The information provided on this website does not, and is not intended to, act as legal, financial or credit advice.

A CD rate refers to the interest someone can earn on a certificate of deposit over time.

A certificate of deposit (CD) is a term deposit where funds are only accessible after a set period. A CD rate refers to the interest that a person can earn on a certificate of deposit over time. There’s more to understand about CDs, including the factors that affect them and the various ways you can find solid rates.

Read on to learn how Credit.com can help you boost your financial knowledge and better understand how CD rates work.

Key Takeaways

- Certificates of deposit (CDs) are savings accounts that brokerage firms, commercial banks, credit unions, and other financial institutions offer for set amounts of time.

- The term CD rate refers to the interest you can gain on a CD account.

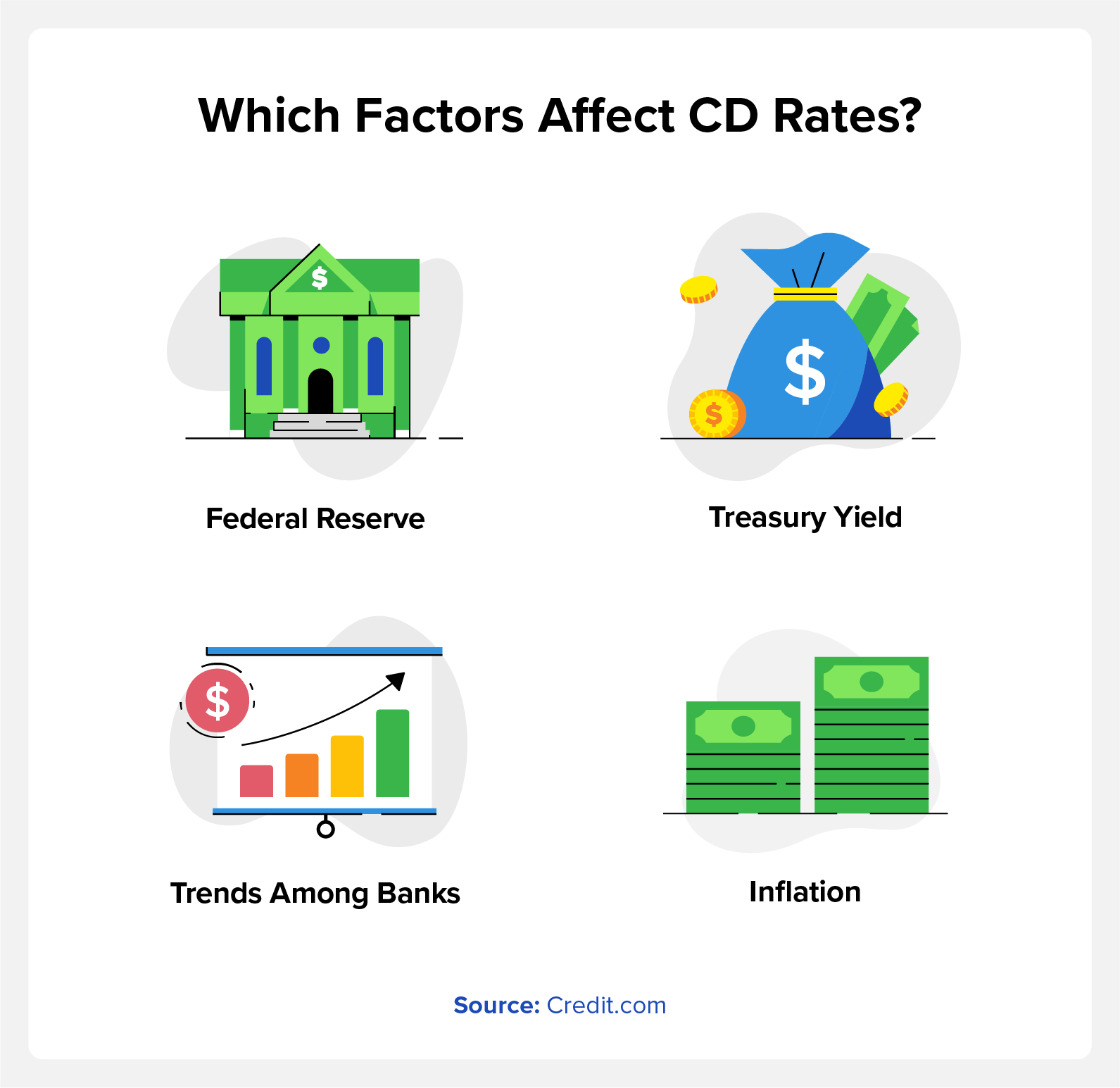

- Inflation, trends in the banking industry, and government policies can impact CD rates.

Table of contents:

- What Is a CD? (Certificate of Deposit)

- How Does a CD Work?

- CD vs. Savings Account

- Are CDs Safe?

- Where Can I Get a CD?

- Find High-Yield CD Rates With Credit.com

What Is a CD (Certificate of Deposit)?

A certificate of deposit (CD) is a term deposit (sometimes called a time deposit) wherein funds are set aside for a preset period of time. Once a person puts money toward a CD, they can’t access those funds until the account reaches maturity—or the date when the term ends.

Brokerage firms, commercial banks, credit unions, and most other financial institutions sell a selection of CDs that patrons can opt into. Some of the best banking apps available let you browse an institution’s inventory of CDs with your smartphone.

How Does a CD Work?

With a CD, a person deposits a certain amount of money into a time-locked account that’s offered by a financial institution. The institution will then borrow that money to make purchases or investments that will ideally generate more revenue. Since the bank is borrowing your money, they have to pay you interest that’s determined by your CD’s interest rate—often just called a CD rate for short.

If you’re still wondering, “How do CDs work?” here’s an example: Let’s say you put $1,000 toward a CD with a five-year term and an annual percentage yield (APY) of 3.14%. Once the account reaches maturity, you’ll earn $167.74 in interest.

What Are Add-On CDs?

Add-on CDs let people put more money toward a CD before it reaches maturity. You still can’t access the funds until the term ends, but you can increase the interest you’ll earn up to a certain amount.

