Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

A financial hardship letter explains an unforeseen circumstance that has made you unable to make regular payments on a loan and requests a modification to help you get back on track.

No matter how well you prepare, many Americans will encounter times of financial hardship due to circumstances outside of their control. Events such as company layoffs, natural disasters, and divorce can throw a wrench in our finances, making us unable to pay our financial obligations.

Instead of falling behind on payments during difficult times, take a proactive approach to your finances. Sending a financial hardship letter to your creditor can help you salvage your credit score while you get back on your feet.

Read on to discover what these letters are, situations that warrant them, and how to write your own.

Table of Contents:

- What Is a Hardship Letter?

- What Is Considered Financial Hardship?

- How to Write a Hardship Letter

- Financial Hardship Letter Template + Sample

- How to Get Through Financial Hardship

What Is a Hardship Letter?

A financial hardship letter is a correspondence you send to a creditor that explains why your current financial situation prevents you from making debt payments. After providing details about your hardship, such as the cause and timeline, request that the creditor provide a mutually beneficial solution.

Depending on your specific circumstances, you could suggest to your lender that they assist you by:

- Suspending your monthly payments for the time being

- Decreasing your payment amount

- Lowering your interest rate

- Pardoning overdue payments

- Waiving penalties for late payments

- Adjusting the terms of your loan

- Resolving your debt for an amount less than you owe

For example, if you were recently injured due to an accident, you could ask the creditor to temporarily pause your payments until you recover.

What Is Considered Financial Hardship?

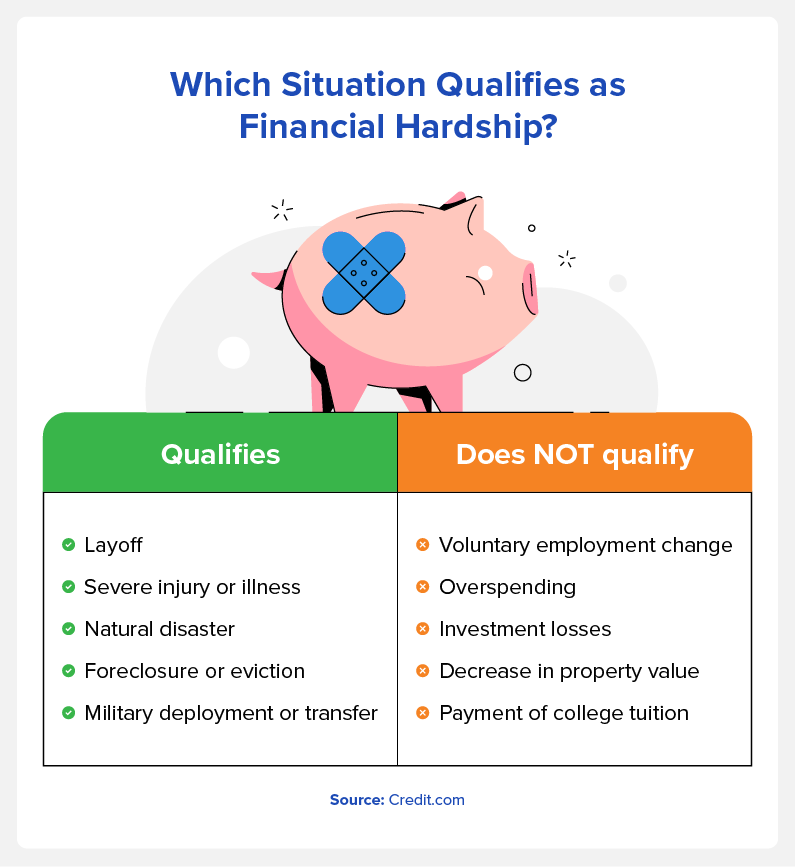

Since everyone’s situation is different, you may be wondering what qualifies as financial hardship. A financial hardship is any scenario beyond your control that makes you unable to pay for your living expenses.

Examples of financial hardships include, but are not limited to, the following:

- Employment layoff

- Pay cut

- Home foreclosure

- Decreased number of working hours

- Job relocation

- Natural disaster

- Emergency event

- Divorce or separation

- Military deployment or transfer

- Death of a spouse or family member

- Incarceration

- Serious injury or illness

As you can see, the examples above are out of your control. On the other hand, circumstances that creditors are not likely to deem as a financial hardship include:

- Poor money management or overspending

- Routine expenses

- Voluntary employment shift

- Purchase of a home

- Decrease in property value

- Payment of college tuition

- Investment losses

How to Write a Hardship Letter

When writing your financial hardship letter, address it to the loss mitigation department of your lender. Include your contact information and loan number so they can identify your account. Write your letter clearly and concisely, following the instructions provided below.

