Inquiries account for 10% of your credit score. Limit and group inquiries to keep your credit score healthy.

A good credit score can help you get access to credit and might even be a positive factor when you’re looking for insurance or a job. But credit is complex, and numerous factors go into determining what your score is. That includes how many inquiries are on your report. Find out what those are and how many inquiries is too many for your credit.

In This Piece

- 5 factors that impact your credit

- What is a hard inquiry?

- Why do inquiries affect your credit?

- How many inquiries is too many?

- Protecting your credit score

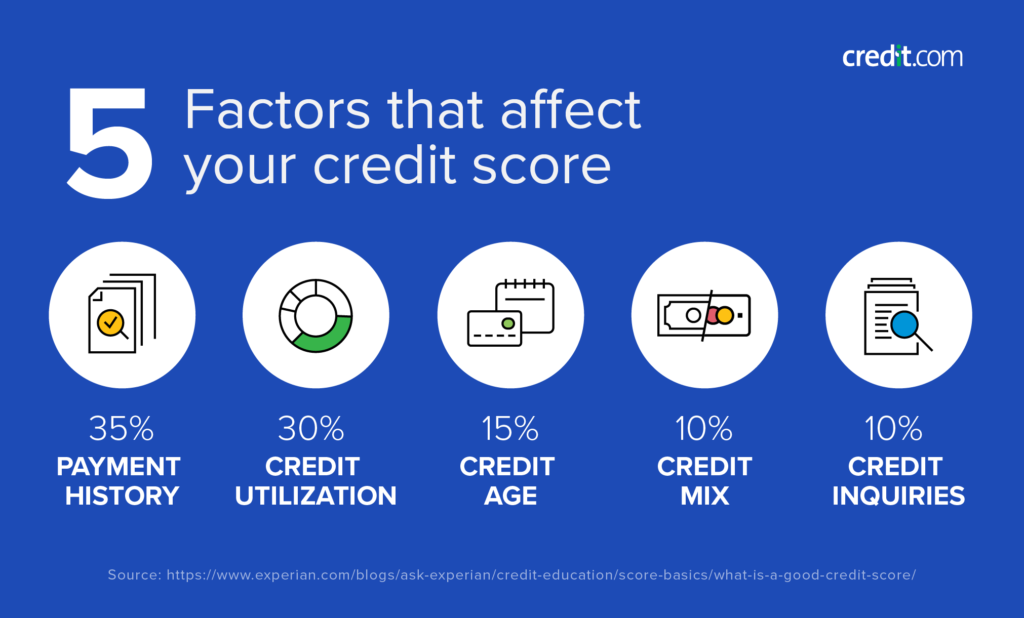

5 Factors That Impact Your Credit Score

There are five main factors that impact your credit score:

- Payment history. Paying your debt on time and as you agreed is a big deal. It accounts for around 35% of your score.

- Amount of debt. This is also called utilization. How much debt you’re using—and specifically how much of your revolving credit limits you’re using—make up roughly 30% of your score.

- Credit age. How long you’ve had credit and the average age of your accounts makes up about 15% of your credit score.

- Credit mix. Lenders want to see you can responsibly manage multiple types of debt, so the types of accounts you have drive around 10% of your score.

- Hard inquiries. The number of times you’ve applied for credit and had a related inquiry accounts for around 10% of your score.

What Is a Hard Inquiry?

A hard inquiry occurs when someone checks your credit for the specific purpose of evaluating you for a loan, credit card, or other debt.

Soft inquiries, on the other hand, occur when someone checks your credit for informational purposes. Here are some times that soft credit checks might occur:

- You check your own credit.

- An employer pulls your credit as part of a background check you agreed to.

- A credit card company does a soft credit pull to prequalify you for an offer it is sending in the mail.

Hard inquiries are the only ones that impact your credit score. In fact, they’re the only ones that show up for other people who look at your report. Soft inquiries only show up for informational purposes when you check your own report.

Note: Checking your credit report does NOT affect your credit score. Go ahead and check it now!

Why Do Hard Inquiries Impact Your Credit?

Hard inquiries impact your credit because they can be indicators for how you’re doing financially and how well you are managing your existing debt. If you’re applying for a lot of credit at once, that is a potential sign that you’re not in a great financial situation, and lenders don’t like to see that.

Hard Inquiries Can Be “Grouped” as One

In certain situations, it’s understandable that you might be applying for multiple loans in a short amount of time. This is especially true when you’re applying for a mortgage or car loan, for example. You may be shopping rates.

In these cases, hard inquiries of the same type that fall within a certain time period are treated as one for the purposes of credit scoring. FICO models use a 45-day time period and VantageScore models use a 14-day time period. When you are shopping around for credit, try to do all your applications within two weeks.

Hard Inquiries Age Off Your Report Quickly

Most items take seven to ten years to age off your credit report. Inquiries, on the other hand, only show up for two years—and their influence on your score decreases after only one year.

If you’re in a situation where you need to apply for a lot of credit, the good news is that the inquiries you’re racking up now won’t have a long-term effect on your scores.

How Many Credit Inquiries Is Too Many?

There’s not really a specific numeric answer for how many are too many inquiries on your credit report. That’s because the impact of hard inquiries really depends on your credit score and overall financial health.

However, since hard inquiries can reduce your credit score, even by a little, you probably want to avoid unnecessary ones. So, the answer is that too many credit inquiries is really any number that is more than you need. Only apply for credit when you need it and group your applications together, and you shouldn’t have to worry about too many credit inquiries affecting your score.

Tips for Protecting Your Credit: Hard Inquiries

If you apply for credit, you’re probably going to take a hit on the hard inquiry. It’s temporary and, in most cases, not that big. But here are some things to know to help you manage your credit score when it comes to inquiries.

- Don’t apply just to apply. Only apply for credit you need. Do your research on loans and other offers to ensure you have a good chance of being approved.

- Plan ahead when shopping rates. A proactive approach lets you shop rates on mortgages and other types of loans in a short time period to minimize the impact to your credit score.

- Check your reports regularly. Look for hard inquiries that don’t make sense. If you didn’t apply for credit and approve the inquiry, dispute it with the credit bureau. If the entity that did the inquiry can’t prove you approved it, the credit bureau typically has to remove it.

Inquiries are important as they do impact your credit score. But they’re only a small part of the bigger puzzle. Sign up for the ExtraCredit to see how you’re doing with the big picture when it comes to credit scores.