Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

Experian reports the average credit card limit was $28,929.80 in 2022. However, credit card limits vary widely based on factors such as credit score, age, and income.

When you first get approved for a new credit card, it can be disheartening to see a low credit card limit, especially if you compare it to the average credit card limit in America. Credit card limits vary widely, making it difficult to understand how your credit card limit compares to others.

To help you compare your credit card limit to people in similar financial positions, we’ve broken down the average credit card limit by several factors, including age, credit score, state, and income. We also break down how your credit card issuer determines your credit limit and how to increase it. So, you can grow your credit responsibly while managing your debt.

Table of Contents:

- Average credit card limit for Americans

- Average credit card limit by age and credit score

- Average credit card limit by state

- How are credit card limits determined?

- How to get a higher credit limit

- FAQ

Average Credit Card Limit for Americans

When averaging credit limit data across generations from Experian®, the average credit limit in America is $28,929.80.

Your credit card limit depends on your credit score, age, income, and other factors. Credit card limits can range anywhere from $300 to more than $100,000.

A credit card limit is the maximum amount you can spend before paying the debt to the credit card company. For example, if you have a credit card limit of $5,000, you can’t spend more than that before paying off some or all of the debt. Credit card companies use credit card limits to control the risk of you not paying back your debt.

Average Credit Card Limit by Age and Credit Score

Your age does not directly impact your credit card limit, but it can impact factors that do. As a result, older people often have higher credit card limits than younger people, at least until age 77, when credit card limits drop.

Since your credit score is a determining factor for your credit card limit, the higher your credit score, the higher your credit card limit. People with high credit scores reliably pay their bills on time or early, making them good risks for credit card companies. They also tend to be older, which explains why older people have higher credit limits.

Older people typically have longer credit histories—a factor that accounts for roughly 15% of your credit score. On-time payment history also impacts your credit score, and people with a longer credit history have had a chance to overcome late payments in the past. As a result, older generations tend to have higher credit scores than younger ones, contributing to their higher average credit card limits, which you can see in the chart below.

|

Generation |

Average Credit Card Limit |

Average Credit Score |

|---|---|---|

|

Generation Z (age 18-25) |

$11,290 |

679 |

|

Millennials (age 26-41) |

$24,669 |

687 |

|

Generation X (age 42-57) |

$35,994 |

706 |

|

Baby Boomers (ages 58-76) |

$40,318 |

742 |

|

Silent Generation (ages 77+) |

$32,379 |

760 |

Data Sources: Experian, Wisevoter

Also, older people have more career experience, which usually correlates with a higher salary. Higher income can lower your debt-to-income ratio—another factor credit card issuers use to determine credit card limits. This also explains why people over 77 experience a drop in credit card limits—they’ve transitioned from work to retirement, which tends to coincide with a lower income.

Average Credit Card Limit by State

Like your age, the state in which you live does not directly affect your credit card limit, but it does impact the factors that determine it.

The following elements vary by state:

- Average cost of living

- Average salary

- Median age

- Job opportunities

- Tax rates

These factors impact your overall economic stability, which in turn does impact your credit card limit.

In the chart below listing the states with the highest average credit card limit, states marked with an asterisk are also in the top 10 states with the highest cost of living, suggesting that your state’s cost of living indirectly correlates with its average credit card limit.

|

State |

Average Credit Card Limit |

Average Credit Score |

|---|---|---|

|

New Jersey |

$37,845 |

714 |

|

District of Columbia |

$36,351 |

703 |

|

Connecticut* |

$36,272 |

717 |

|

Massachusetts* |

$34,685 |

723 |

|

Colorado |

$34,061 |

718 |

|

Virginia |

$34,011 |

709 |

|

New Hampshire* |

$33,666 |

724 |

|

Maryland* |

$33,645 |

704 |

|

New York* |

$33,381 |

712 |

|

Hawaii* |

$33,254 |

723 |

This correlation between the average cost of living and credit card limit continues when we look at the 10 states with the lowest average credit card limit. In the chart below, the states marked with an asterisk are also on the list of states with the lowest cost of living.

|

State |

Average Credit Card Limit |

Average Credit Score |

|---|---|---|

|

Mississippi* |

$21,676 |

667 |

|

Arkansas |

$24,570 |

683 |

|

West Virginia* |

$24,684 |

687 |

|

Alabama* |

$25,621 |

680 |

|

Louisiana |

$25,781 |

677 |

|

Kentucky |

$25,962 |

692 |

|

Oklahoma* |

$26,041 |

682 |

|

Indiana* |

$26,676 |

699 |

|

Idaho |

$26,871 |

711 |

|

Iowa* |

$27,052 |

720 |

How Are Credit Card Limits Determined?

