Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

A score of 850 is the highest credit score possible, and to achieve it you need a great credit payment history, low credit utilization rate, and credit lines that have been open for many years.

Many people are curious to know how to get the highest credit score possible, and while it’s an ambitious goal, do you actually need this high of a credit score? Although having the highest possible credit score is great, you don’t need the highest score to live a financially healthy life.

In this article, you’ll learn how to get the highest credit score as well as how credit score ranges work and the benefits of a high credit score.

Key Takeaways:

- The highest credit score possible is 850 using the FICO® scoring model.

- FICO’s credit scoring model ranges from 300 to 850, and anything over 740 is considered very good.

- To achieve a perfect credit score, you need to make your payments on time, have both revolving and installment credit lines, and keep a low credit utilization rate.

- The credit scoring factor that takes the most time is credit age, which means you need lines of credit that have been open for many years.

How Do You Get the Highest Credit Score?

If you’re trying to get the highest credit score of 850, you need to make all your payments on time and have a good mix of credit, a low utilization rate, and very old lines of credit. As mentioned earlier, this is an ambitious goal that not many people achieve. In fact, an Experian® report shows only 1.31% of people had perfect FICO credit scores as of Q3 2021.

A perfect credit score is also a moving target. Periodically, there are changes to what contributes to your credit score. For example, in 2017 there were major changes like how medical bills and public records are reported to the credit bureaus. Fortunately, these changes were in favor of the consumer, but there may be future changes that could lower your score.

FICO, the primary scoring model used by lenders, also regularly updates how it scores. Although it uses the same five factors, the latest FICO Score 10 has an updated predictive method it uses to provide consumers with a credit score.

The Credit Profile of People with a Perfect Credit Score

Should you decide to work toward a perfect credit score, it’s helpful to know what separates the average credit score from the perfect credit score. Obviously, those who manage to get a perfect credit score are doing something different than the average person. Experian regularly publishes credit and other financial data, and they analyzed data from the third quarter of 2021 to see what differentiates good credit scores from perfect credit scores.

|

|

Consumer Averages |

Average for People With an 850 FICO Score |

|---|---|---|

|

FICO® Score |

714 |

850 |

|

FICO® Score |

3.9 |

5.9 |

|

Credit card balance |

$5,221 |

$2,558 |

|

Number of retail credit cards |

3 |

4.2 |

|

Retail credit card balance |

$1,046 |

$182 |

|

Auto loan balance |

$20,987 |

$17,074 |

|

Personal loan balance |

$17,064 |

$32,872 |

|

Mortgage balance |

$220,380 |

$205,057 |

|

Non-mortgage balance |

$21,539 |

$16,482 |

|

Total tradelines ever delinquent |

1.8 |

0 |

As you can see, there’s quite a bit to learn from those with perfect credit scores. They have more credit cards than the average person, but they keep their credit card balance much lower. They also have lower balances on their auto loans and have no delinquencies on their credit report.

What Factors Affect Your Credit Score?

