Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

Credit card interest rates are a percentage of the amount a borrower owes, depending on the total amount lent, the length of the loan, and compounding frequency.

Building credit with credit cards can be an excellent way to achieve financial independence, earn rewards, and make significant purchases. However, a few aspects may not be straightforward, such as interest rates. To complicate it further, interest rates can seemingly rise and fall without warning, leaving many newcomers scratching their heads and wondering how credit card interest works. In this post, we’ll cover the basics of credit card interest, including what it is, when it gets charged, and the methods of calculating interest. By the end of this post, you’ll feel comfortable knowing how interest works, and you can use this knowledge to make informed financial decisions.

Key Takeaways:

- Credit card companies generate their revenue from interest.

- Any leftover balances at the end of each month will generate interest on your credit card balance.

- Many credit card companies have a grace period before charging their customers interest, though grace periods aren’t required by law.

- Though they seem similar, credit card interest rates and annual percentage rates (APRs) are different.

What Is Credit Card Interest?

Interest rates are how credit card companies earn money from their customers and reflect how much more customers will pay for their outstanding balances. When you make a credit card purchase, you’re essentially borrowing money from the issuer, and the interest rate is the cost of that. And of course, you’re responsible for paying off the balance.

If you make a large purchase and can’t pay it off before the next billing cycle, your issuer will charge you interest for the remaining balance in your account. Furthermore, interest will continue to accrue when your balance carries over from one billing cycle to the next. It’s important to note that interest charges on credit cards start after a billing cycle and its grace period.

In every billing cycle, you may incur interest charges on purchases. Some larger charges can have individual interest promotions and financing offers, which you must pay off every month to avoid interest getting charged to your account.

When Is Interest Charged on a Credit Card?

Most credit card companies charge interest at the end of their monthly billing cycles. However, it’s important to remember that each credit card company has its own billing cycles and interest-free programs that customers can benefit from. This means that the frequency of credit card companies charging interest happens case by case.

Your best chance of reducing the monthly interest that credit cards will charge you is by eliminating the existing balance on your account. The last thing you want is for the balance to carry over from month to month, creating revolving utilization.

You may also be at risk of compound interest if you aren’t careful. Interest may compound daily, weekly, monthly, or quarterly. Compounding interest is not only determined by your principal balance, but it also accrues interest from your already existing interest.

Is Credit Card Interest Monthly or Yearly?

Your credit card issuer will most likely show your interest rate as a percentage known as the annual percentage rate, or APR. But just because this percentage rate is labeled “annual,” it doesn’t mean that interest rates will only accrue yearly.

In fact, most credit card companies use the annual percentage rate to determine how interest will be added to your remaining balance. Since interest rates become part of your overall balance, you’ll pay off interest monthly as you pay off your credit.

Is There a Grace Period for Credit Card Payments?

Though credit card companies aren’t required by federal law to provide a grace period to their issuers, most companies will provide them. These grace periods usually happen after a payment is due but before the bill is due.

Paying off your balance while in a grace period can help you break bad credit card habits by reducing your monthly interest charges.

How to Calculate Credit Card Interest

Knowing how to calculate credit card interest can help you plan for big purchases. But you’ll need to know a few things first, like the remaining balance on your credit card—the amount you owe your issuer. You’ll also need to be aware of your APR.

Interest for credit cards is calculated by dividing your annual percentage rate by 12 (for months of the year) then multiplying that number by the remaining balance on your account. For example, if you owe $750 and your APR is 15.6%, your interest rate formula will look like this:

(15.6 / 12) x 750 = monthly interest rate

In the above example, 15.6 divided by 12 is 1.3%, which is your monthly interest percentage. Convert this percentage to a decimal (.013) and multiply it by 750. This means the monthly interest in the example above is $9.75.

Another way to calculate your credit card interest is by finding your daily periodic rate (DPR). Simply divide your interest rate by the number of days in the current year to see how much your interest rate affects your outstanding balance on a daily basis.

15.6 / 365 = daily periodic rate

In the above example, the daily periodic rate equals .04%. If you multiply that by your daily balance, you’ll see how daily charges accrue interest to your credit card account. Understanding how APR works is an important step in planning your financial future and knowing your credit health.

What’s the Difference Between Interest Rate and Annual Percentage Rate (APR)?

