![Average Electric Bill by State [2023]](https://www.credit.com/blog/wp-content/uploads/2023/07/image-32.png)

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

In 2022, the national average electric bill was $137 per month, and residents consumed an average of 907 kWh of energy monthly.

If you’re trying to save money, you may be examining your electric bill to see how much you’re spending each month. But how do you know if you’re overpaying and need to decrease your energy usage?

In this article, we take a closer look at the average electric bill in the U.S. and each state to help you determine how much to budget each month.

How Much Is the Average Electric Bill?

According to the U.S Energy Information Administration (EIA), the national average electric bill in 2022 was $137 per month, with residents consuming an average of 907 kWh of energy monthly. After adjusting for inflation, this is a 5% price increase and a 2% energy usage increase from the previous year.

As of the first three months of 2023, the monthly average electric bill was $133 per month, which is a 5% increase from the same time period last year.

Average Electric Bill by State

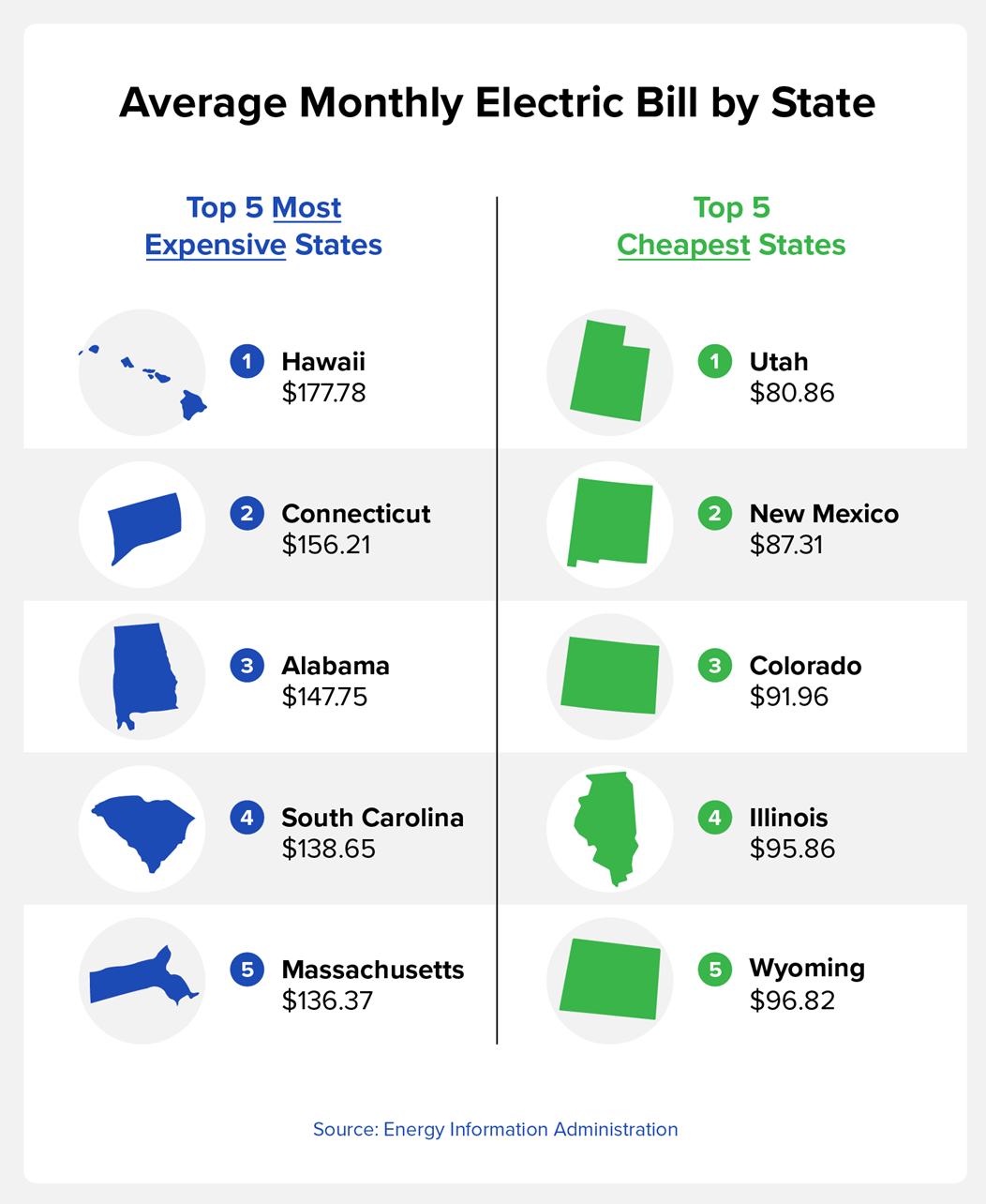

The average electric bill varies by state based on a number of factors, including local power plant costs, weather conditions, state regulations, electricity transmission and distribution systems, and fuel costs.

Utah has the lowest monthly bill, which costs residents $80.87 on average. Meanwhile, Hawaii has the highest bill, with an average of $177.78 per month, due in part to the cost of importing petroleum fuels.

Reference the chart below to see your state’s average monthly consumption, average unit price, and average monthly bill according to the EIA.

|

State |

Average Monthly Consumption (kWh) |

Average Price (cents/kWh) |