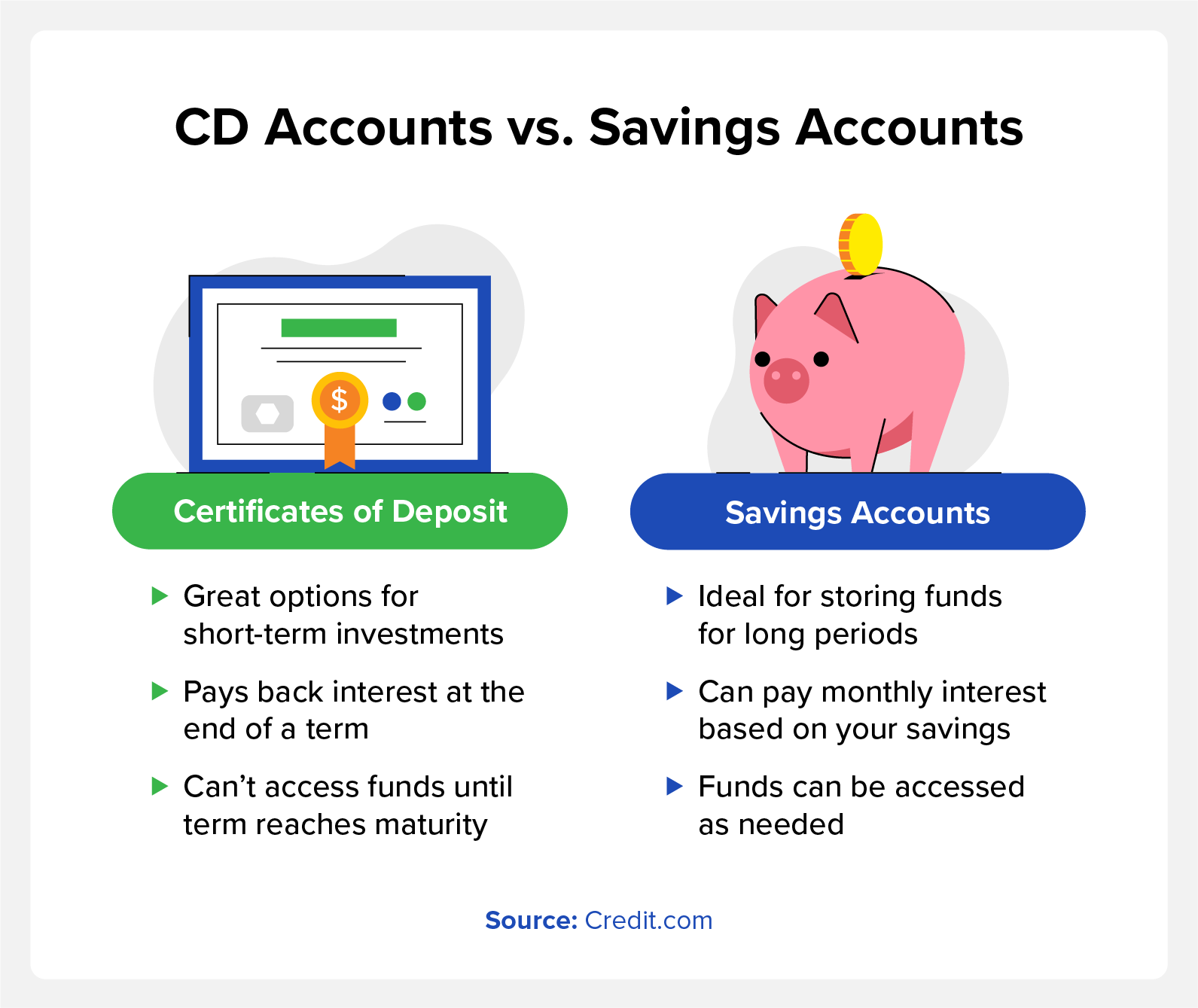

CD vs. Savings Account

CDs and savings accounts meet two different needs. Savings accounts are solid ways to store funds for long periods. CDs, on the other hand, are investments to make money in the future. Savings accounts, especially high-yield savings accounts, can also generate revenue based on the total funds within the account. CDs, however, can yield revenue based on one initial deposit.

Patrons typically can’t add more money to a CD or access their funds until a specified date. Savings accounts normally let people access funds whenever they need to, as long as they don’t drop below a threshold outlined in your account agreement.

Are CDs Safe?

CDs are one of the safer, lower-risk investment options for several reasons. If you’re wondering whether CDs are FDIC insured, don’t worry—the Federal Deposit Insurance Corporation (FDIC) will offer up to $250,000 against losses. CDs are also exclusively offered by financial institutions that must abide by government regulations.

Stocks are a higher-risk investment option than CDs with potentially higher returns. However, stocks don’t normally have government backing, and businesses can use their investors’ funds on ventures that may result in a substantial loss of capital.

Where Can I Get a CD?

You can find CDs at traditional brick-and-mortar banks as well as online. Capital One made headlines in February 2023 for becoming the first major financial institution to offer a CD with an APY of 5%. Capital One CD rates are competitive, but other institutions might have more attractive short-term CDs. A financial advisor can leverage their experience to help you find the best CDs for your circumstances.

Find High-Yield CD Rates With Credit.com

CDs can be potent investment vehicles once you learn how to make them work for you. Credit.com has resources to learn more about CDs, bonds, and other investment options. Learn more about personal finance at Credit.com today.

You Might Also Like

April 17, 2023

Budgeting and Saving Money

April 3, 2023

Budgeting and Saving Money

March 8, 2023

Budgeting and Saving Money