Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

Can you pay a loan with a credit card? Yes, paying a loan with a credit card is sometimes possible. Yet, whether or not you can do so depends on factors such as the lender’s policies or the type of loan you want to pay off.

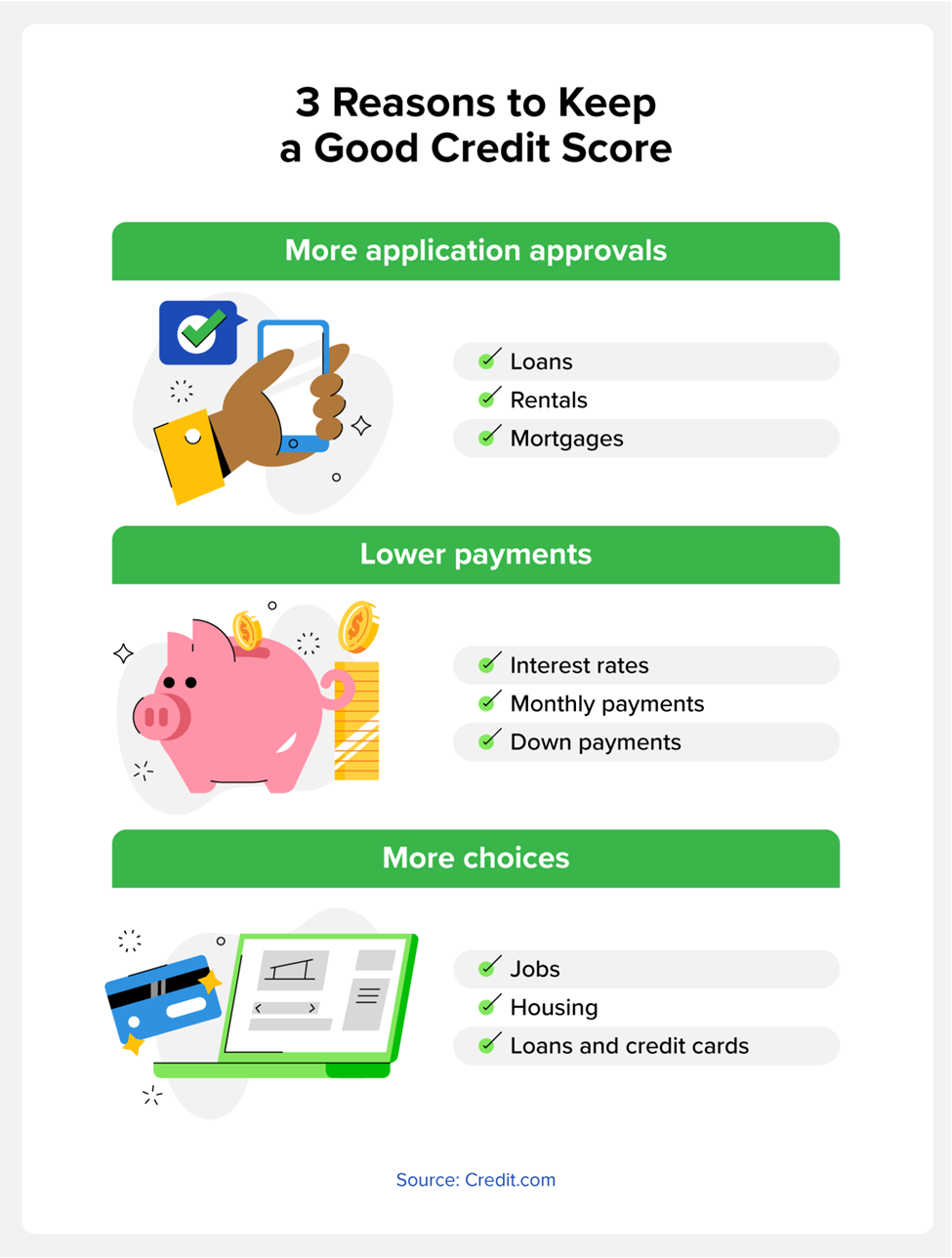

Good credit can open doors, but bad credit can keep them shut. In fact, research shows one in 10 Americans were denied work because of poor credit history! Good credit is important because it tells lenders you’re not a risk and that you pay loans on time. A good score can help you get approved for mortgages, financing, loans, and credit cards. Bad credit leads to more fees, higher interest rates, and rejected applications.

