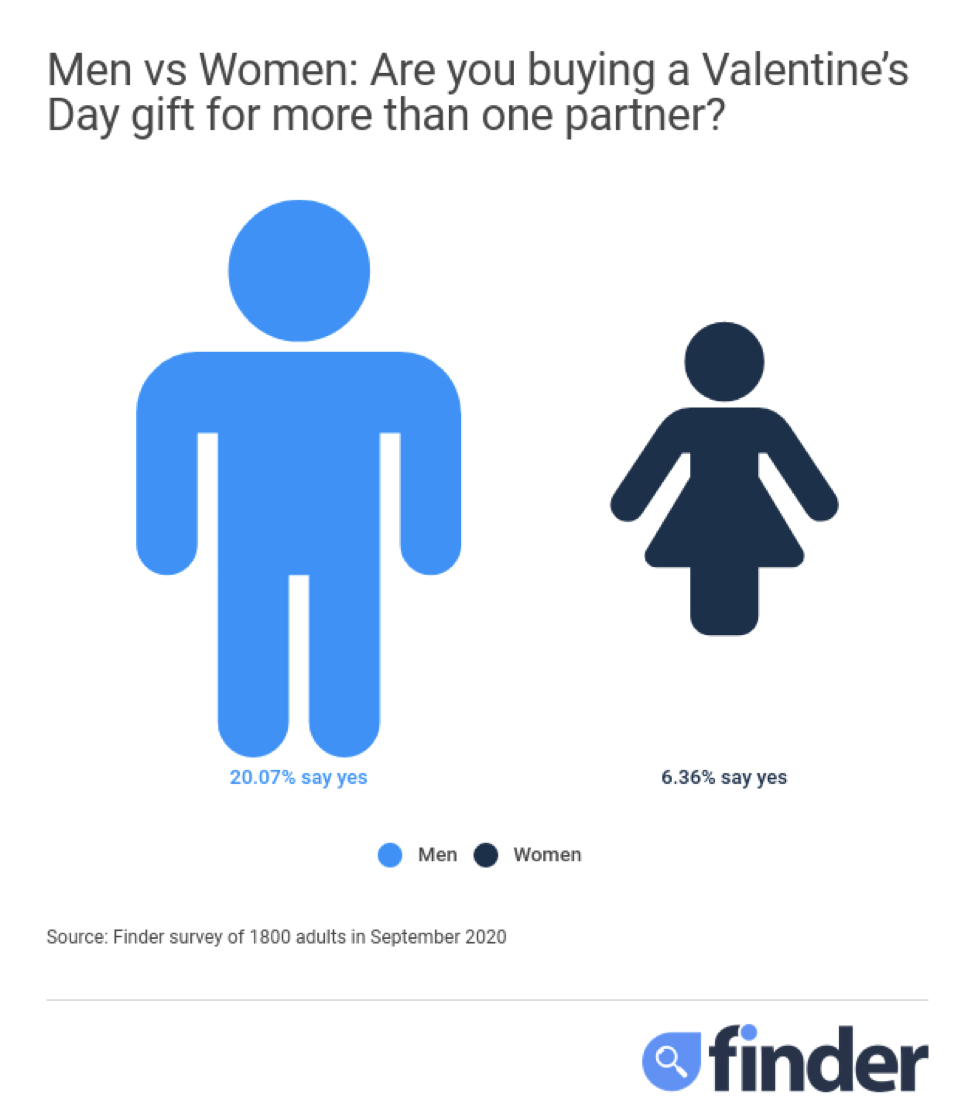

Men are more likely than women to shop for more than one partner, with 20.07% of men saying they will purchase a Valentine’s Day gift for more than one romantic partner, compared to only 6.36% of women.

Men vs Women: Are you buying a Valentine’s Day gift for more than one partner? – data