Average Monthly Bill (Dollar and cents) |

|---|---|---|---|

|

AK |

594 |

22.55 |

133.89 |

|

AL |

1,140 |

12.96 |

147.75 |

|

AR |

1,098 |

11.27 |

123.69 |

|

AZ |

1,048 |

12.54 |

131.35 |

|

CA |

542 |

22.82 |

123.67 |

|

CO |

704 |

13.07 |

91.96 |

|

CT |

713 |

21.91 |

156.21 |

|

DE |

950 |

12.52 |

118.85 |

|

FL |

1,096 |

11.90 |

130.40 |

|

GA |

1,072 |

12.51 |

134.11 |

|

HI |

531 |

33.49 |

177.78 |

|

IA |

861 |

12.73 |

109.63 |

|

ID |

961 |

10.16 |

97.62 |

|

IL |

728 |

13.18 |

95.86 |

|

IN |

946 |

13.37 |

126.51 |

|

KS |

890 |

12.98 |

115.53 |

|

KY |

1,084 |

11.50 |

124.67 |

|

LA |

1,192 |

11.02 |

131.37 |

|

MA |

596 |

22.89 |

136.37 |

|

MD |

973 |

13.12 |

127.62 |

|

ME |

584 |

17.02 |

99.44 |

|

MI |

670 |

17.54 |

117.57 |

|

MN |

776 |

13.50 |

104.76 |

|

MO |

1,039 |

11.41 |

118.55 |

|

MS |

1,171 |

11.56 |

135.31 |

|

MT |

872 |

11.22 |

97.84 |

|

NC |

1,063 |

11.32 |

120.38 |

|

ND |

1,041 |

10.85 |

112.93 |

|

NE |

1,005 |

10.75 |

108.09 |

|

NH |

631 |

19.85 |

125.24 |

|

NJ |

687 |

16.35 |

112.39 |

|

NM |

646 |

13.52 |

87.31 |

|

NV |

959 |

11.49 |

110.17 |

|

NY |

599 |

19.48 |

116.70 |

|

OH |

879 |

12.77 |

112.21 |

|

OK |

1,088 |

11.00 |

119.69 |

|

OR |

936 |

11.37 |

106.49 |

|

PA |

851 |

13.76 |

117.11 |

|

RI |

585 |

22.30 |

130.40 |

|

SC |

1,078 |

12.86 |

138.65 |

|

SD |

1,019 |

12.22 |

124.50 |

|

TN |

1,183 |

11.07 |

130.98 |

|

TX |

1,094 |

12.11 |

132.40 |

|

UT |

775 |

10.43 |

80.87 |

|

VA |

1,094 |

11.96 |

130.92 |

|

VT |

567 |

19.26 |

109.24 |

|

WA |

984 |

10.11 |

99.45 |

|

WI |

690 |

14.52 |

100.18 |

|

WV |

1,066 |

12.15 |

129.61 |

|

WY |

867 |

11.17 |

96.82 |

What Contributes to a High Electric Bill?

