Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

The cash envelope system is a budgeting tool that helps you develop self-discipline by only spending the allotted amount of cash from labeled envelopes each month. It can help reduce overspending and impulsive purchases.

Budgeting is one of the best ways to keep track of your spending, pay down debt, and build wealth. Unfortunately, many Americans don’t take advantage of preparing a monthly budget. Our team at Credit.com surveyed over 1,000 Americans, and 27 percent said they don’t think a budget is necessary.

We also found that 15 percent of people don’t want to feel restricted by a budget, and 24 percent simply don’t think they will stick to it. Fortunately, with the cash envelope system, it’s easy to do both.

Today, you will learn about this simple budgeting method that can help you save money, lower your debt, and potentially help raise your credit score.

Key takeaways:

- You can use cash envelopes as a monthly budget by putting cash in different envelopes for spending categories.

- The system is ideal for people who have a habit of impulsive spending or overspending.

- It allows you to monitor your money rather than guessing how much you’re spending.

- The cash envelope system is often called “cash stuffing” on social media apps like TikTok.

What Is the Cash Envelope System?

The cash envelope system, also known as “cash stuffing,” is an easy-to-use budgeting tool that helps track how much money you have to spend. You’ll put the cash in labeled envelopes and check each envelope throughout the budgeting period to see how much money you have left to spend.

Different budgeting systems work for different people. For some, having a monthly budget template on their computer is the best option. Others may benefit more from being able to physically see how much money they have left for purchases like groceries, gas, and entertainment.