| Gender | Yes | No |

| Men | 20.07% | 79.93% |

| Women | 6.36% | 93.64% |

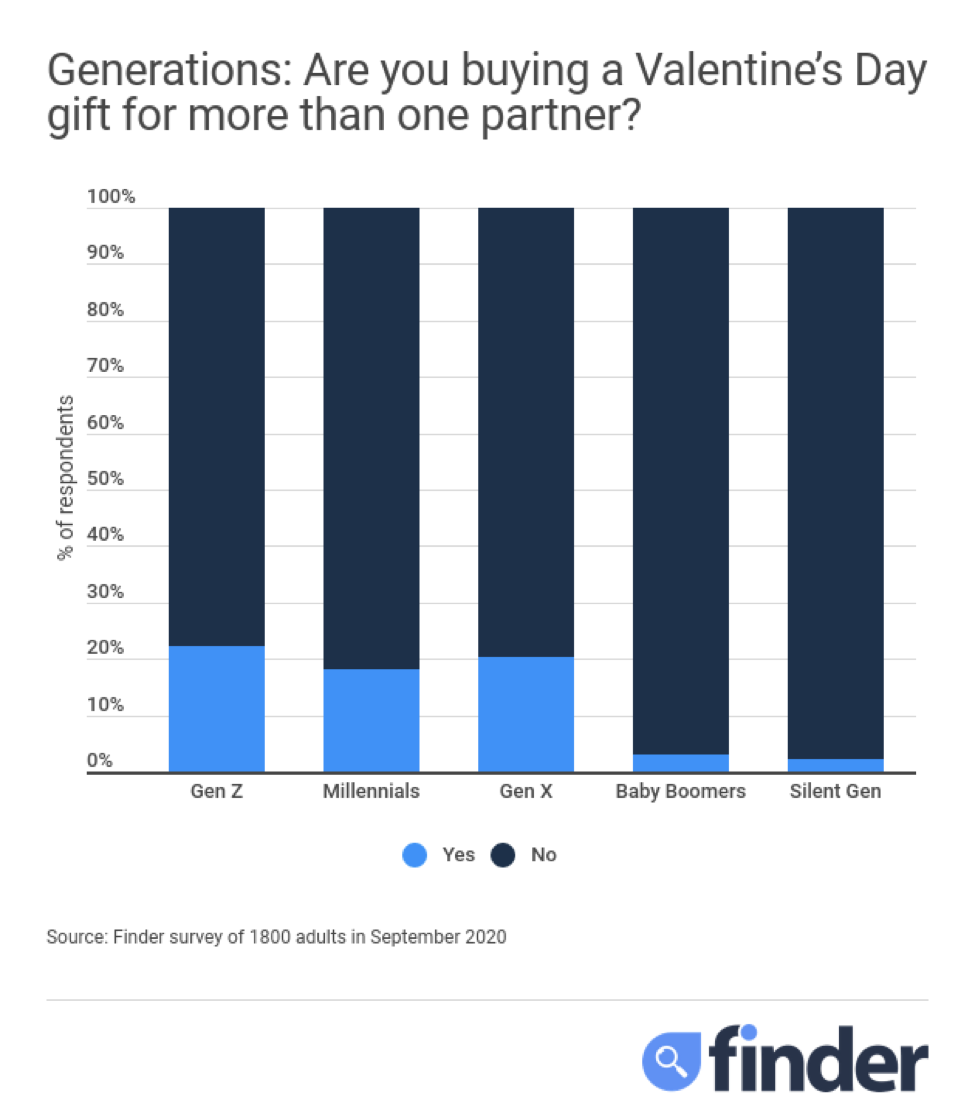

Gen Z leads the pack of those shopping for more than one romantic partner, with 22.16% of the generation — or 5.8 million Gen Zers — saying they would purchase a Valentine’s gift for more than one romantic partner.

Generations: Are you buying a Valentine’s Day gift for more than one partner? – data

| Generation | Yes | No |

| Gen Z | 22.16% | 77.84% |

| Millennials | 18.16% | 81.84% |

| Gen X | 20.38% | 79.62% |

| Baby Boomers | 2.91% | 97.09% |

| Silent Gen | 2.29% | 97.71% |

Where are people getting their gifts?

Those who plan to double dip on Valentine’s gift giving don’t make up the whole present-buying pie. In 2021, roughly 161.8 million people will buy gifts for their Valentine, 11.02% less people than last year, and where they’re shopping may surprise you.

Where are you buying Valentine’s Day gifts? – data

| Retailer | % of respondents that are buying Valentine’s Day gifts |

| Amazon | 36.55% |

| Brick-and-mortar store | 36.37% |

| Make it yourself/DIY | 16.48% |

| Other online retailer | 10.60% |

Undoubtedly influenced by the global pandemic, Amazon narrowly beats out brick-and-mortar stores as the top source for Valentine’s Day gifts, with 36.55% of people planning on buying a Valentine’s Day gift saying they will buy their gifts from Amazon compared to 36.37% who say they will buy from a brick-and-mortar store. An additional 10.60% of gifters say they will purchase presents from an online retailer other than Amazon, meaning nearly half of all Americans (47.15%) shopping for Valentine’s Day gifts will get their gifts online in 2021. More people also plan on DIY-ing their Valentine’s Day gifts than last year, with 16.48 of Valentine’s gifters choosing to create their own gift.

Who’s Buying Valentine’s Day Gifts?

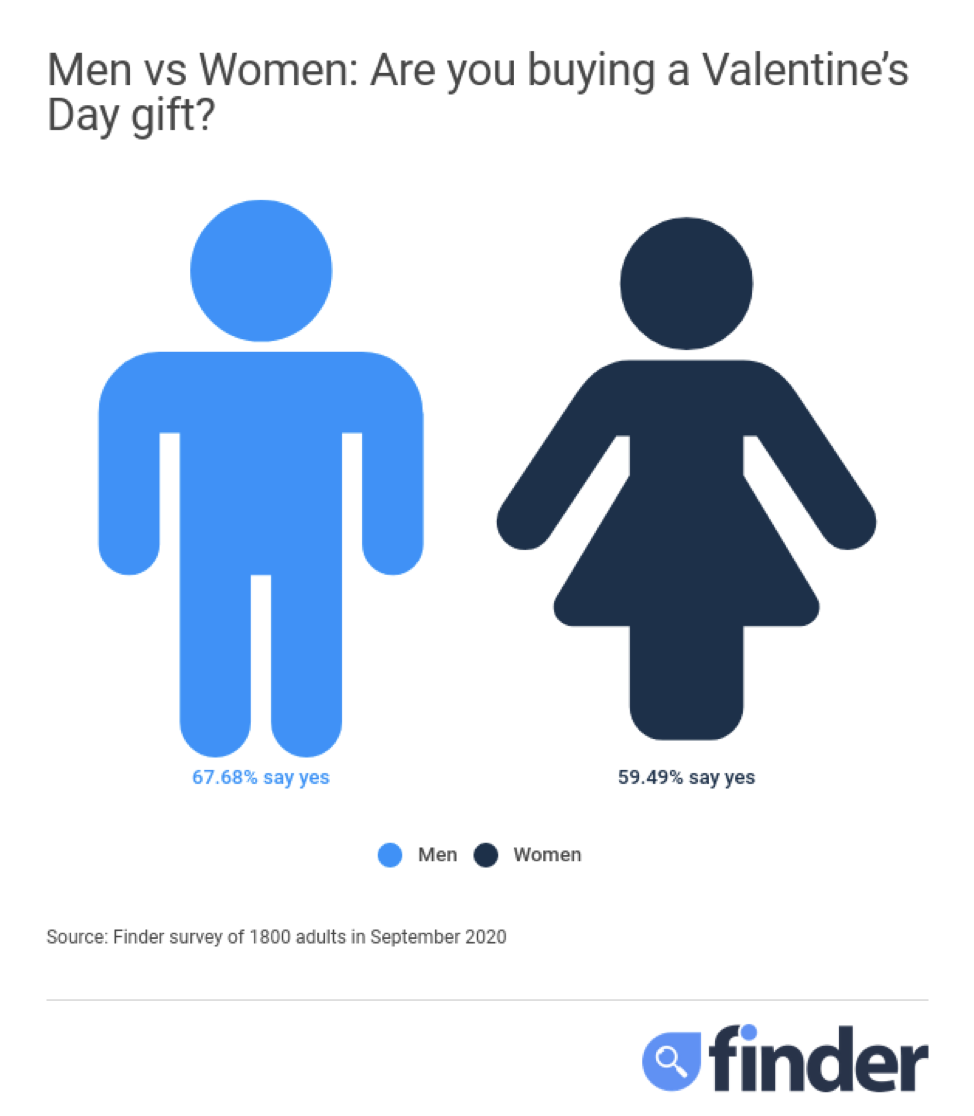

More men than women are planning on purchasing gifts for Valentine’s Day, with 82.2 million men saying they’ll buy Valentine’s gifts compared to 79.5 million women.