Credit card companies use several factors to determine your limit, which they review periodically over time. Some factors count more than others, varying by the credit card issuer.

Your Credit Score

A higher credit score indicates you are more likely to pay your debts, which tells credit card issuers you are lower-risk. As a result, people with higher credit scores often have higher credit card limits.

According to FICO®, a variety of factors determine credit scores, including:

- Payment history: Your payment history determines 35% of your credit score, which shows how likely you are to pay your debts on time.

- Credit utilization rate: Your credit utilization rate is the ratio of the debt you owe to the total amount of credit available to you. You can factor your credit utilization rate by dividing your current balance by your total credit limit and multiplying the result by 100. A healthy credit utilization rate is considered anything below 30% —any higher and potential lenders may consider you overextended.

- Length of credit history: The longer your credit history, the better picture a lender has of your risk level. A short history isn’t necessarily bad unless it contains a poor payment history and high utilization rate.

- Recent hard inquiries: A hard inquiry is a record of a lender checking your credit. Too many hard inquiries in a short period can lower your credit score temporarily, so experts recommend six months between hard inquiries.

Credit card companies also use your credit score to determine your interest rate, so keeping an eye on your score with free credit reports is important.

Monthly Income

Credit card issuers want to know if you have monthly income to ensure you can pay your debts. The higher your monthly income, the more likely you are to get approved for a higher credit limit.

Monthly Expenses

Credit card companies look at your total monthly expenses, especially compared to your monthly income. Generally, they’ll look at your monthly housing costs (mortgage or rent), although they may also ask for information about other regular expenses such as utilities. Your monthly expenses are then compared to your monthly income to determine your credit card limit.

High monthly expenses won’t hurt your credit card limit as long as your monthly income is high enough to cover them.

Debt-to-Income Ratio

Credit card issuers also examine your debt-to-income ratio when determining your credit card limit. Experts consider anything under 36% to be a good debt-to-income ratio for a credit card.

To calculate your DTI ratio, divide your total recurring monthly debt (mortgage, auto loan, student loans, existing credit card debt, etc.) by your gross monthly income (how much you make before taxes) and multiply the answer by 100.

Your History with the Issuer

If you already have a positive credit history with the company issuing the credit card, they may be more likely to give you a higher credit limit. However, if they feel you have too many cards or a rocky credit history with them, they may issue a lower credit limit.

The Issuer’s Credit Approval Policies

Every credit card company wants to avoid risk and crafts a specific set of policies to determine how much credit to extend to a cardholder. Its policies may consider elements not listed here or weigh factors differently than another company, which is why credit card limits are not standard across companies.

Current Economic Outlook

When the economy is healthy, credit card companies may be more open to taking risks and offer higher credit card limits. However, when the economy is uncertain, such as during the pandemic, issuers are less likely to take risks, offering lower credit card limits for new cardholders.

How to Get a Higher Credit Limit

A low credit card limit isn’t necessarily bad, but it can make getting approval for additional loans or credit challenging if your credit utilization rate is too high. It can also put large purchases, such as an appliance or unexpected car repair, out of reach.