When examining your electric bill, you’ll likely see your charges grouped into two categories: supply and delivery charges.Knowing what these charges mean can help you understand what’s contributing to your high electric bill.

Supply Charges

Supply charges account for the cost of generating the energy you use. The total you are charged each month depends on the amount of energy you use and the cost per kWh of electricity. Your utility provider determines the unit rate (kWh) and should be noted in your contract.

It’s also important to check if you have a fixed-rate or variable-rate electric plan. With a fixed-rate electric plan, your unit rate will remain the same for a set duration. With a variable-rate plan, your unit rate will depend on the cost to supply electricity, which changes minute by minute depending on electricity demand. However, most customers pay a seasonal average rate (a type of variable rate), so they don’t experience these constant fluctuations.

Delivery Charges

Delivery charges are the costs associated with delivering electricity to your home. These charges are categorized into the following rates on your electric bill:

- Distribution rate: This charge pays for distributing electricity to your home via power lines. This fee also includes metering services, billing services, and customer service.

- Transition rate: This fee helps cover utility companies’ costs in building and maintaining power plants.

- Transmission rate: This charge is controlled by the Federal Energy Regulatory Commission and helps cover the cost of the high-voltage power lines, which transport electricity from the power plants to the utility company.

How Can You Budget for Your Electric Bill?

While it can be difficult to pinpoint exactly how much your electric bill will cost each month, the National Foundation for Credit Counseling suggests spending no more than 10% of your monthly income on utilities. For example, if you earn $3,000 monthly, you shouldn’t be spending more than $300 on utilities each month.

If you’d prefer to take the guesswork out of budgeting for utilities, you can sign up for budget billing through your utility company, which involves paying a set amount for monthly utilities based on your average usage. Contact your utility company to learn more about budget billing.