Men vs Women: Are you buying a Valentine’s Day gift? – data

| Gender | Purchasing gifts | Not purchasing gifts |

| Men | 67.68% | 32.32% |

| Women | 59.49% | 40.51% |

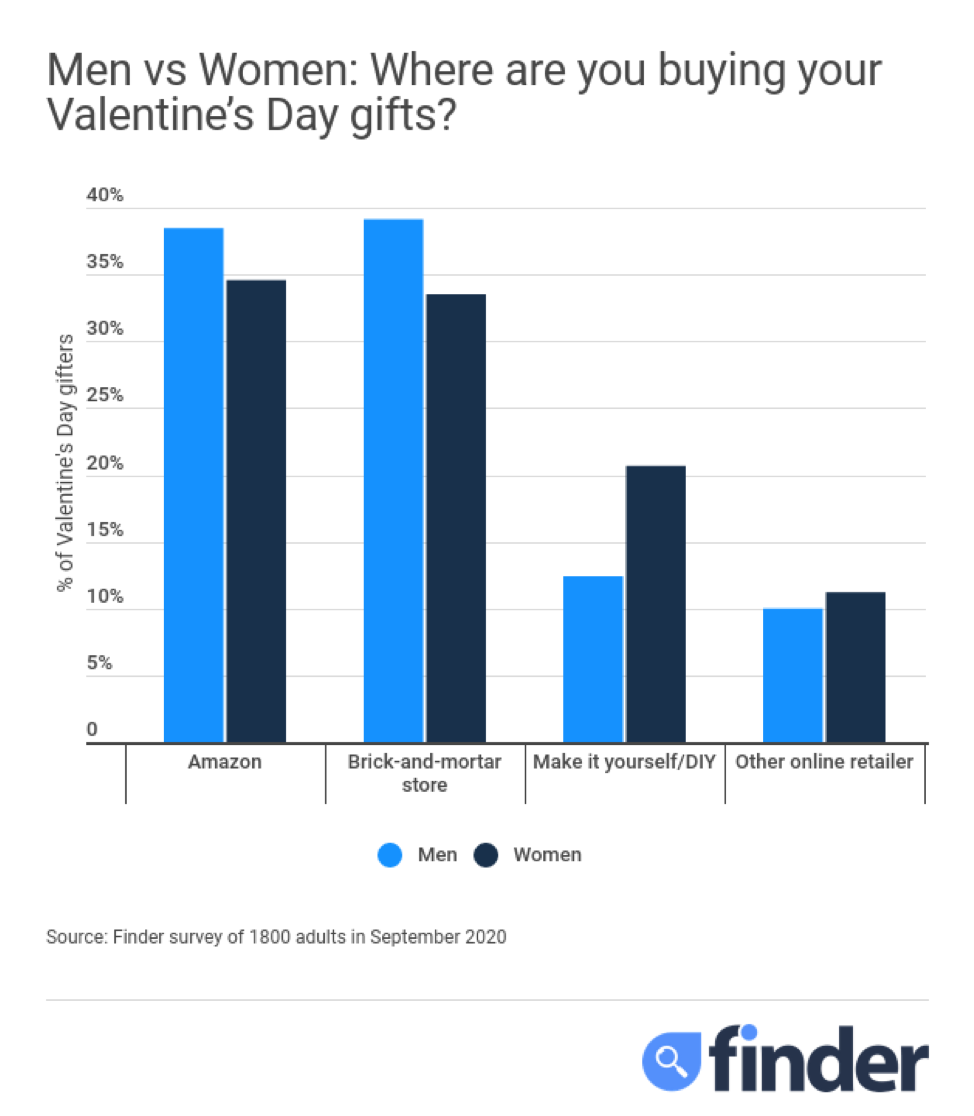

As to where people will get their gifts, men are more likely than women to pick up presents from a brick-and-mortar store or on Amazon, whereas far more women than men plan to make their own gifts.