How the Cash Envelope System Works

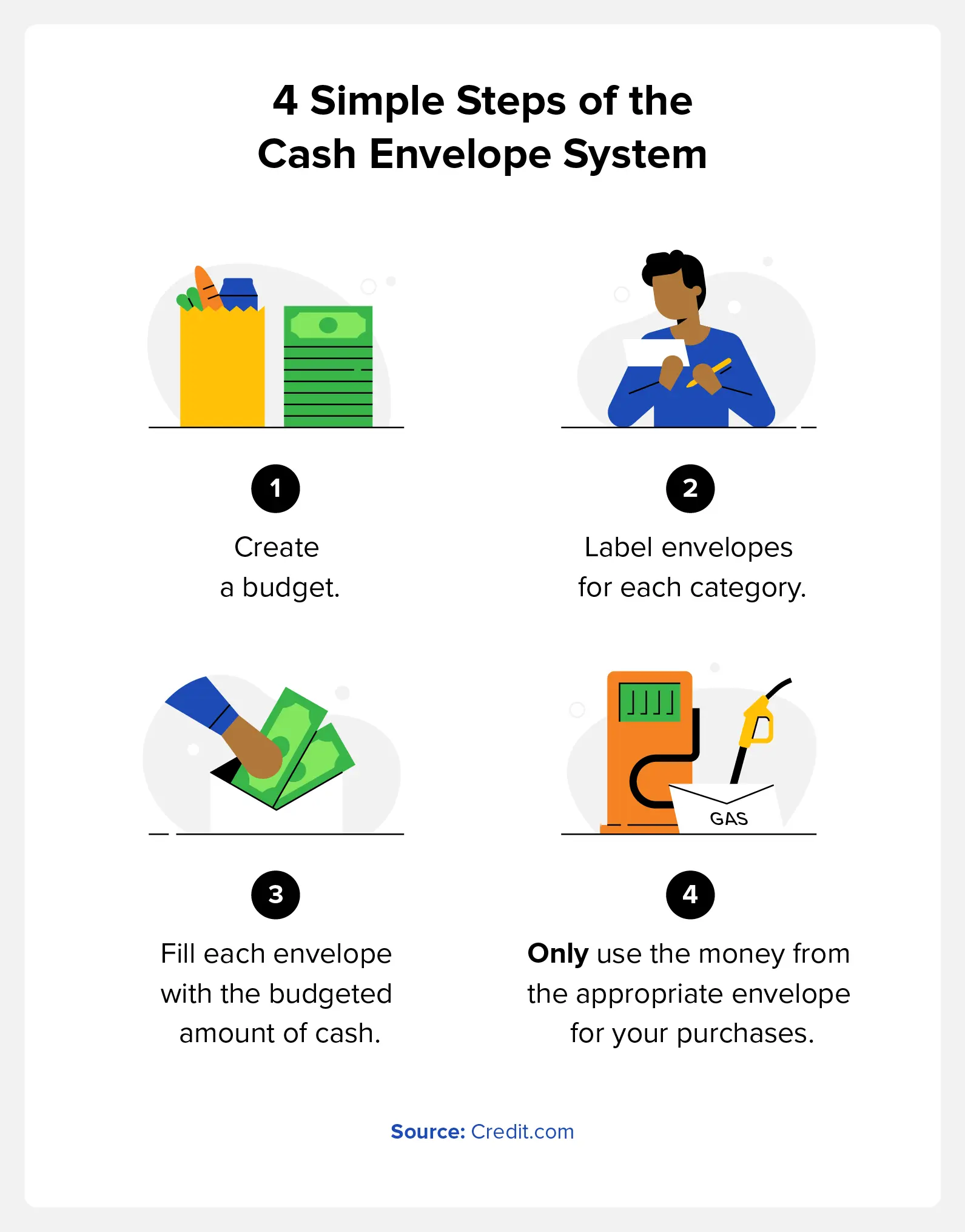

Before cash stuffing, you will need to organize your money envelopes into different categories. If it helps, you can start with a spreadsheet budget template, or you can write down the categories in a notebook. Some of the top budget categories to consider include:

- Utilities

- Fuel or transportation costs

- Groceries

- Healthcare and medications

- Savings

- Debt

It’s also beneficial to ensure you have cash envelopes for areas where you typically overspend. This may be eating out, buying clothes, or online shopping. You can allocate money toward these areas, but the goal is to ensure you don’t overspend.

During the month, whenever you spend money in one of these categories, you only use the money from the appropriate envelope. For example, if you enjoy buying a $5 cup of coffee on your way to work and allocate $100 to that envelope, take $5 out of it each morning.

The cash envelope system is a way to hold yourself accountable for your spending. This means that once the money is gone from an envelope, it’s gone. If you miscalculated how much you need in a certain category, revisit your budget the following month and tweak the amounts.

You can refill your envelopes at the start of each budgeting period or after each paycheck.