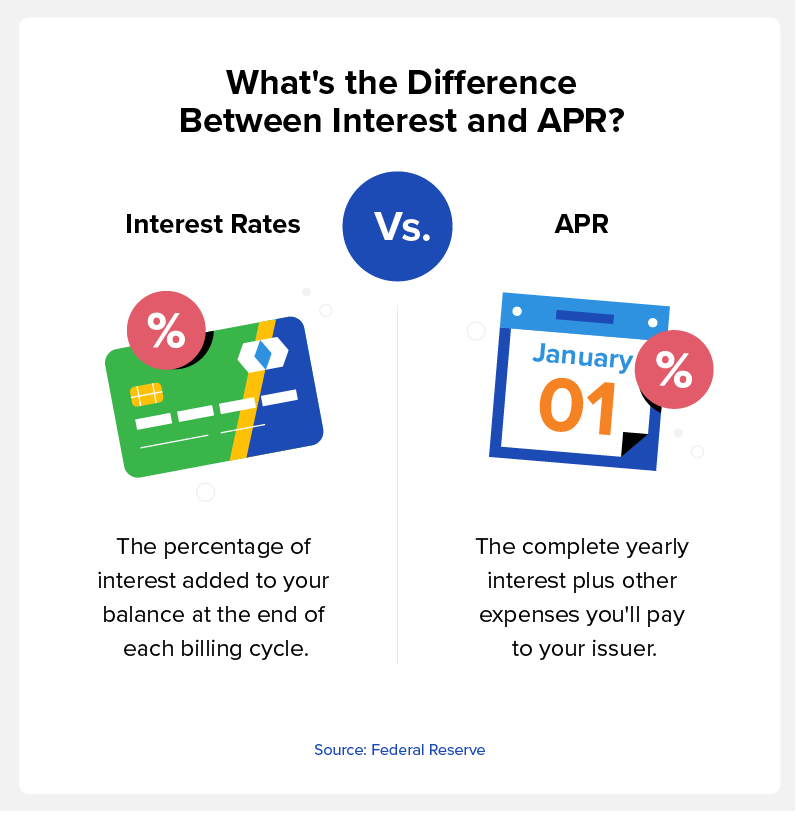

Though many credit card companies use “APR” and “interest rate” interchangeably, they don’t necessarily mean the same thing. APR refers to the complete yearly interest and includes other charges like origination fees, closing costs, and other expenses you’ll pay your issuer.

The interest rate, however, solely focuses on the accruing interest that will get added to your balance at the end of each billing cycle. The main difference between an interest rate vs. an APR is that the interest rate is more of a short-term view, while the APR is a more detailed breakdown of the complete loan. This is why it’s important to find a credit card with a lower APR.

The Different Types of Credit Card Interest

There are many different types of credit card interest rates you should keep in mind before taking out a loan. These types of interest will determine when interest will accrue on your credit card. Be sure you understand which kind of interest you’ll pay and the stipulations of your contract.

- Variable rates: These types of interest rates are also known as adjustable or floating interest rates. This type of interest rate isn’t fixed and may fluctuate over the lifespan of your loan.

- Fixed rates: Fixed interest rates mean that the interest rate will likely stay the same. However, the credit card issuer may change the rate under specific conditions. Also, it’s important to learn how long the loan will remain “fixed.” Sometimes, issuers may say that interest rates will only stay fixed for a specified period.

- Introductory rates: Introductory rates are sometimes referred to as teaser rates. This type of interest rate occurs at the beginning of a loan. Some credit card issuers may even promote a 0% interest rate for a specific time.

- Promotional rates: This kind of interest rate is meant to entice consumers into signing up for a credit card or loan. Like introductory interest rates and some fixed interest rates, issuers will offer these lower interest rates to consumers for a limited time.

- Penalty rates: If a customer fails to make monthly payments or violates the terms of service, the credit card lender may penalize them with increased interest rates. One way to avoid penalty interest rates is by paying your monthly bill on time.

- Prime rate: This is the baseline interest rate banks will use to calculate their rates. Most variable APRs are based on prime rates.

How to Avoid Credit Card Interest

Interest can sound scary on the surface. However, there are several ways that you can avoid credit card interest and ensure you have a good credit score while doing so. Interest rates can compound, so following these best practices to avoid credit card interest can help you in the long term.

- Pay off your balance on time: Paying off your credit card balance on time is the most important way to avoid credit card interest. Since you’ll pay off your balance every month, the APR won’t have anything to accrue unless you have a daily interest accrual.

- Pay your bill the moment you get it: Paying off your bill the moment you receive it will help you avoid interest charges—especially if your credit card issuer gives you a grace period for interest.

- Go beyond the minimum payment: Your minimum monthly payment may not help you avoid interest charges because it won’t pay off your balance in full, meaning that interest will still get charged depending on how much money is left in your account.

- Make multiple payments: A great way to pay beyond your minimum credit card payment is by making multiple monthly payments, if your budget allows. Chipping away at your balance is a great way to avoid interest.

- Transfer balances: You may find it helpful to transfer your balances to reduce your credit card balance. However, carefully research your options to avoid making common balance transfer credit card mistakes.

On the surface, interest is complicated. Though we don’t learn about interest rates in school, knowing how credit card interest works and how to avoid interest is a great first step to financial health, freedom, and avoiding going over your credit limit. Learning to be responsible with your money and credit card balances will equip you with the knowledge to master your credit and finances.

Check out Credit.com to learn more about how credit cards affect your finances.

You Might Also Like

April 9, 2024

Credit Cards

October 21, 2020

Credit Cards

August 3, 2020

Credit Cards