Men vs Women: Where are you buying your Valentine’s Day gifts? – data

| Source of gifts | Men | Women |

| Amazon | 38.45% | 34.58% |

| Brick-and-mortar store | 39.14% | 33.51% |

| Make it yourself/DIY | 12.41% | 20.68% |

| Other online retailer | 10.00% | 11.23% |

Generational Valentine’s Day Buying Habits

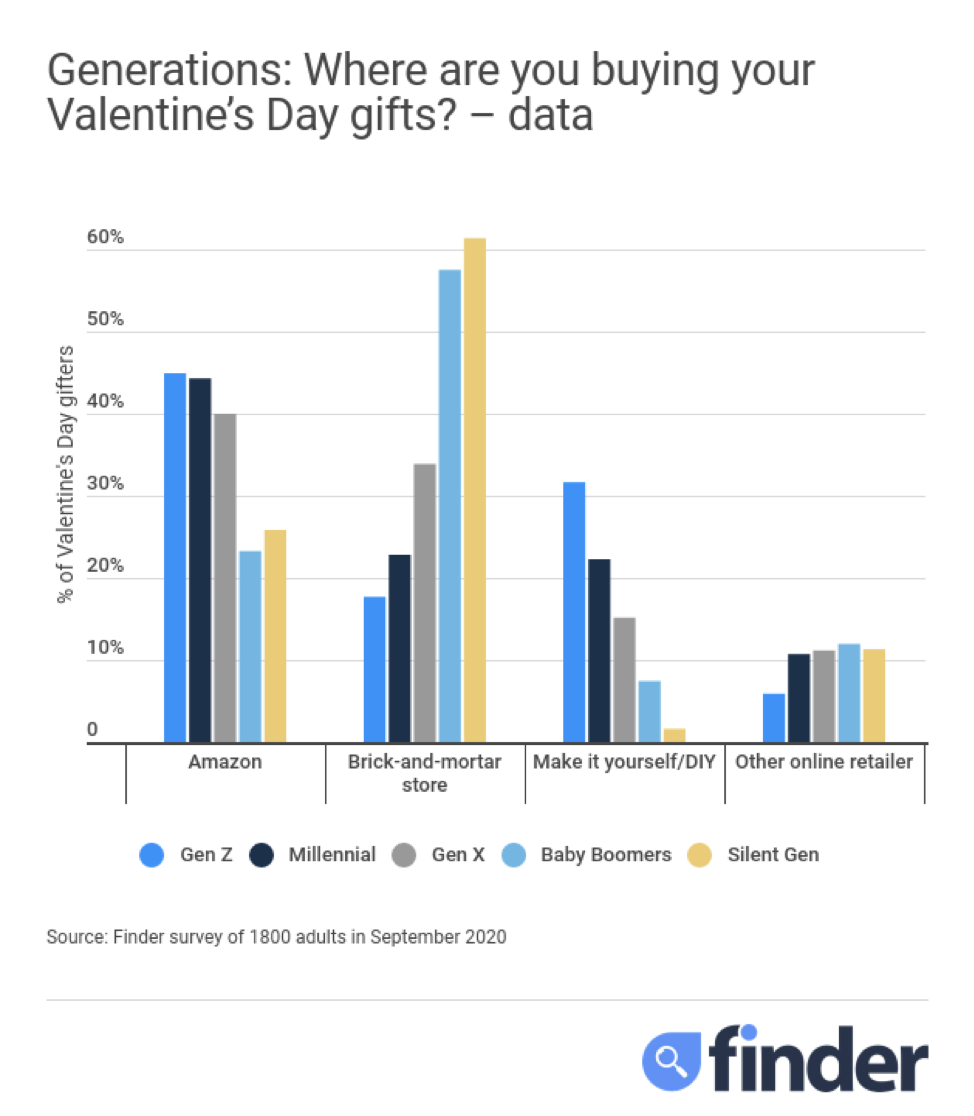

Gen Z and millennials are neck-to-neck for the most likely to shop on Amazon for St. Valentine’s, with 44.85% of Gen Zers and 44.23% of millennials who are planning on buying Valentine’s gifts looking to the retail giant for a Valentine’s Day gift this year. At the other end of the spectrum are boomers, among whom 57.42% of gifters plan to buy from a brick-and-mortar store and a further 43.64% say they won’t buy anything.

Generations: Where are you buying your Valentine’s Day gifts? – data

| Source of gifts | Gen Z | Millennial | Gen X | Baby Boomers | Silent Gen |

| Amazon | 44.85% | 44.23% | 39.93% | 23.23% | 25.81% |

| Brick-and-mortar store | 17.65% | 22.82% | 33.81% | 57.42% | 61.29% |

| Make it yourself/DIY | 31.62% | 22.25% | 15.11% | 7.42% | 1.61% |

| Other online retailer | 5.88% | 10.70% | 11.15% | 11.94% | 11.29% |

Spending Big on Valentine’s Day

With 161.8 million planning to buy a gift in 2021, it may not surprise you that February 14th is big business. Americans will spend roughly $27.9 billion on gifts this year, each gift averaging $187.

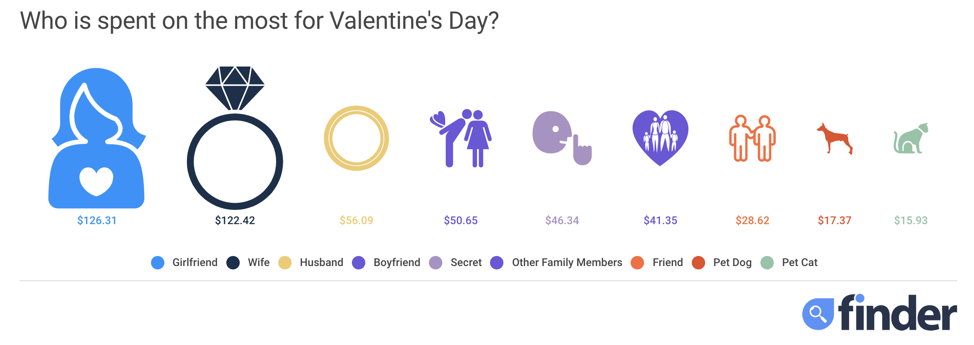

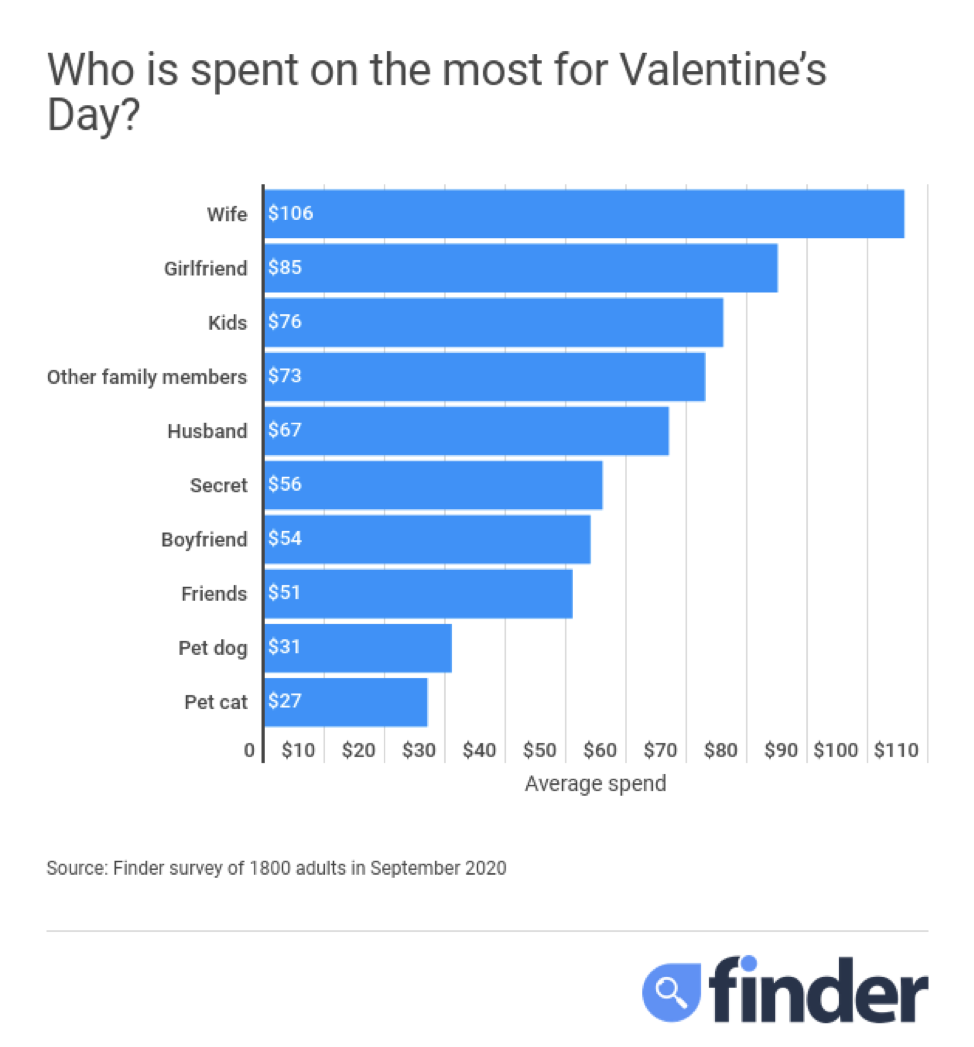

Where that money is spent and on whom varies widely. Girlfriends and wives luck out on Valentine’s, with people spending an average of $106 on gifts for their wives and $85 on gifts for their girlfriends. These values are almost double the average amount spent on husbands ($67) or boyfriends ($54).