Aside from securing loans, your credit can impact your ability to secure housing and even employment. Understanding your credit score can help you make more informed decisions. We’ll explore how credit works, why it’s important, and how to maintain a good credit score.

What Is Credit?

We often hear people saythat it’s important to build credit. But what is credit? When you pay for something “on credit,”you’re actually borrowing money to make the purchase, which you pay back later. But when people say “your credit,” they’re usually talking about a credit score.

Your credit score is a three-digit number calculated by FICO®, VantageScore, or other scoring models. Your score indicates how well you manage credit. Institutions and agencies use this score to determine risk, such as how likely you are to repay loans on time. A credit score of 670 or higher is considered good by most standards.

Why Is Credit Important?

Good credit is important because it helps you secure loans, mortgages, rentals, and other important financial goals. Financial institutions perform a credit check before approving applications, and use your credit history to determine available options, associated fees, and interest rates.

Credit can impact our daily lives in many ways. Potential lenders, landlords, and employers might reject your application if you have bad credit. But good credit can help you get approved for loans and save money.

There are many benefits to a good credit score. You’ll need a strong credit score for things like:

- Loan applications: Lenders assess your credit to determine how likely you are to repay a loan. People with poor credit may face higher interest rates, smaller loans, or rejection.

- Credit card applications: Banks and credit card companies need to look at your credit report before you can get a credit card. With good credit, you can get lower interest rates and higher limits.

- Mortgage applications: Your credit score will determine monthly payments and interest rates. Good credit is essential if you can’t afford a large down payment.

- Rental applications: Landlords can run a credit check or ask you to provide one. Credit score won’t impact the rental costs, but a landlord can reject an application due to poor credit.

- Job applications: Prospective employers can ask for credit checks, especially if you are dealing with sensitive information. You may need a credit check for jobs in accounting, sales, the military, and other industries.

- Insurance applications: Depending on where you live, you might need a credit check for insurance. Not all states allow insurance companies to access your credit information.

- Vehicle rentals: You might need a credit check for vehicle rentals if you don’t pay with a credit card. And depending on your state and the company, your credit may impact your rental options.

- Credit card benefits: Good credit can help you secure credit cards with benefits, including airline miles, travel credits, cashback rewards, and other perks.

- Lower interest rates: Poor credit leads to higher interest rates, making borrowing money expensive. The better your credit, the more money you will save.

- Better loan terms: Good credit gives you more options and freedom for repayment. Bad credit can limit your options to short-term loans with higher monthly payments.

Credit is always important, no matter how high or low your score. At the end of the day, everybody needs good credit to achieve their financial goals. That’s why it’s important to understand what can impact your credit score.

What Can Impact a Credit Score?

It might be surprising, but personal savings and stocks don’t impact your credit score. Credit score calculations look at your detailed credit history, and anything that impacts these calculations will impact your score.

The five main factors that impact your credit score are:

- Payment history: when you make payments

- Credit utilization: the amount of credit you use compared to your limit

- Credit age: how long you’ve had credit and how old your accounts are

- Credit mix: the types of credit you hold

- Credit inquiries: how often your credit is reviewed

While this might look simple, many surprising scenarios can affect your credit. Unpaid parking tickets in collections can impact your payment history, for example. And closing a credit card can lower your credit utilization. You can review your free annual credit reports to watch for drops in your credit and work toward preventing a bad score.

What Happens with a Bad Credit Score?

