Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

Zombie debt is a broad term that refers to past debts that are still affecting you. An example of zombie debt is a three-year-old loan that should be paid off.

The term “zombie debt” refers to a past debt that shouldn’t affect you anymore yet continues to appear on your credit report. Dealing with zombie debt can be extremely complicated as debt collectors may repeatedly contact you about an account that belonged to you years ago.

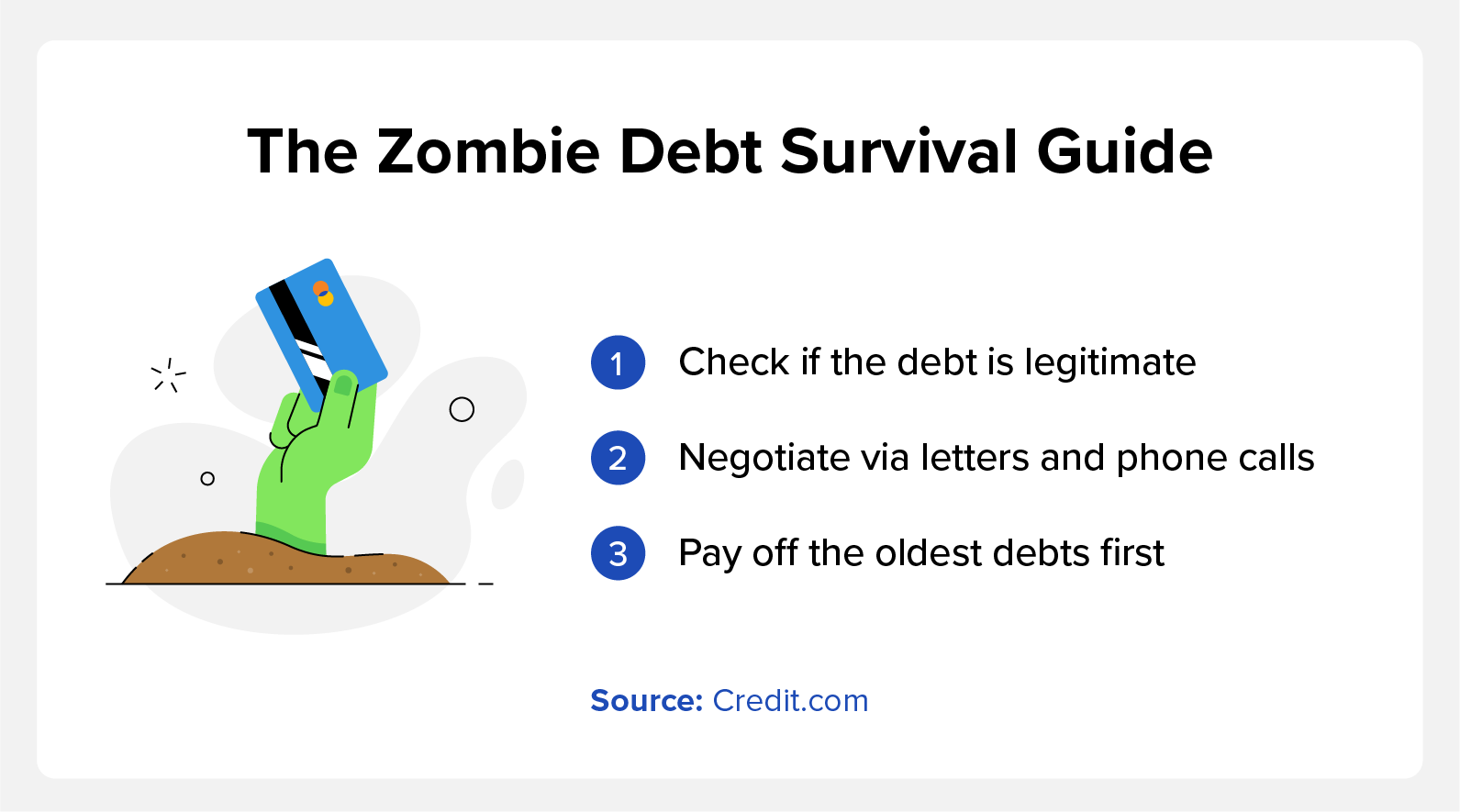

Much like the characters in a post-apocalyptic story, it’s possible to overcome zombie debt with the right know-how. This guide will teach you how to deal with debt collectors and educate you on the laws relating to outstanding debt. We’ll also arm you with tools like Credit.com’s free credit report card to stave off the next wave of debt-related threats.

Key Takeaways:

- Zombie debt arises based on collection agencies.

- It may be possible to settle zombie debt with your original creditor.

- The Fair Debt Collection Practices Act (FDCPA) helps protect you from harassment.

How Does Zombie Debt Work?

Collection activities are the most common causes of a zombie debt outbreak. Here’s a step-by-step breakdown of how a buried debt might rise from the grave:

- You default on a loan, which means that you have unpaid debt.

- The original lender or collection agency fails to collect within the statute of limitations.

- The unpaid debt falls off your credit report after a certain amount of time.

- A separate collection agency purchases your unpaid debt and tries to collect it.

That collection agency may report the debt as owed to the three major credit reporting agencies (Equifax®, Experian®, and TransUnion®). This prompts the debt to reappear on your credit report as zombie debt.

How Do I Get Rid of Zombie Debt?

Learning how and why you have zombie debt is the first step to effectively protecting yourself. When devising your zombie debt survival plan, you should also know your .

Debts Past the Statute of Limitations

The law is on your side in cases where a debt collector tries to revive a debt that’s past the statute of limitations. Credit dispute letters can help you challenge a debt with a collector—legally, they must halt collection activity until they provide documented proof that the debt is legal and still collectible.

In some cases, zombie debt collectors may be aggressive in their pursuit of payment. The Fair Debt Collection Practices Act (FDCPA) prevents creditors from harassing you, so consult an attorney if you believe anyone is infringing on your rights.

Remember that one of your Fair Credit Reporting Act (FCRA) rights is to have an accurate credit report. If a collection agency reports a dead debt, you may be able to dispute it.

When Judgments Revive Debts

If a judge rules that the creditor can renew the debt, it could be collectible for years. In some cases, they could hold you liable for decades.

There are a few options for dealing with this type of zombie debt. First, contact the creditor that originally secured the judgment. Work directly with them and not a secondary collection agency.

If the debt is still owed, try to negotiate a settlement. The debt is old now, and they may accept a partial payment of the balance and agree to list the collection as paid. Once that occurs, no one else can continue to take action to collect the money from you.

If you can’t afford to settle the debt or you’re dealing with several collection accounts or judgments, you might consider bankruptcy.

While you’re under the protection of bankruptcy, no creditor covered by the petition can take any action to collect from you. Once the bankruptcy is finalized, the debts are considered settled and paid off.

Protect Yourself From Zombie Debt With Credit.com

An encounter with zombie debt might be spooky, but it’s important to stay calm. Our guide outlined several ways to deal with this unexpected threat, but monitoring your credit can help you stave off future attacks.

Credit.com’s ExtraCredit® service helps you track activity on your credit report and address errors or other surprises if they arise. ExtraCredit can also protect you from bad actors on the internet and alert you if anyone attempts to steal your identity.

You Might Also Like

May 30, 2023

Managing Debt

September 7, 2021

Managing Debt

December 23, 2020

Managing Debt