The Benefits of the Cash Envelope System

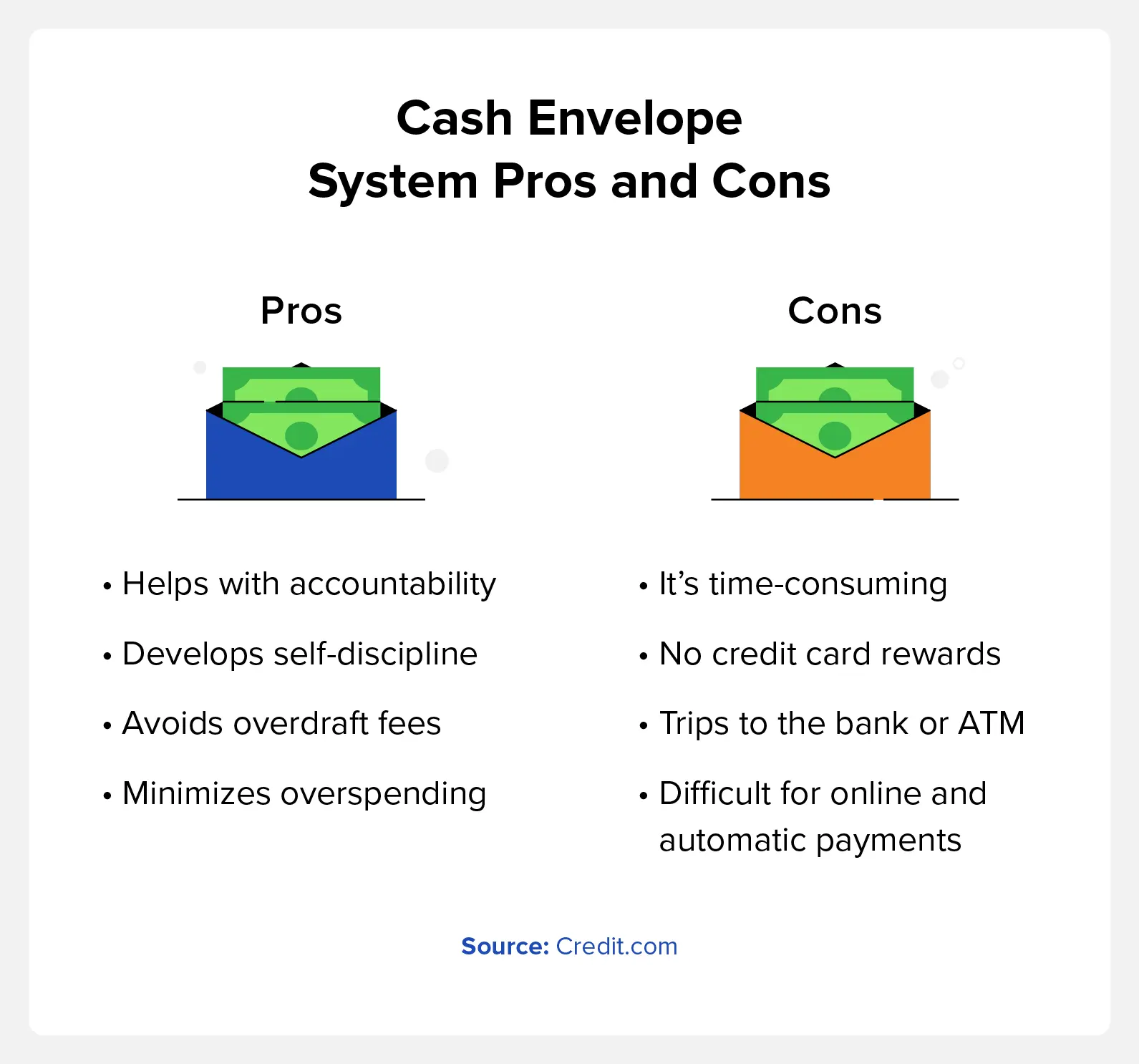

There are pros and cons that come along with every budgeting strategy, so it’s helpful to know the benefits and drawbacks and find the one that’s right for you. The cash-stuffing envelope system is great for people who don’t check their bank account daily or are better with their money when using cash.

Additional benefits include:

- Avoiding overdraft fees

- Minimizing overspending

- Increasing accountability

- Helping with disciplined spending

By sticking to cash, the system also helps reduce the frequency with which you use your credit card, minimizing interest fees.

The Downsides of the Cash Envelope System

The cash envelope system isn’t for everyone, and it may create some additional challenges. The primary downside of this budgeting system is that you need to go to your bank or an ATM whenever you need to refill your envelopes. It’s also beneficial to consider that carrying large amounts of cash has the risk of losing it for the money being stolen.

Some of the other downsides include:

- It’s time-consuming.

- You get no credit card rewards.

- You can only spend the amount contained within each envelope.

The other challenge with the cash envelope system is making online payments or automatic payments. Automatic payments are a great way to avoid forgetting about a payment and accruing late fees. You can still use the cash envelope system, but you will need to keep track by writing on the back of the envelope, similar to balancing a checkbook.

Should You Use the Cash Envelope System?

This budgeting system is ideal for people who are quick to pull out their debit or credit card and have trouble with overspending. It can be difficult to track your money electronically, but using physical cash can help many people stick with a budget.

The system is also a great way to budget for beginners. It’s a simple system, and you can start with just a few categories. If you know you have a problem with overspending on ordering food or going out, use this system to allocate a specific amount of cash for these activities.

FAQ

Although the cash stuffing system is a simple method, there are some common questions people have when getting started.

Can the Cash Envelope System Work If You Make Online Payments?

The most common method is to create a physical envelope while keeping the money in your bank account for online payments. You can keep track by writing on the back of the envelope each month.

What If an Envelope Runs Out of Cash?

If you run out of cash from the envelope, stay disciplined and avoid borrowing money from other envelopes. Revisit your budget and find ways to save in different categories, earn extra money, or reduce your spending.

How Do You Use the System When Emergency Expenses Happen?

Emergencies happen, and in these cases, you can shift money around from your envelopes and budget accordingly the following month. It’s also helpful to build an emergency fund for these situations, and you can also keep a credit card for emergency funds.

What Do You Do If There’s Money Left Over in Your Cash Envelope?

Money left over in cash envelopes means you’re doing a great job with your budget. You can use this to treat yourself or add to your personal spending money envelope the next month. You may also want to use this extra money to make extra debt payments or put it in your savings account.

How the Cash Envelope Budget System Can Help Improve Your Credit

Creating a budget is a great way to get your finances under control and create quality spending habits. The cash envelope system is also helpful for reducing your debt and improving your credit. One of the key factors of your credit score is credit utilization, so allocating an envelope toward paying down your debt and using leftover money for additional payments can help increase your score.

For additional credit resources, you can sign up for Credit.com’s free credit report card or our ExtraCredit service.

You Might Also Like

April 17, 2023

Budgeting and Saving Money

April 3, 2023

Budgeting and Saving Money

March 8, 2023

Budgeting and Saving Money

![Average Electric Bill by State [2023]](https://www.credit.com/blog/wp-content/uploads/2024/10/average-electric-bill-hero.webp)