Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

Yes, a 720 credit score falls into the “good” credit score range according to both FICO® and VantageScore® scoring models.

Table of Contents

- Is a 720 FICO Score Good?

- Is a 720 VantageScore Good?

- What Kind Of Loan Can I Get With a 720 Credit Score?

- How to Further Improve Your 720 Credit Score

Your credit score is a number, typically ranging from 300 to 850, that assesses your credit risk. A score of 720 is considered a good credit score, which means you’re likely able to qualify for loans and receive favorable terms.

Read on to learn exactly where a 720 score falls on each scoring model, the types of loans you may qualify for, and how to further improve your credit.

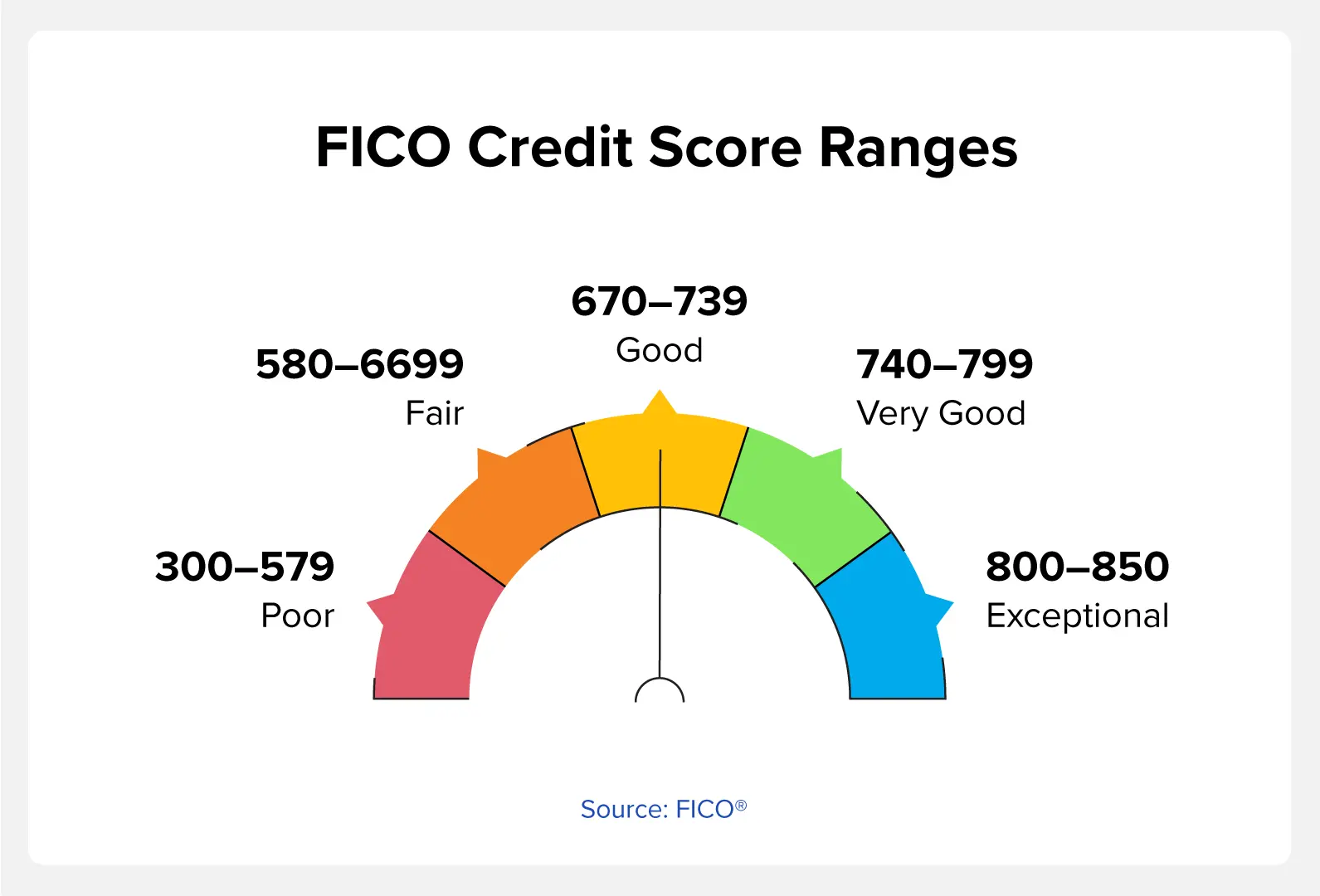

Is a 720 FICO Score Good?

Developed by the Fair Isaac Corporation (FICO) in 1989, the FICO score is the most widely used credit scoring model. According to FICO, a 720 score falls in the “good” credit score range, which means that most lenders will likely approve you if you have this score, assuming you meet other approval criteria. Plus, you’re likely to get approved for lower interest rates, which can save you money in the long run.

According to the latest credit score statistics, the average FICO score is 716, so a 720 is slightly above average. 67% of Americans have a score in this range or higher based on data from Experian®.

|

FICO Credit Score Ranges |

Americans With Credit Scores in This Range |

|

|

|

|---|---|---|---|---|

|

Poor (300 – 579) |

16% |

|||

|

Fair (580 – 669) |

17% |

|||

|

Good (670 – 739) |

21% |

|||

|

Very good (740 – 799) |

25% |

|||

|

Exceptional (800 – 850) |

21% |

You may be wondering how exactly FICO determines your score. FICO calculates your credit score based on five factors that each carry different weights:

- Payment history (35%): Your track record of paying past loans on time.