1. Explain Your Hardship

Be honest with your creditor about the circumstances surrounding your hardship, but keep your explanation concise. Aim to keep your explanation under one page.

While you should include relevant details such as what caused the hardship and when it started, don’t include unnecessary information. For example, you might inform the creditor that you’re going through a divorce and the legal fees are causing financial strain, but you don’t need to go into the cause of the divorce.

Remember to be truthful—don’t exaggerate your circumstances or include inaccurate information.

2. Provide Documentation to Back Up Your Claim

Provide up-to-date and relevant documentation as evidence for the statements you make in the letter to bolster your claim. Documents the lender may want to review include:

- Bank statements

- Pay stubs

- Tax returns

- Medical bills

- Employee termination letter

- Divorce certificate

- Military orders

- Proof of incarceration

3. List Steps You’ve Taken to Alleviate Your Financial Burden

Let the creditor know the actions you’ve already taken to help improve your financial situation and pay your debt. Steps you might take include limiting expenses, selling personal items, or working a side gig to make extra income. This provides the lender with additional context and shows that you’re taking personal responsibility for your financial situation.

4. Clearly State Your Request

The purpose of writing a hardship letter is to request help from the creditor during your difficult time. Make sure to clearly state exactly the action they can take to assist you and how it will help you. Provide your proposed solution or a couple of suggestions the lender might consider.

5. State Your Commitment to Paying Your Debt

Conclude your letter with a statement expressing to the lender that you’re committed to paying your debt and finding a solution that works for both of you. Sign your name to the end to formally close the letter.

Financial Hardship Letter Template + Sample

Below is a hardship letter sample and template to help you get started. When using the template, make sure to enter your own information where there is bolded text.

Mary Smith

101 Cedar Road

Savannah, GA 31302

msmith@gmail.com

(912) 333-3333

11/01/2023

Harry Jones, Loss Mitigation Department of Georgia Bank

444 Peach Lane

Atlanta, GA 30033

Re: Account #10122467894231

Dear Harry Jones:

I am writing this letter to request assistance with my personal loan during a time of financial hardship.

Approximately two weeks ago, I was let go from my job due to company-wide layoffs. As a result, I have been unable to continue making regular payments on my loan. I have included my termination letter that proves the validity of my hardship.

While I have taken steps to increase my income during this time, such as babysitting and selling old clothes, I am still not able to make full payments.

I fully intend to pay off my loan and am requesting your help to get me back on track. I would like to discuss possible solutions such as temporarily pausing payments, lowering my interest rate, or any other option that might be available to me. I expect my hardship to be resolved in approximately three to six months, after which I can resume my regular payments.

I want to reiterate my intention to fulfill my financial obligation. If you have any questions or would like to discuss a solution, please contact me at (912) 333-3333 or email me at msmith@gmail.com.

Thank you for taking the time to review my request, and I hope we can come to a mutually beneficial agreement. Your support during this time of financial hardship is greatly appreciated.

Sincerely,

Mary Smith

How to Get Through Financial Hardship

In addition to writing a hardship letter, here are some other tips to help you get through times difficult times and continue to reach your financial goals:

- Create a budget: Use a monthly budget template to write down your monthly income, expenses, and debt to paint a full picture of your current financial situation.

- Consider debt consolidation: If you have many different debts, debt consolidation can simplify your finances and help you pay your balance quicker and at a lower interest rate.

- Limit unnecessary expenses: During difficult times, it’s important to only spend money on the essentials. Consider canceling subscriptions, reducing electricity use, and eating at home to save money.

- Start a side hustle: Having multiple income streams can help mitigate financial burdens. Examples of side hustles include pet sitting, driving for a ride-share company, online tutoring, and joining a focus group.

- Build an emergency fund: Aim to save three to six months’ worth of expenses as a cushion in case of a personal emergency or unexpected expense.

Writing a financial hardship letter can help you maintain a good credit score during a crisis. While navigating your situation, it’s important to continue monitoring your credit. To make this easier during times of stress, check your free credit report card to see what’s happening with your credit at a glance.

You Might Also Like

May 30, 2023

Managing Debt

September 7, 2021

Managing Debt

December 23, 2020

Managing Debt