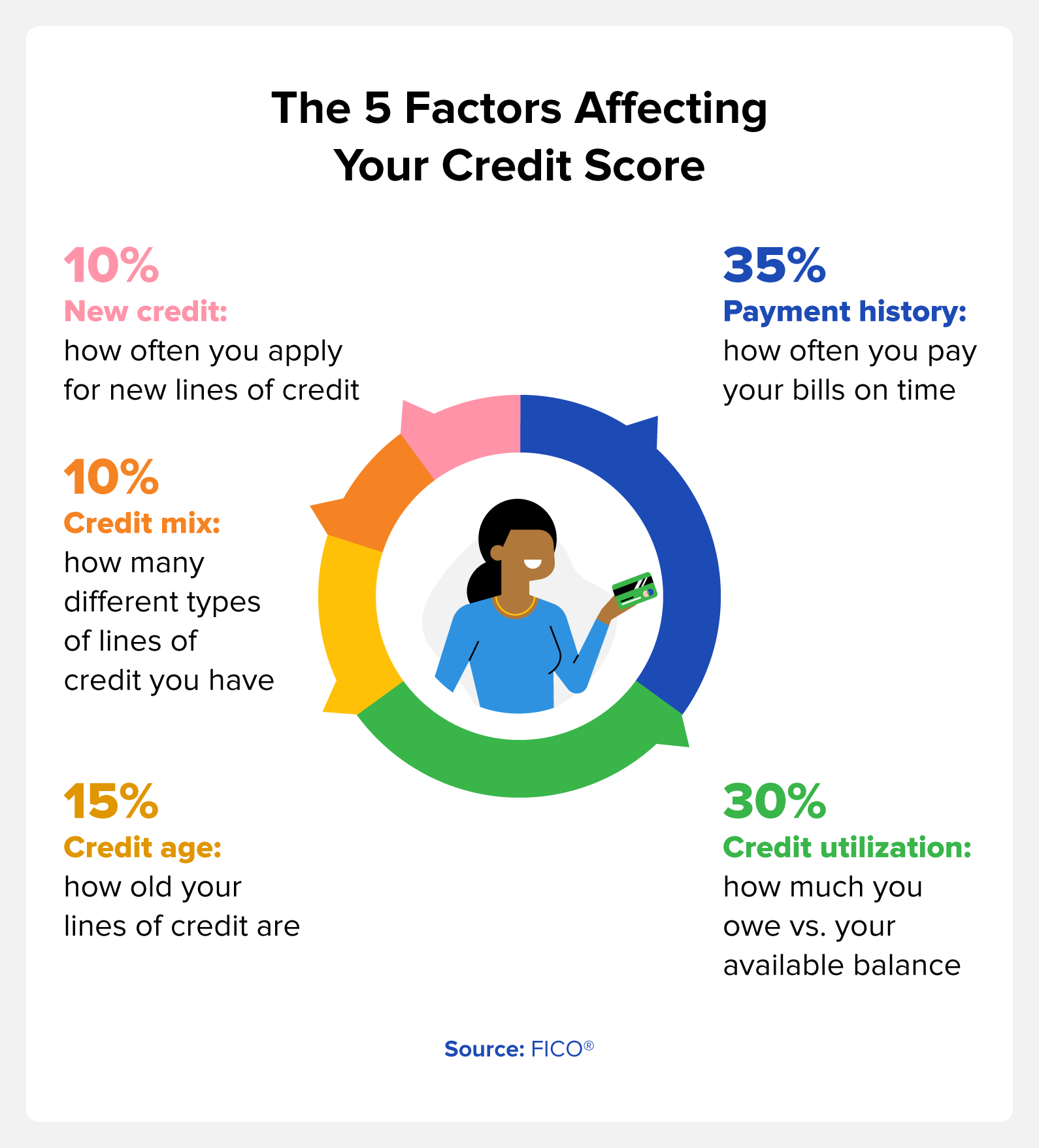

The information on your credit report is used to calculate your credit score, and there are different factors credit scoring companies consider when generating your score. Below are the five primary factors used by FICO. They’re weighted, which means some factors contribute more to your score than others:

- Payment history (35%): how often you pay your bills on time

- Credit utilization (30%): how much you owe vs. your available balance

- Credit age (15%): how old your lines of credit are

- Credit mix (10%): how many different types of lines of credit you have

- New credit (10%): how often you apply for new lines of credit

Payment history and credit utilization account for 65% of your score, so you’ll want to focus on these areas by paying all your bills on time and keeping your utilization rate under 30%. Ideally, you’ll also want the longest credit history possible, which is why it’s good to open up lines of credit when you’re younger and keep the accounts open.

Your credit mix is a blend between revolving credit and installment credit. Revolving credit lines include credit cards and personal lines of credit, whereas installment credit includes auto loans and home loans.

What’s the Credit Score Range?

Credit scores range from 300 to 850. Within the overall range, different scores are considered poor, fair, good, very good, or excellent. Some lenders or services require a minimum credit score for applicants, so it’s helpful to know where you stand.

FICO Score Range

According to FICO is the primary scoring model lenders look at to determine your potential level of risk. Rather than looking at your entire credit report, this score gives lenders a rough idea of how well you pay your bills on time and how much experience you have managing lines of credit. Below is the FICO score range, but FICO also offers industry-specific scores for auto loans and other industries.

- Poor: 300-579

- Fair: 580-669

- Good: 670-739

- Very good: 740-799

- Excellent: 800-850

VantageScore Range

VantageScore isn’t used as often as FICO, but some lenders will take this score into consideration. This scoring model was created by the three major credit bureaus in 2006 as an alternative to FICO. Not only is the VantageScore range different from FICO, but it also uses a slightly different scoring model.

- Very poor: 300-499

- Poor: 500-600

- Fair: 601-660

- Good: 661-780

- Excellent: 781-850

What Are the Benefits of a High Credit Score?