- Amounts owed (30%): The amount of credit you’re using.

- Length of credit history (15%): The age of your credit accounts.

- New credit (10%): The number of new credit accounts you’ve applied for.

- Credit mix (10%): The different types of loans you have.

Is a 720 VantageScore Good?

Created by the three credit bureaus in 2006, VantageScore is another popular credit scoring model. While VantageScore ranges differ slightly from FICO ranges, a 720 is also considered “good” according to the VantageScore model.

The average VantageScore is 697, so a 720 score is above average. As seen below, 61% of Americans have a VantageScore credit score in the “good” range or above.

|

VantageScore Credit Score Ranges |

Americans With Credit Scores in This Range |

|

|

|

|---|---|---|---|---|

|

Very poor (300 – 499) |

5% |

|||

|

Poor (500 – 600) |

21% |

|||

|

Fair (601 – 660) |

13% |

|||

|

Good (661 – 780) |

38% |

|||

|

Excellent (781 – 850) |

23% |

While FICO and VantageScore take some of the same factors into account, VantageScore determines your credit score based on six different factors. Let’s look at how VantageScore weighs each factor:

- Payment history (41%): Your past ability to pay bills on time.

- Depth of credit (20%): The ages and types of credit accounts you have.

- Credit utilization (20%): How much of your credit limit you’re using.

- Recent credit (11%): The number of hard inquiries on your credit report.

- Balances (6%): The total balances on your credit accounts.

- Available credit (2%): The amount of credit you have available to you.

What Kind of Loan Can I Get With a 720 Credit Score?

As mentioned above, a good credit score can help you qualify for better rates and terms for loans. However, it’s important to keep in mind that your credit score isn’t the only factor that lenders look at when reviewing your loan application. Your income, employment, credit history, and debt-to-income ratio are also taken into consideration during the approval process.

With that in mind, here’s a look into the loans you can generally expect to qualify for with a 720 credit score. Assuming you also qualify for income thresholds as well.

Mortgages

Generally, mortgage lenders require a minimum credit score of 620, so you should have no problem qualifying for a mortgage with a 720 credit score. You’ll also likely qualify for low interest rates, although you might not get the best rate available. Borrowers who qualify for the lowest interest rates typically have a 760 credit score or higher.

Additionally, how much of a down payment you put down may influence your interest rates. A larger down payment provides less risk to the lender because you have additional stake in the house.

Auto Loans

A 720 credit score will allow you to qualify for an auto loan. When looking at the average car loan interest rates, borrowers with credit scores between 661 and 780 qualify for an average used car APR of 7.83% and an average new car APR of 5.82%. However, if you bring your score to 781 or above, you can expect a 1.84% lower interest rate for used cars and a 1.07% lower interest rate for new cars, on average.

Personal Loans

With a 720 credit score, you’ll have many options for personal loans, so you should shop around for the best rates. Personal loan interest rates can range from 6% to 36%, although a good credit score should allow you to qualify for rates on the lower end of that spectrum. According to recent personal loan statistics, the average interest rate is 11.2%.

Student Loans

While federal student loans don’t have credit score requirements, private student loan lenders typically require a good credit score. With a 720 score, you’ll likely get approved by most lenders and may even qualify for the best interest rates.

Credit Cards

Most credit card issuers will approve borrowers with a 720 credit score and potentially offer the lowest interest rates. You can likely even get approved for a 0% APR card. Keep in mind that certain prestigious credit cards that provide luxurious perks require excellent credit to qualify plus additional requirements. Therefore, you may need to improve your credit score before applying for an exclusive credit card.

How to Further Improve Your 720 Credit Score

If you have a good credit score but want to reach the very good or excellent range, here are some tips for how to make your good credit score even better:

- Pay your bills on time: Since 720 is a high credit score, a single late payment can cause a significant drop in points. Make sure to continue paying your bills on time to further improve your credit.

- Make payments more frequently: Making multiple payments on your credit card bill each month can help keep your credit utilization low.

- Request a credit limit increase: Another way to lower your credit utilization is to increase your credit limit.

- Leave credit accounts open: Avoid closing old credit accounts to maintain the length of your credit history.

- Space out new credit applications: Wait six months between credit card applications to limit the number of hard inquiries on your credit report.

- Get credit for rent and utility payments: If you regularly pay your bills on time, a rent and utility reporting service can report your payments to the credit bureaus, which may help improve your credit.

- Dispute any errors: Check your credit report at least once a year and challenge any inaccurate information you find.

While a 720 credit score is considered good, there’s still room for you to stay on top of your credit—that’s where ExtraCredit® comes in. ExtraCredit is a credit management product that helps you check your FICO® scores, view your credit reports from all three credit bureaus, report rent and utilities, and more. Start your free trial* today.

*Your 7-day trial will begin after agreeing to these terms and submitting your ExtraCredit® sign-up. After your trial period, your subscription will automatically continue on the same day every month as the day you started your trial membership. The free trial is available for new ExtraCredit customers only. The credit card you provided will be charged $24.99 (plus any applicable tax) on the next business day and monthly; after your trial period unless you cancel. You may cancel at any time by downgrading your service level in your settings or by contacting us at support@credit.com. Dishonored payments will result in an automatic downgrade to the free credit.com product.

You Might Also Like

June 14, 2023

Credit 101

January 25, 2022

Credit 101

February 19, 2021

Credit 101