Who is spent on the most for Valentine’s Day – data

| Categories | Average spend |

| Wife | $106 |

| Girlfriend | $85 |

| Kids | $76 |

| Other family members | $73 |

| Husband | $67 |

| Secret | $56 |

| Boyfriend | $54 |

| Friends | $51 |

| Pet dog | $31 |

| Pet cat | $27 |

In 2021, men are expected to spend $6.2 billion more on Valentine’s gifts than women, spending an expected $17.1 billion for men compared to $10.8 billion for women.

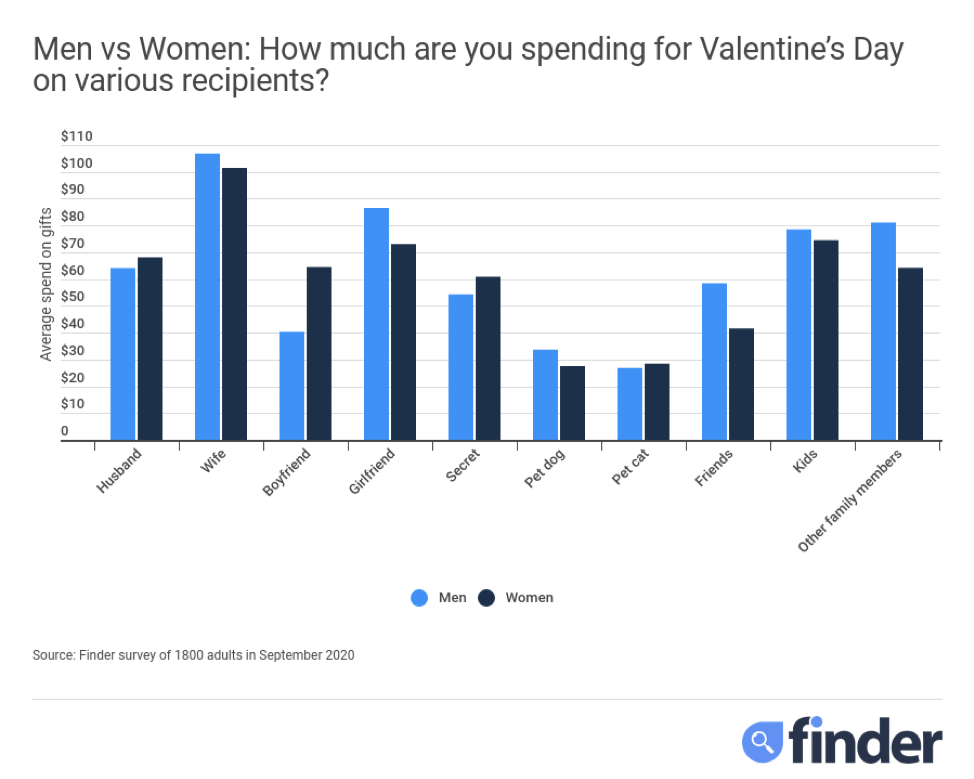

As far as the average gift, men will spend more than women. Of those who plan to spend on Valentine’s Day gifts, men say they’ll spend an average of $225.49 compared to $147.42 women plan to spend. Women are expected to outspend men in the recipient categories: Husband, Boyfriend, Secret and Pet cat.

Men vs Women: How much are you spending for Valentine’s Day on various recipients? – data

| Category | Men | Women |

| Husband | $64.07 | $68.10 |

| Wife | $106.85 | $101.51 |

| Boyfriend | $40.31 | $64.46 |

| Girlfriend | $86.50 | $73.12 |

| Secret | $54.25 | $60.89 |

| Pet dog | $33.62 | $27.54 |

| Pet cat | $26.80 | $28.36 |

| Friends | $58.40 | $41.54 |

| Kids | $78.56 | $74.54 |

| Other family members | $81.08 | $64.25 |

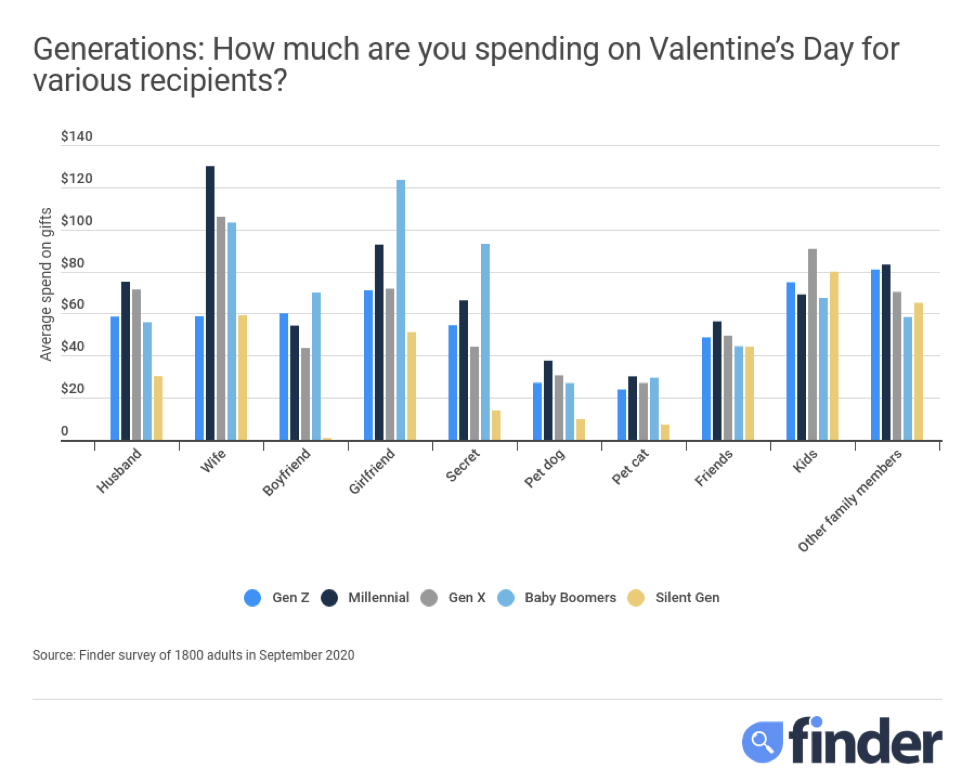

Millennials are expected to spend the most among the generations on Valentine’s Day gifts, dropping some $9.9 billion in 2021, representing almost 36% of all Valentine’s spending.