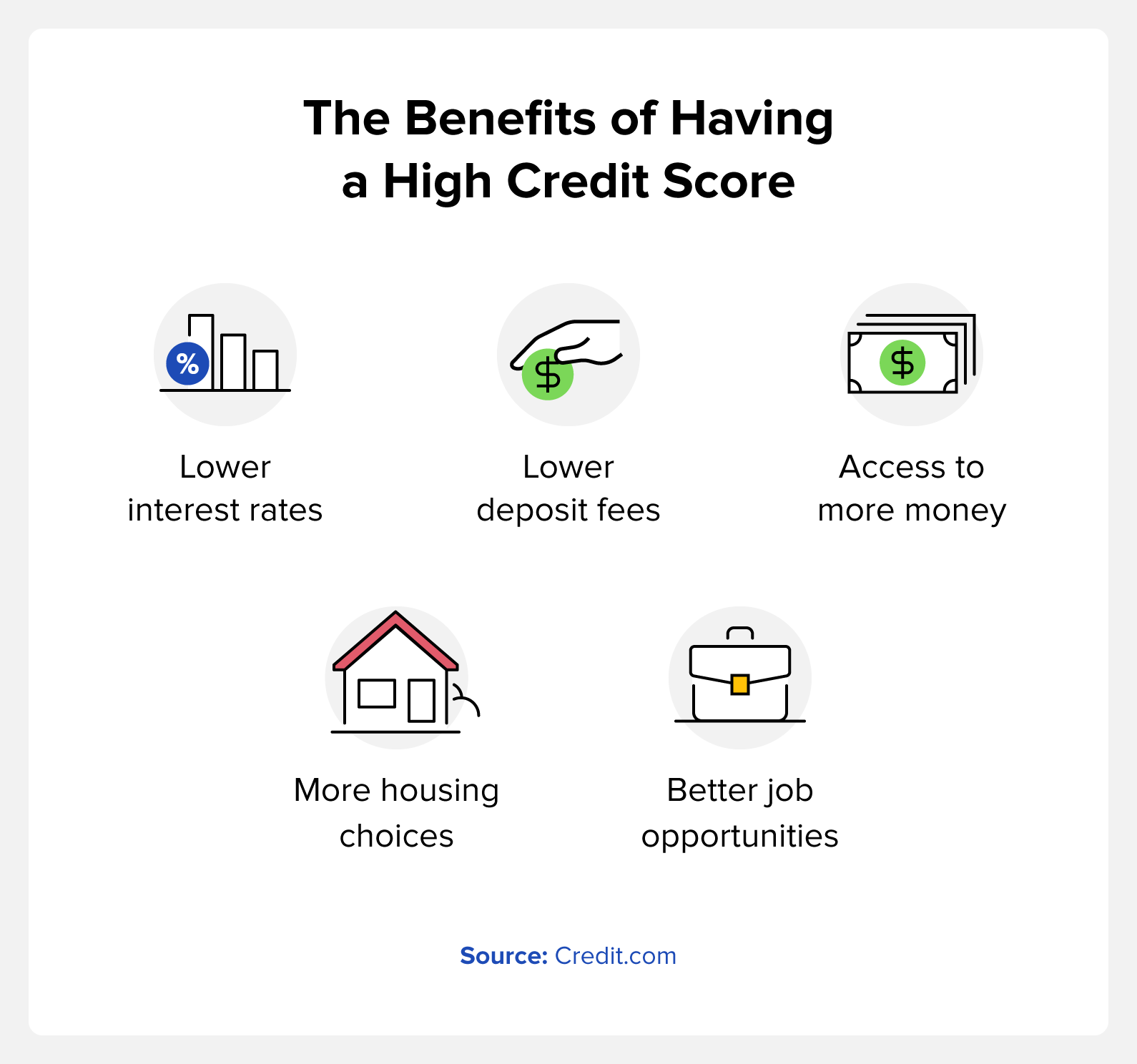

Although you may not be able to reach a perfect credit score for a while, there are many benefits to simply having a high credit score. Remember that a good credit score may be in the 600s, but you’ll receive more benefits as your score gets higher.

Some of the main benefits of having a high credit score include:

- Lower interest rates: Loans and lines of credit come with interest charges that are a percentage of the overall cost. When you have a high credit score, these rates are much lower.

- Lower deposit fees: When you sign up for certain services, like a new cell phone provider, they may check your credit score for a deposit. A higher score often means little to no deposit fee.

- Access to more money: Should you need a loan, a higher credit score can get you approved for a larger amount assuming you have the income.

- More housing choices: Whether you’re renting or buying, a good credit score gives you better options.

- Better job opportunities: Some jobs check your credit as part of the application process, and a bad score may prevent you from getting hired.

Perfect Credit Score FAQ

Next, we answer some of the most commonly asked questions about achieving the perfect credit score.

Can You Get a 900 Credit Score?

No. The highest credit score possible is 850.

Is 770 a Good Credit Score?

A 770 credit score is good, but it’s technically considered a “very good” score in the FICO credit score range. A good score in that range is between 670 and 739.

Can You Have a Credit Score of 100?

No. The lowest credit score you can get is 300, but any score below 579 is considered “poor” in the FICO credit score range.

How Credit Monitoring and Additional Reporting Can Help Your Credit Score

If you’re looking to improve your credit score or even reach the perfect credit score of 850, a great place to start is with credit monitoring. When you have credit monitoring, you’re able to regularly check your credit score and be alerted when anything triggers a change to your score from your credit report.

For credit monitoring and a variety of other features, sign up for Credit.com’s ExtraCredit® program. You can also get a free credit report card to see where your current credit health stands and where you can improve.

You Might Also Like

June 4, 2024

Credit Score

March 7, 2023

Credit Score

January 4, 2021

Credit Score