Keep in mind that you can improve a bad credit score over time. But until you do, there can be negative consequences. Most credit scores range from 300-850, depending on the scoring model. A bad credit score generally ranges from 300-600.

Bad credit scores can lead to:

- Rejected applications

- Higher fees and interest rates

- Lost work opportunities

- Difficulty renting a vehicle

- Required deposits for utilities

- Difficulty securing a student loan

- Expensive insurance rates

- Difficulty opening bank accounts

Bad credit doesn’t shut every door, but it can make life more difficult and expensive. It’s important to check your credit score before buying a home, applying for student loans, and other important life events. This will give you time to understand your situation and make a plan to build and improve your credit.

How Do You Build and Improve Credit?

Now that you understand what credit is and why it’s important, you can plan for success. There are many ways to build and improve your credit without overextending yourself. No matter your score today, you can work toward a bright future with good credit.

- Understand how credit works: Learn how your credit score works and what can impact it.

- Set goals for yourself: Use this knowledge to set goals for minimizing debts, increasing utilization, and more.

- Address your debts: Assess your debts and plan to pay them off.

- Monitor your credit score: Look for suspicious activity on your credit report and be aware of the potential impact on your score.

- Clean your credit report: Dispute errors on your credit report.

- Get a secured credit card: Use it regularly and pay your bills on time.

- Become an authorized credit card user: Build credit in association with somebody you trust.

- Apply for a credit builder loan: Improve your score if you have poor or no credit.

- Create a budget: Manage your finances to ensure consistent repayments.

Achieving a good credit score isn’t the end of your credit journey—once you have a good credit score, you will need to maintain it. Stay diligent and follow best practices to keep a good credit score.

How Do You Keep a Good Credit Score?

Don’t take good credit for granted. To keep a good credit score, you need to stay organized and sensible about your credit usage. This means understanding your responsibilities and following best practices for credit management.

Follow these tips for keeping a good credit score:

- Stick to your budget: Committing to a budget can help you make payments on time, which is key to achieving a good credit score.

- Avoid carrying debt: Credit utilization is the second most important factor that makes up your credit score. Unpaid debts accumulate interest, which means less money for you.

- Pay bills and parking tickets on time: It’s important to pay all utility bills, phone bills, and parking tickets on time. Not paying bills can lead to collections and this impacts your credit score.

- Don’t let debts go to collections: You should avoid collections at all costs. When unpaid debts go to collections, it can cause significant damage to your credit score.

- Monitor your credit score and reports: When it comes to your credit, ignorance is not bliss. It’s important to watch your credit report for changes, errors, and suspicious activity.

- Protect yourself from identity theft: A large drop in your credit score can be a sign of identity theft. Stay aware, protect your information, and consider a credit card with security features.

- Use your credit card consistently: Using your credit card will help you build credit—just don’t spend more than you’re able to pay back each month.

- Don’t close old credit cards: Closing a credit card lowers your credit mix, so it’s a good idea to leave old credit cards open, even if you don’t use them. Keep an eye on them for suspicious activity.

- Only authorize people you trust: Authorized users on your accounts can impact your credit score. Only authorize accountable and trustworthy people.

- Avoid retail credit cards: While retail credit cards can be easy to get, they can come with expensive rates and fees. And not all retail credit cards report payments, making them less ideal for building credit.

- Don’t treat credit like extra cash: Building credit takes organization and discipline. You should always stick to a budget and avoid spending beyond your means.

Your credit score is like a financial reflection of you, so take pride in your credit and make an effort to keep a good score. Knowledge is power—the more you understand credit, the more confident you’ll feel when preparing for large purchases and other financial ventures.

Whether you have good or bad credit, it’s all about setting goals and staying organized. Remember, your current score is not set in stone. You can always improve credit management and make a difference in your future.

If you’re worried about bad credit or just want to see where you stand, get your free credit score today.

You Might Also Like

March 7, 2023

Credit Repair

March 6, 2023

Credit Repair

May 10, 2022

Credit Repair