On a per-gift basis, Gen Z is expected to spend the most on average on other family members ($81), Gen X is expected to spend the most on their wives ($106), baby boomers are expected to spend the most on their girlfriends ($123) and the silent generation is expected to spend the most on average on their kids ($80).

Generations: How much are you spending on Valentine’s Day for various recipients? – data

| Categories | Gen Z | Millennial | Gen X | Baby Boomers | Silent Gen |

| Husband | $58.52 | $75.16 | $71.44 | $55.90 | $30.26 |

| Wife | $58.68 | $130.04 | $105.97 | $103.19 | $59.12 |

| Boyfriend | $60.09 | $54.26 | $43.68 | $70.01 | $0.96 |

| Girlfriend | $71.06 | $92.81 | $71.86 | $123.47 | $51.14 |

| Secret | $54.42 | $66.21 | $44.31 | $93.20 | $13.90 |

| Pet dog | $27.06 | $37.68 | $30.68 | $26.93 | $9.75 |

| Pet cat | $23.91 | $30.16 | $26.98 | $29.52 | $7.30 |

| Friends | $48.67 | $56.33 | $49.52 | $44.49 | $44.32 |

| Kids | $74.92 | $69.07 | $90.77 | $67.40 | $79.95 |

| Other family members | $80.94 | $83.19 | $70.27 | $58.28 | $65.06 |

What Are People Doing for Valentine’s Day?

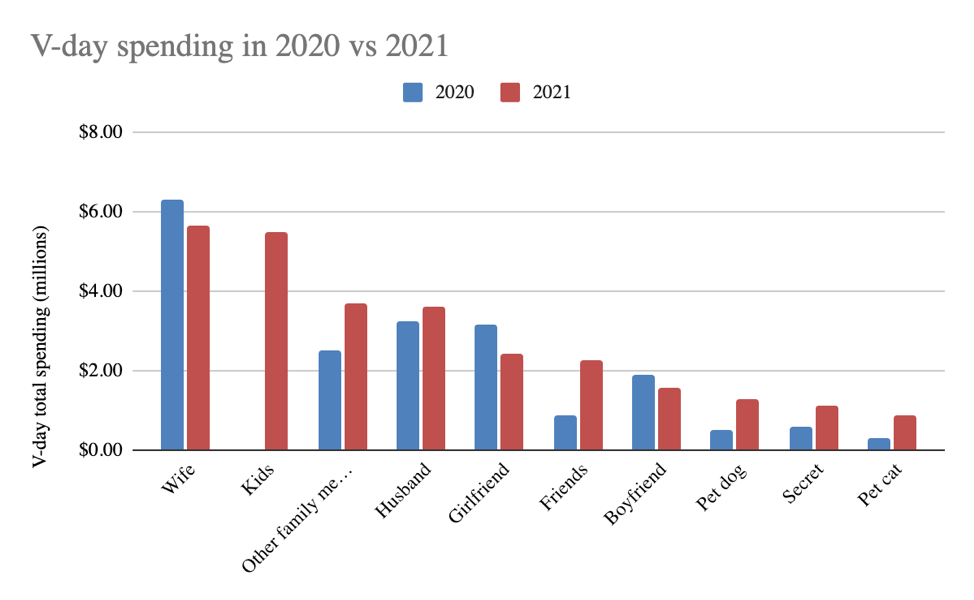

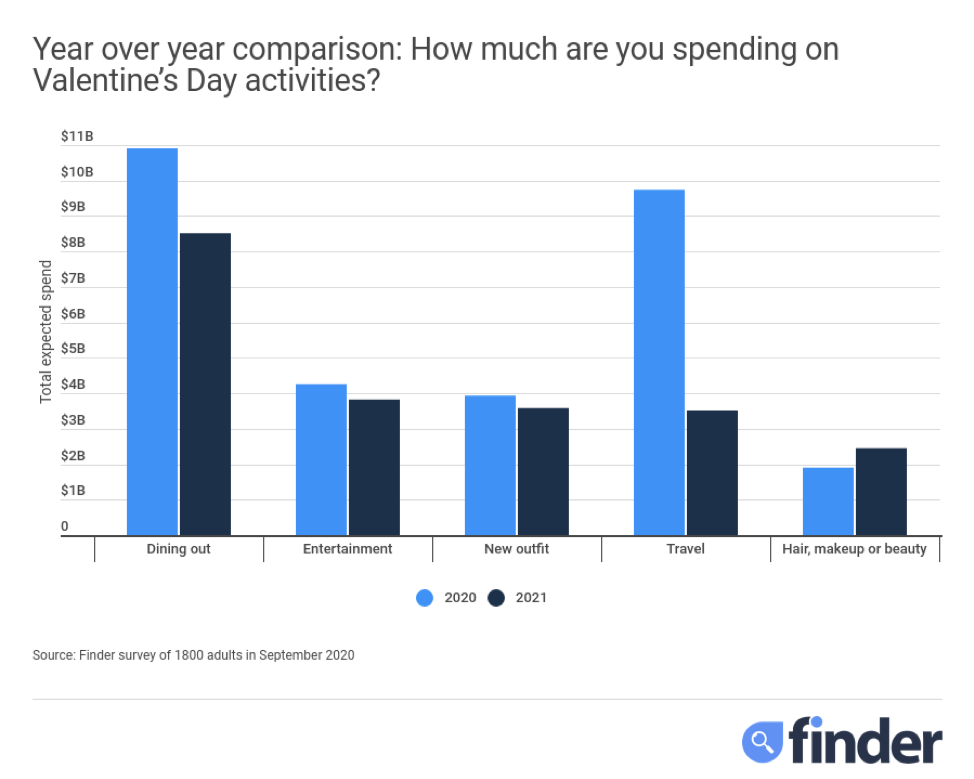

In a shift from last year, Americans are planning on spending less on V-Day activities and more on gifts this year. In 2021, Americans will spend $21.9 billion on Valentine’s Day activities, 29% less than last year.