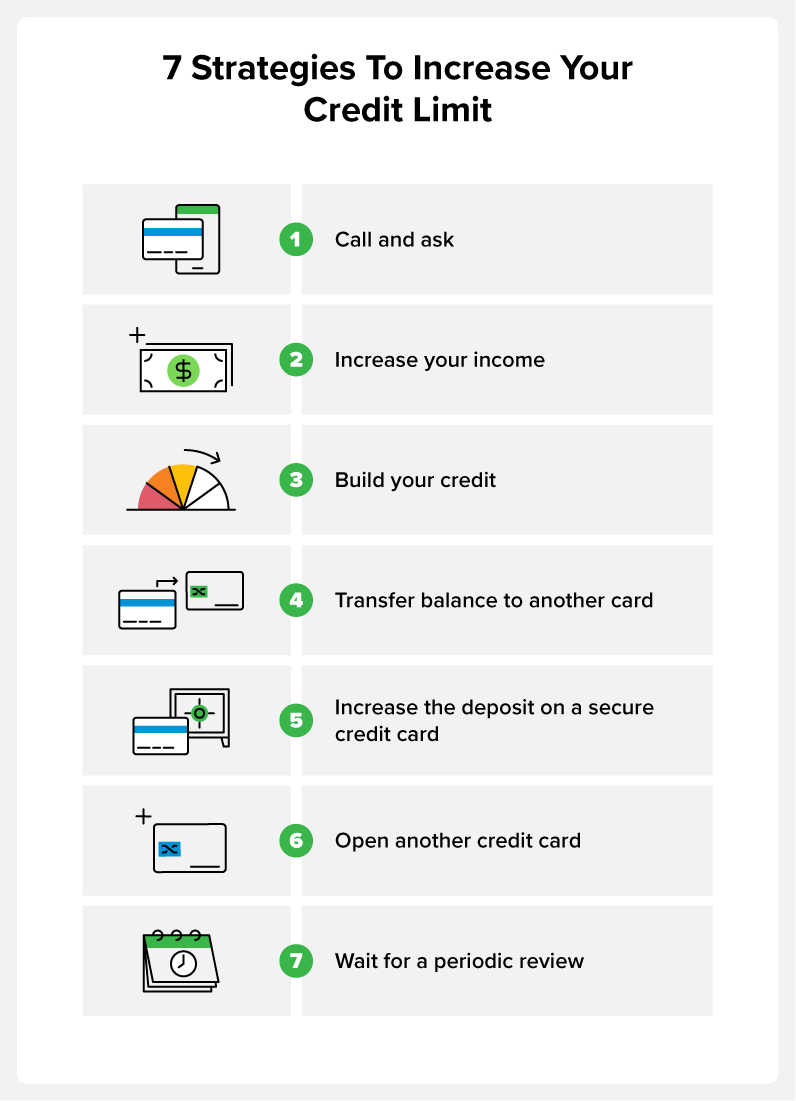

To get a higher credit card limit:

- Call your credit card issuer and ask for an increase. Call the customer service number on the back of your card and ask the representative for a higher credit card limit. Only consider this if you are trying to lower your credit utilization rate to raise your credit score. They look for six months of on-time payments and will ask for updates on your annual income, employment status, and monthly expenses before deciding.

- Increase your income. Since monthly income is a factor in your credit limit, increasing your monthly income can boost your credit card limit. Ask for a raise at work, get a second job, or start a side hustle. When your credit card issuer sees you have more income, they may offer you a higher credit limit. You can update this information with them anytime by contacting them directly, or you can wait until they discover it in a periodic review of your status.

- Build your credit. Pay your bills on time and pay down debt to increase your credit score. Over time, your credit score should increase, which can lead your credit card issuer to raise your credit limit.

- Transfer the balance from one card to another. Some credit cards allow you to transfer debt from one account to another in a credit transfer. If you have multiple credit cards and one allows credit transfers, transfer the debt from one card to another. This won’t increase your credit card limit overall, but it can increase the amount of credit available on a specific card.

- Increase your deposit on a secure credit card. If your card is a secured credit card, your credit card limit directly correlates to your security deposit. Add more to your security deposit, and you’ll have a higher credit card limit.

- Open another credit card. This won’t increase the credit card limit on your current card, but it will expand how much credit is available to you. Avoid temporarily dinging your credit score by waiting six months between credit card applications.

- Wait. Most credit card companies annually review your account, and as long as you pay your bills on time, they can likely naturally increase your credit card limit.

You can also always pay off purchases immediately rather than waiting until the end of your payment period to gain access to more credit without increasing your credit limit.

Credit scores strongly indicate what your potential credit card limit will be, so learn more about yours today. Before applying for a new credit card, get a sense of where you stand with a credit report card. Then use the tools and features in ExtraCredit to see where you need to work toward your credit goals to qualify for a higher credit card limit.

FAQ

Here are some answers to common questions regarding credit card limits.

What Happens if I Go Over My Credit Limit?

If you try to make a purchase over your credit limit, most credit card companies will deny the transaction. Some may allow the purchase but charge a fee, although most companies have abandoned this practice.

If I Request an Increase to My Credit Limit, Will That Impact My Credit Score?

When you request an increase to your credit card limit, your credit score may drop if your credit card issuer places a hard inquiry on your credit score. This can temporarily lower your credit score, and not all credit card companies do so.

You Might Also Like

April 9, 2024

Credit Cards

October 21, 2020

Credit Cards

August 3, 2020

Credit Cards