Tips to Lower Your Electric Bill

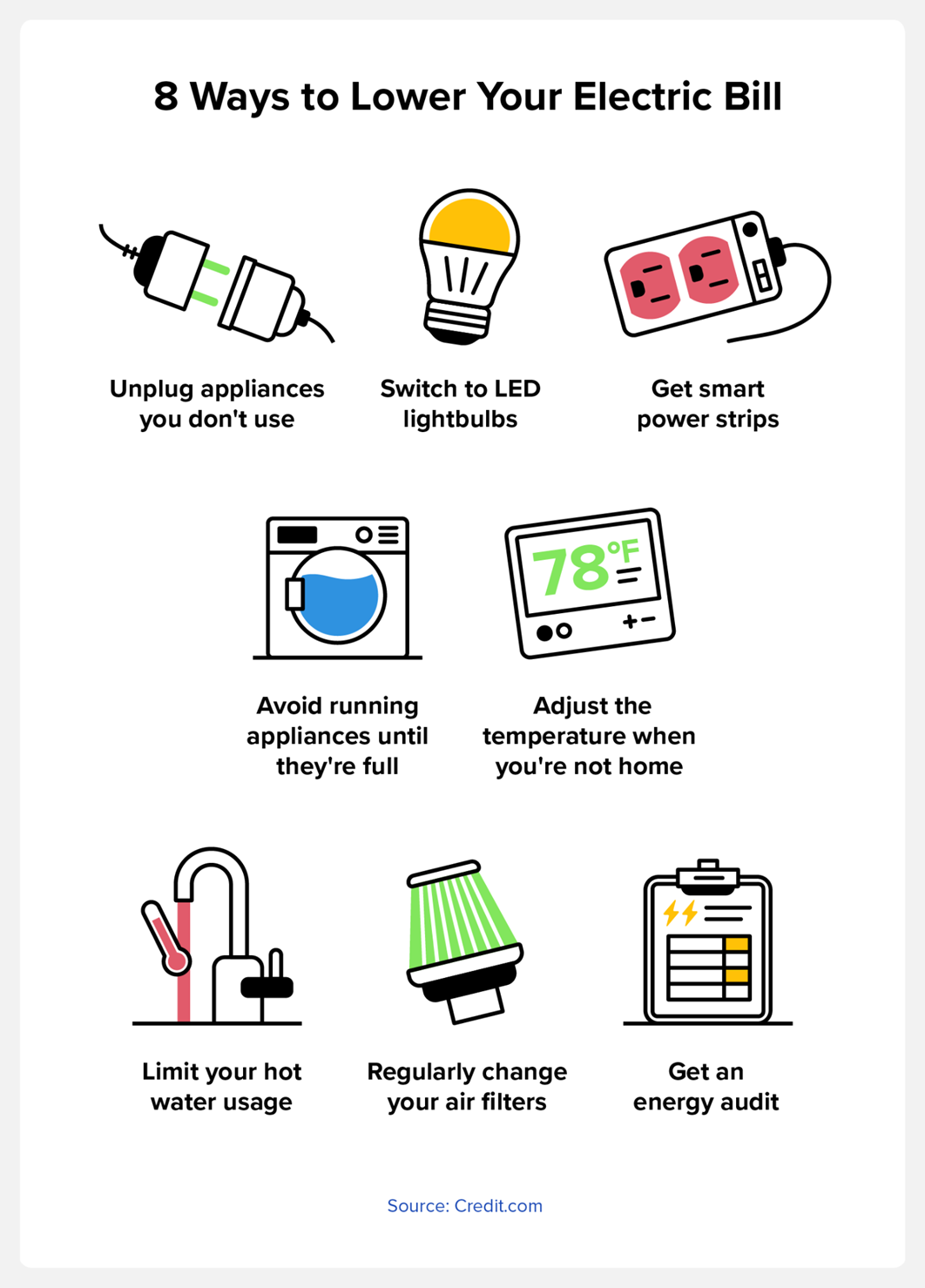

If you’re spending too much on your electric bill, try incorporating these tips to save money:

- Unplug appliances you don’t use: Walk around your house and unplug anything you don’t frequently use. For example, if you only make a smoothie once a week, you don’t need to leave the blender plugged in 24/7.

- Get smart power strips: Smart power strips work by automatically shutting down the power to devices not in use. This is a great option if you frequently forget to unplug your devices.

- Switch to LED light bulbs: LED bulbs use approximately 75% less energy than incandescent lighting, according to Energy.gov.

- Limit your hot water usage: Heating water requires a lot of energy, so avoid washing your clothes or running the dishwasher using hot water. You could also try taking cooler showers, too.

- Avoid running appliances until they’re full: When it comes to doing laundry or running the dishwasher, hold off until you have a full load.

- Adjust the temperature when you’re not home: Heating and cooling are typically one of the main culprits for high energy bills. While you don’t need to set your thermostat to 80 degrees in the dead of summer, adjusting the temperature when you’re not home can help lower your bill. You can even program your thermostat to turn off automatically during times of the day you’re not home.

- Regularly change your air filters: According to the Department of Energy, replacing a dirty air filter can lower your AC’s energy usage by up to 15%.

- Get an energy audit: An energy audit involves a professional reviewing your electric bills and assessing your home to provide specific recommendations on how to lower your energy costs.

Does Paying Utilities Build Credit?

Typically, paying your utility bill doesn’t build credit since most utility companies don’t report payment history to the three credit bureaus. However, if you’re making timely payments and want to build credit, you can use a third-party service to report your utility payments for you.

ExtraCredit®’s Build it tool helps youreport utilities and rent and provides other services to help you manage your credit. Try it for free today.

You Might Also Like

March 11, 2021

Personal Finance

March 1, 2021

Personal Finance

February 18, 2021

Personal Finance