Anticipated spending on Valentine’s Day activities dropped in all categories except for hair, makeup or beauty. Americans plan on spending $2.5 billion on hair, makeup or beauty activities for Valentine’s Day, 29% more than last year. Unsurprisingly, Travel saw the largest drop, with Americans planning to spend 64% less on V-Day travel than last year.

Year over year comparison: How much are you spending on Valentine’s Day activities? – data

| V-Day activity | Total spend in 2020 | Total spend in 2021 | % decrease |

| Dining out | $10.9 billion | $8.5 billion | -22% |

| Entertainment | $4.3 billion | $3.8 billion | -10% |

| New outfit | $3.9 billion | $3.6 billion | -9% |

| Travel | $9.7 billion | $3.5 billion | -64% |

| Hair, makeup or beauty | $1.9 billion | $2.5 billion | 29% |

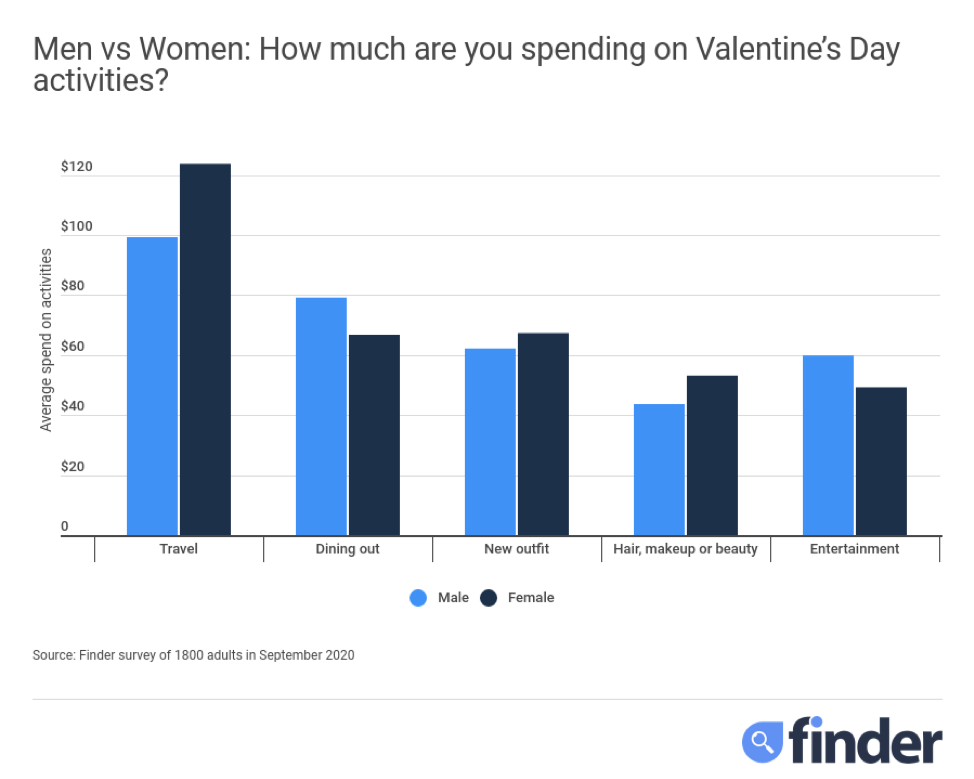

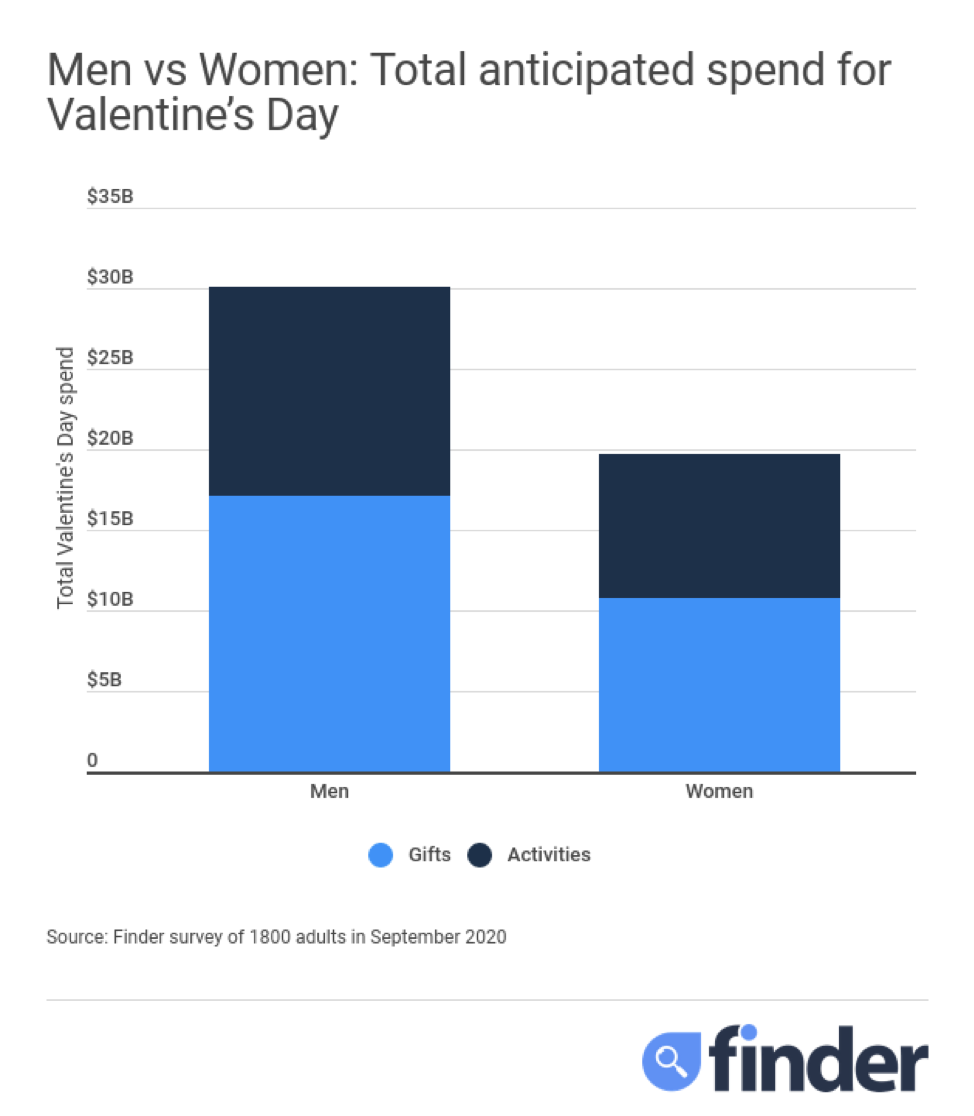

Women are expected to outspend men for travel, a new outfit, and for hair, makeup or beauty. Men are expected to outspend women for dining out and entertainment.

Men vs Women: How much are you spending on Valentine’s Day activities? – data

| Category | Men | Women |

| Travel | $99.27 | $123.73 |

| Dining out | $79.19 | $66.83 |

| New outfit | $62.17 | $67.33 |

| Hair, makeup or beauty | $43.66 | $53.20 |

| Entertainment | $59.89 | $49.28 |

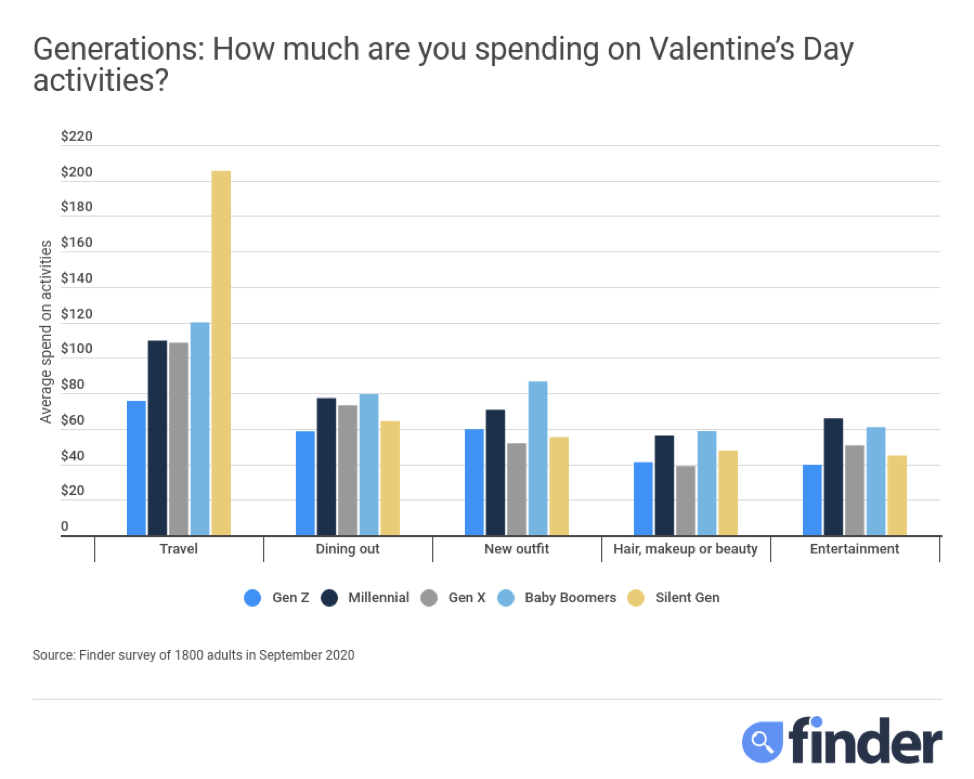

Travel is where big money is spent this Valentine’s Day, led by the silent gen in average amount splashed. The average silent gener expected to spend $206 in 2021, followed by baby boomers at an average of $120.

Generation: How much are you spending on Valentine’s Day activities? – data

| Categories | Gen Z | Millennial | Gen X | Baby Boomers | Silent Gen |

| Travel | $75.76 | $109.65 | $108.46 | $120.08 | $205.50 |

| Dining out | $58.59 | $77.33 | $73.20 | $79.46 | $64.28 |

| New outfit | $59.66 | $70.73 | $51.83 | $86.57 | $55.31 |

| Hair, makeup or beauty | $41.15 | $56.24 | $38.98 | $58.68 | $47.68 |

| Entertainment | $39.72 | $65.84 | $50.51 | $60.93 | $44.90 |

Valentine’s Day Spending to hit $50 billion in 2021

All told, Americans are planning to spend roughly $50 billion for Valentine’s Day in 2021, combining $27.9 billion on gifts and $21.9 billion on activities.

Men are expected to foot slightly more of the Valentine’s Day bill spending approximately $30.1 billion on the day, with women planning to spend $19.7 billion.

Men vs Women: Total anticipated spend for Valentine’s Day – data

| Type of spending | Men | Women |

| Gifts | $17.1 billion | $10.8 billion |

| Activities | $13 billion | $8.9 billion |

Among the generations, millennials will take the brunt of Valentine’s Day spending, expected to spend $18.4 billion.

Generation: Total anticipated spend for Valentine’s Day – data

| Type of spending | Gen Z | Millennial | Gen X | Baby Boomers | Silent Gen |

| Gifts | $3 billion | $9.9 billion | $8.8 billion | $5.3 billion | $0.8 billion |

| Activities | $2.6 billion | $8.5 billion | $6 billion | $3.9 billion | $0.9 billion |

| Total | $5.6 billion | $18.4 billion | $14.9 billion | $9.3 billion | $1.7 billion |

Methodology

Finder’s data is based on an online survey of 1,800 US adults born between 1928 and 2002 commissioned by Finder and conducted by Pureprofile in September 2020. Participants were paid volunteers.

We assume the participants in our survey represent the US population of 254.7 million Americans who are at least 18 years old according to the July 2019 US Census Bureau estimate. This assumption is made at the 95% confidence level with a 2.32% margin of error.

The survey asked respondents where they planned on buying Valentine’s Day gifts, how much they planned to spend on gifts, how much they planned to spend on activities, and whether they were planning on purchasing a Valentine’s Day gift for more than one romantic partner.

Average calculations of spending were based on only the participants who were planning on spending in that particular category — for example, to calculate mean spending on Valentine’s gifts for girlfriends, participants who selected “Not purchasing gifts for Valentines Day” and participants indicated that they were spending “0” on their girlfriends were not included.

We define generations by birth year according to the Pew Research Center’s generational guidelines:

- Gen Z — 1997-2002

- Millennials — 1981-1996

- Gen X — 1965-1980

- Baby boomers — 1946-1964

- Silent generation — 1928-1945

You Might Also Like

March 11, 2021

Personal Finance

March 1, 2021

Personal Finance

February 18, 2021

Personal Finance